- United States

- /

- Software

- /

- NYSE:FIG

Figma (FIGMA) Faces Scrutiny as Revenue Growth Outpaces Market but Losses Persist

Reviewed by Simply Wall St

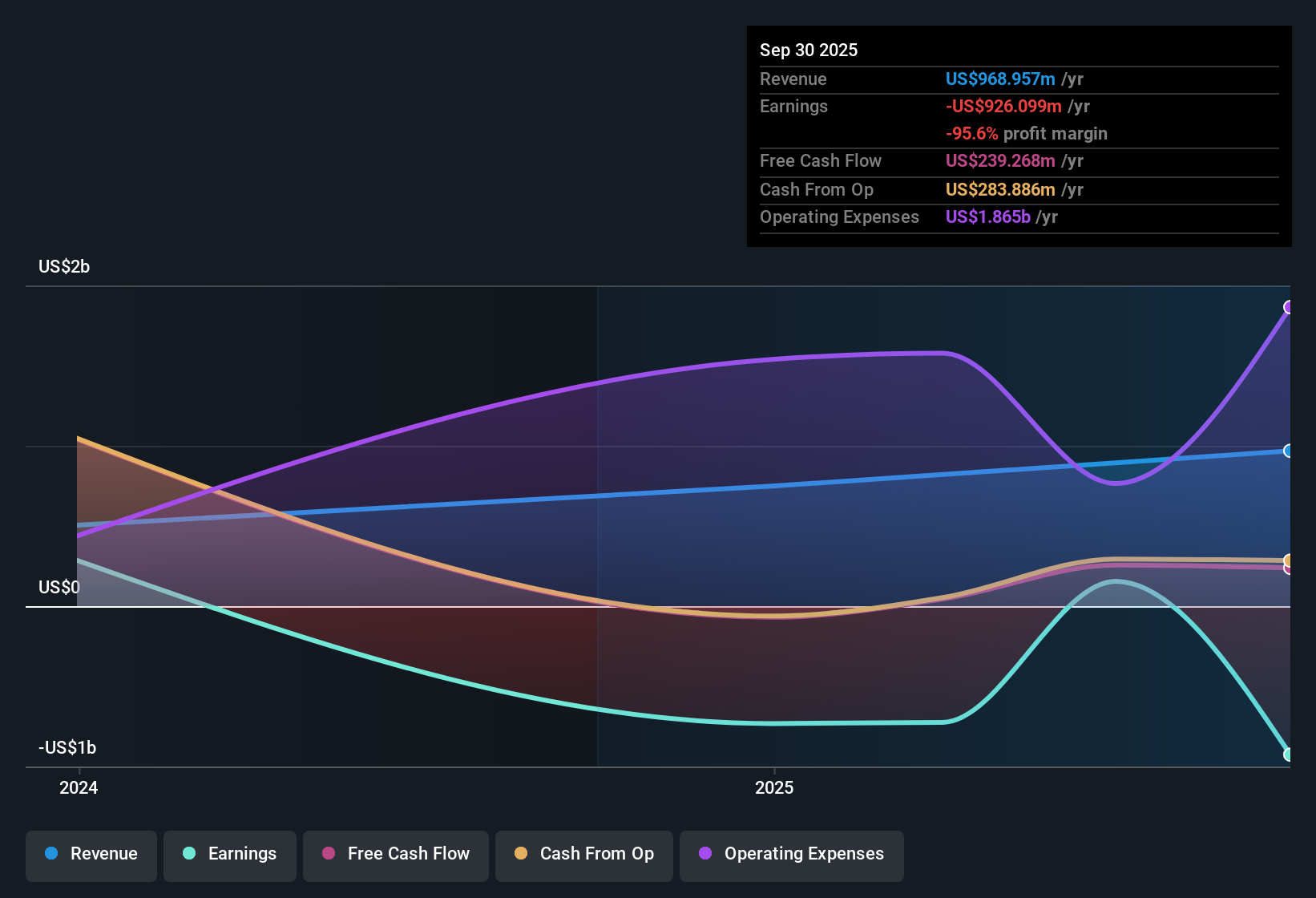

Figma (FIGMA) posted annual revenue growth of 18.5%, outpacing the US market average of 10.4%. However, the company remains unprofitable and is expected to stay in the red for at least the next three years. The current share price of $45.98 trades at a premium to estimated fair value. Investors are eyeing Figma’s high growth trajectory, but persistent losses and a lofty price-to-sales ratio are putting its valuation under the microscope.

See our full analysis for Figma.Now, let’s see how these results compare to the widely discussed market narratives. We can then examine whether the numbers back up the current sentiment or challenge it.

See what the community is saying about Figma

Revenue Growth Far Outpaces Sector

- Figma is expected to grow revenue by 18.5% per year, significantly exceeding the US market average growth rate of 10.4% per year.

- This rapid top-line momentum heavily supports bullish arguments around Figma’s upside potential.

- It highlights serious outperformance versus both software sector and market averages.

- This suggests that the company’s appeal is rooted in unusually strong demand, despite the lack of current profitability.

Valuation Premium Raises Eyebrows

- Figma trades at a Price-To-Sales Ratio of 23.5x, which is a steep premium to both its software peers at 8.8x and the wider industry at 5.1x.

- Critics highlight how the elevated multiple challenges bullish enthusiasm.

- The valuation is not just higher than sector averages, but nearly triple the typical software peer.

- This means investors are paying a hefty premium for future growth that needs to be delivered to justify this price.

Continued Losses Cloud the Path

- With the business unprofitable today and forecast to remain so for at least the next three years, Figma faces an extended journey before reaching break-even.

- Despite heavy revenue growth, the ongoing lack of profit is notable.

- This fuels the cautious view that market excitement may be overlooking how long it could take to achieve sustainable earnings.

- Share price stability remains a key risk in the near term given persistent red ink.

See if analysts’ balanced take squares with this rapid growth and ongoing losses. 📊 Read the full Figma Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Figma on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different angle on the figures? Share your perspective, build your view, and contribute your own narrative in just a few minutes. Do it your way

A great starting point for your Figma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Figma’s premium valuation and ongoing losses highlight the risk of paying up for growth before profitability is in sight.

If chasing steep multiples makes you nervous, you can search for better value with these 853 undervalued stocks based on cash flows and uncover companies trading at more attractive prices with healthier financial prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIG

Figma

Develops a browser-based tool for designing user interfaces that helps design and development teams build various products.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives