- United States

- /

- IT

- /

- NasdaqGS:FSLY

Evaluating Fastly’s Valuation After Edge Cloud Tech Rollout and Recent Share Price Swings

Reviewed by Bailey Pemberton

- Wondering if Fastly could be a hidden gem or just another risky play? Let’s break down what’s driving interest in the stock right now and whether its current price tells the full story.

- Fastly’s share price has been bouncing around recently, with a -4.0% move in the last week and down nearly 10% over the past month. However, it is still sitting about 3.8% higher than a year ago.

- Recent headlines highlight Fastly’s rollout of new edge cloud technologies and ongoing partnerships with major digital platforms, which are fueling both excitement and questions about the company’s growth trajectory. These updates put Fastly in the spotlight and may explain some of the recent volatility.

- When it comes to valuation, Fastly lands a 3 out of 6 on our undervaluation checks. This score helps set the stage for a deeper dive into whether the numbers actually match the narrative, along with a look at one of the most robust ways to figure out what the company is really worth.

Find out why Fastly's 3.8% return over the last year is lagging behind its peers.

Approach 1: Fastly Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and then discounting them back to today’s value. This approach uses assumptions about how much cash the business will generate in upcoming years and applies a discount rate to reflect present-day worth.

For Fastly, the latest reported Free Cash Flow is $7.98 Million. Analysts predict significant growth ahead, with estimates reaching $28.8 Million by the end of 2027. Although analyst forecasts only cover the next five years, further projections out to 2035 were extrapolated to estimate longer-term performance. These projections suggest a steady increase in cash flow, with Fastly potentially generating over $88 Million annually in a decade’s time.

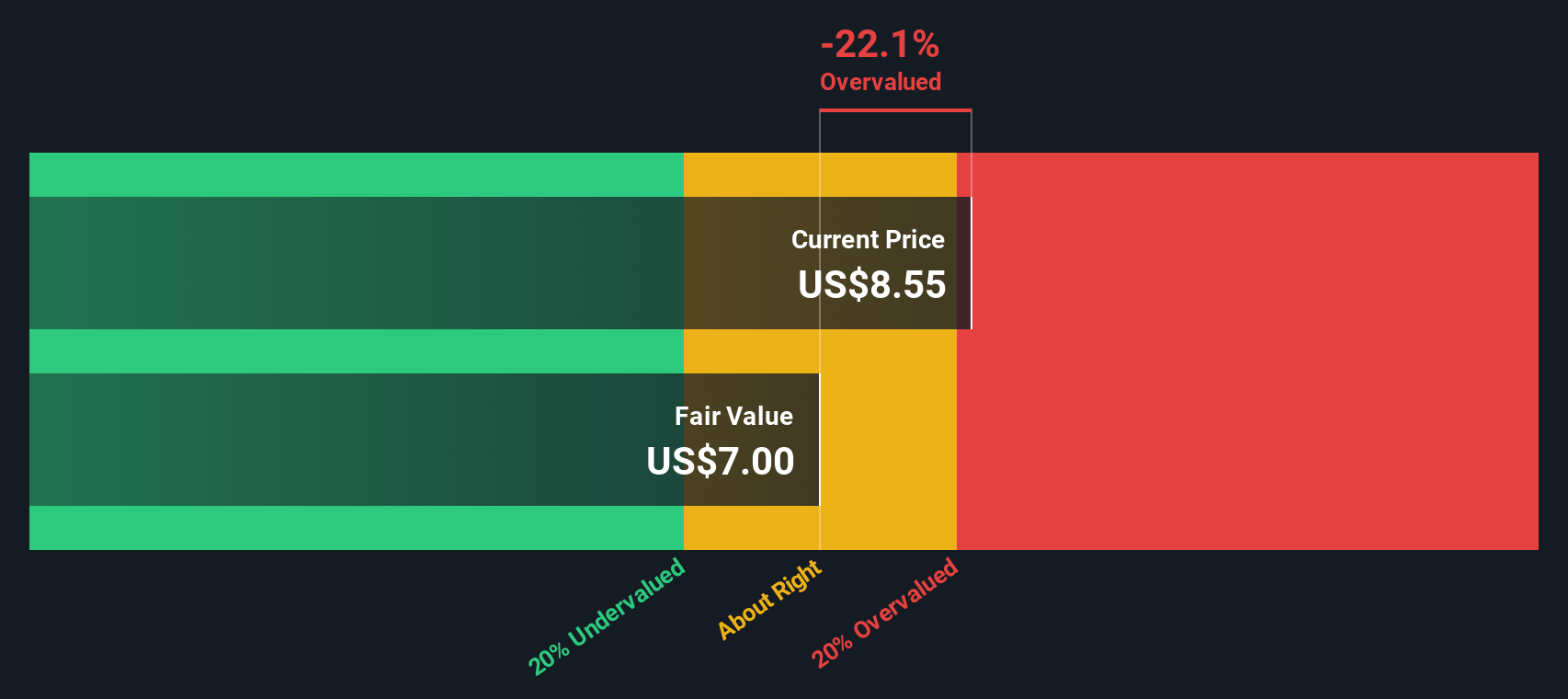

Based on these figures and the two-stage Free Cash Flow to Equity model, the estimated intrinsic value per share is $5.59. This reflects a 42.3% premium over the current price, indicating the stock is trading well above its fair value as implied by future cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Fastly may be overvalued by 42.3%. Discover 844 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Fastly Price vs Sales

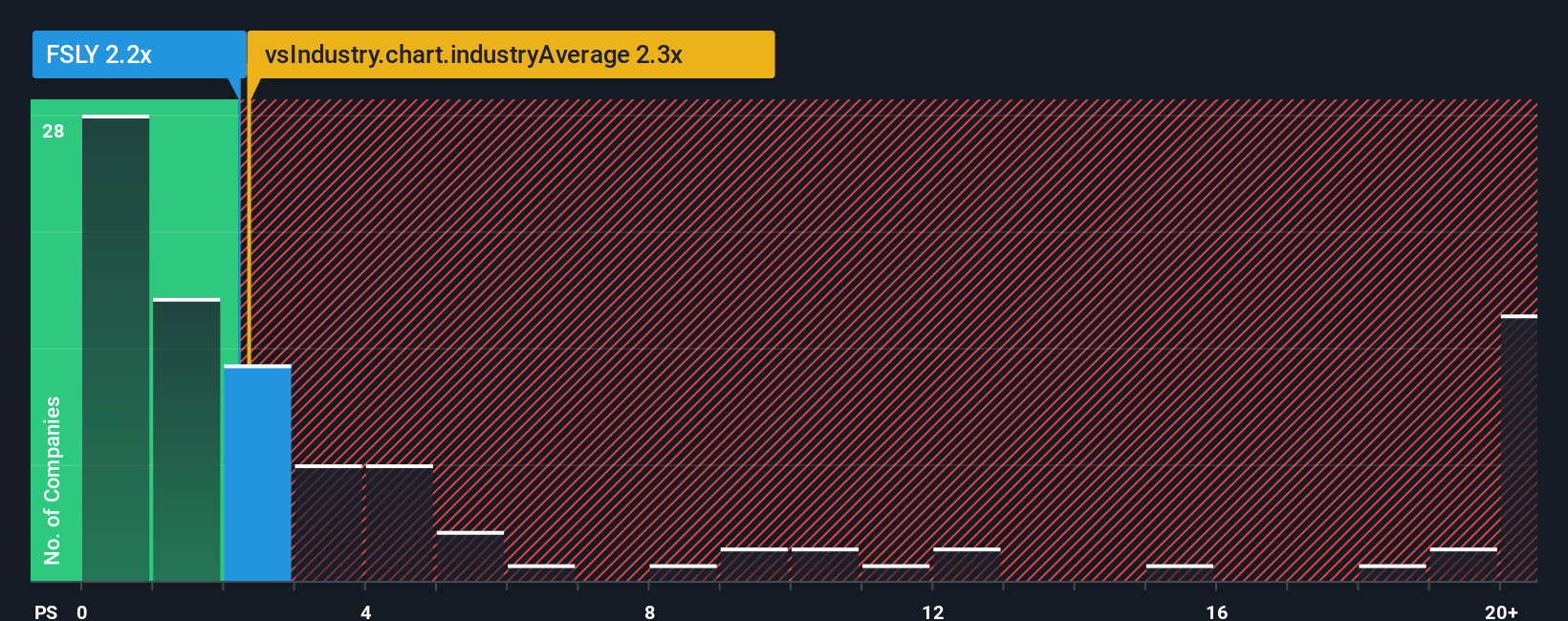

The Price-to-Sales (P/S) ratio is often a suitable valuation metric for companies like Fastly, especially when they are not yet profitable on a net income basis or are focused on high growth. This ratio allows investors to compare a company’s stock price to its revenues, making it easier to value firms that reinvest heavily and do not yet generate consistent earnings.

Growth expectations and risk play a key role in deciding what counts as a “normal” or “fair” P/S ratio. If a company is expected to grow faster than its rivals or operates in a less risky environment, a higher P/S ratio can be justified. In contrast, slower-growing or riskier companies typically deserve lower multiples.

Currently, Fastly trades at a P/S ratio of 2.05x. This is slightly below the IT industry average of 2.52x, and also under the peer group average of 6.95x. To provide a more tailored benchmark, Simply Wall St’s “Fair Ratio” for Fastly is 2.52x. Unlike simple peer or industry comparisons, the Fair Ratio incorporates Fastly’s specific growth prospects, profit margins, market cap and risk profile, offering a more nuanced view of what the stock should be worth.

Since Fastly’s P/S ratio of 2.05x is only marginally below the Fair Ratio of 2.52x, the stock appears to be valued about right on this basis.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Fastly Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, yet powerful framework for making investment decisions, allowing you to define the story behind your assumptions about Fair Value, future revenue, earnings, and margins. Narratives connect what you believe about Fastly’s business, such as how it wins, where it grows, and what could go wrong, to realistic forecasts and a resulting fair value estimate.

With Narratives, you can see your investment viewpoint quantified and mapped to the numbers, making it much easier to decide if a stock is a buy, sell, or hold by directly comparing your Fair Value to the current price. Available to all users on the Simply Wall St Community page, Narratives are easy to create, widely used, and automatically adjust when real-world events like news or earnings change the outlook, keeping you ahead of the curve.

For example, one Fastly investor might build a bullish Narrative if they believe edge security demand and product cross-selling will drive rapid revenue growth, supporting a fair value above $10 per share. Another, more cautious investor could focus on intensifying competition and persistent losses, justifying a much lower fair value closer to $6. Narratives put your reasoning and method front and center so you can invest with clarity and confidence.

Do you think there's more to the story for Fastly? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLY

Fastly

Operates an edge cloud platform for processing, serving, and securing its customer’s applications in the United States, the Asia Pacific, Europe, and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

BABA Analysis: Buying the Fear, Holding the Cloud

Q3 Outlook modestly optimistic

A fully integrated LNG business seems to be ignored by the market.

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale