- United States

- /

- IT

- /

- NYSE:FSLY

Fastly, Inc. (NYSE:FSLY) Looks Inexpensive After Falling 27% But Perhaps Not Attractive Enough

Unfortunately for some shareholders, the Fastly, Inc. (NYSE:FSLY) share price has dived 27% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

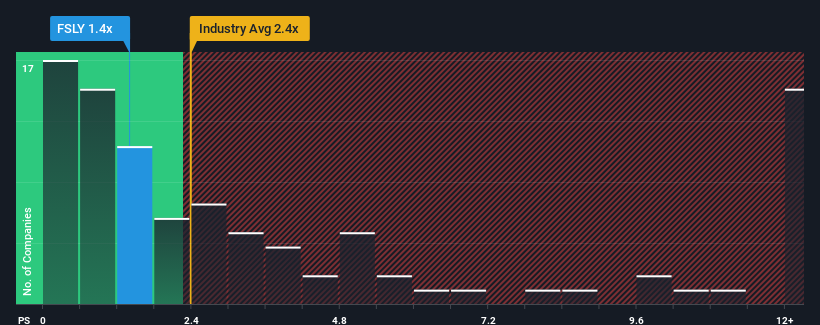

Since its price has dipped substantially, Fastly may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 1.4x, considering almost half of all companies in the IT industry in the United States have P/S ratios greater than 2.4x and even P/S higher than 6x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Fastly

What Does Fastly's P/S Mean For Shareholders?

Recent times haven't been great for Fastly as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Fastly.Is There Any Revenue Growth Forecasted For Fastly?

Fastly's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 7.4%. This was backed up an excellent period prior to see revenue up by 53% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 6.3% per annum over the next three years. Meanwhile, the rest of the industry is forecast to expand by 11% per annum, which is noticeably more attractive.

In light of this, it's understandable that Fastly's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Fastly's P/S

Fastly's P/S has taken a dip along with its share price. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Fastly's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

It is also worth noting that we have found 2 warning signs for Fastly that you need to take into consideration.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives