- United States

- /

- Software

- /

- NYSE:FIG

Figma (FIG): Exploring Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

Figma (FIG) stock has caught investors' attention recently after a volatile trading period. Shares have faced a steep decline over the past month. Many are now watching closely for signs of stabilization or renewed momentum.

See our latest analysis for Figma.

Zooming out, Figma’s 30-day share price return of -28.39% reflects a sharp pullback, continuing the momentum fade seen in recent months. The latest closing price of $35.69 points to ongoing uncertainty, with investors still evaluating growth prospects and near-term risks in a shifting software landscape. Over both the short and long term, the stock has struggled to build upward momentum. The valuation picture now looks increasingly complex.

If you’re curious to see which other fast movers may be flying under the radar, this is a great moment to broaden your search with fast growing stocks with high insider ownership

With shares trading far below recent analyst targets, investors are left to wonder if this is a sign that Figma is undervalued or if the market is already accounting for the company’s future growth prospects.

Most Popular Narrative: 45.7% Undervalued

Figma’s most widely followed narrative values the company substantially higher than its recent share price. With a user-submitted fair value of $65.70 compared to the latest close at $35.69, the narrative sets ambitious expectations well above where the market is pricing the software stock.

“Right now, around 95% of Fortune 500 companies, including most of the S&P 500, use Figma Design for their workflows. That’s not a small number; it shows how deeply it’s embedded in the way big enterprises actually work. And once a tool is so integrated into the daily process of thousands of people, it’s not easy to replace. That kind of adoption is the moat, the safety wall, that gives Figma strength even as competition grows.”

What’s the secret behind this high fair value? This narrative relies heavily on the potential for margin expansion and an investor-focused perspective regarding profit multiple and discount rate. Explore which bold forecasts and underlying trends could support such a significant upside and decide for yourself if the story is compelling.

Result: Fair Value of $65.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unforeseen competition in AI features or a sharp slowdown in Figma’s revenue growth could quickly challenge the optimism surrounding its current valuation.

Find out about the key risks to this Figma narrative.

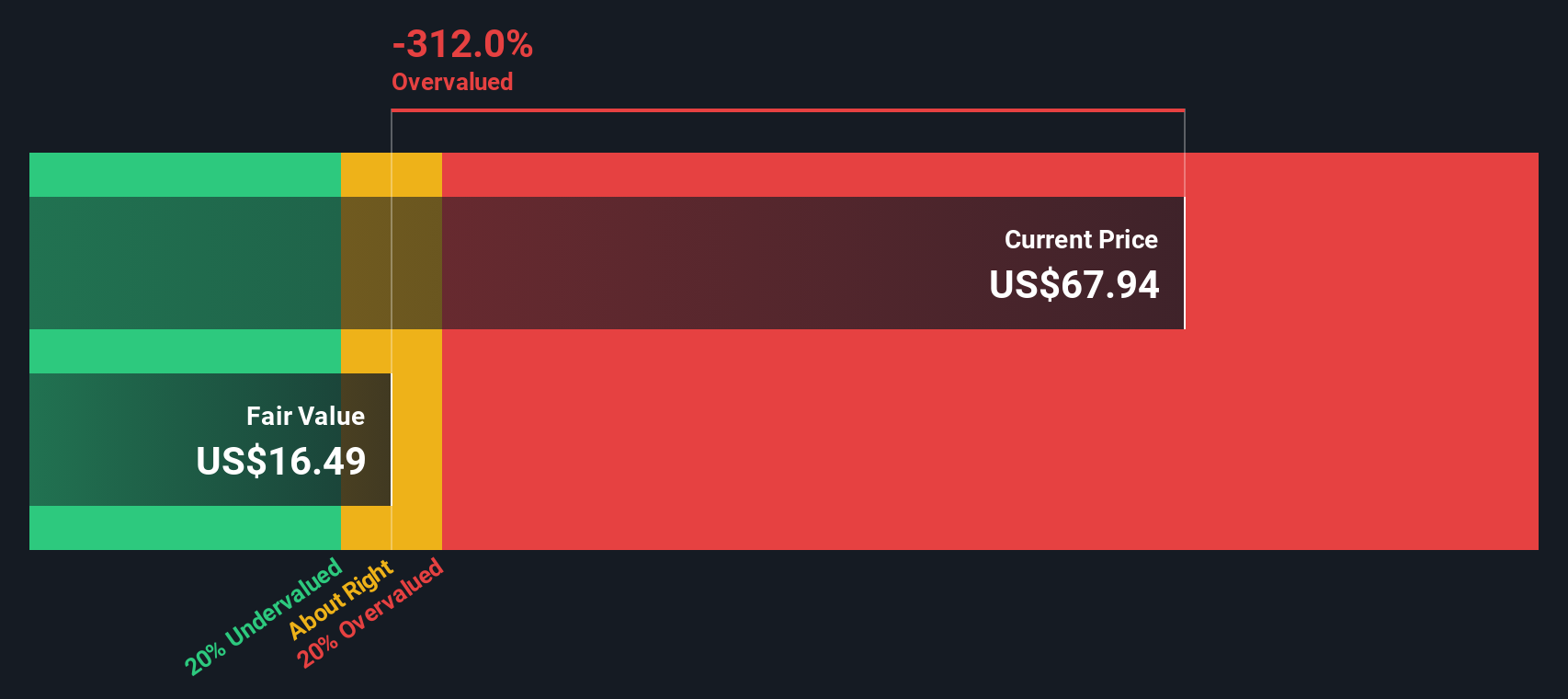

Another View: Challenging the High Narrative

Despite the optimism built into fair value narratives, a look through our DCF model tells a much more conservative story. According to this analysis, Figma’s shares are actually trading well above our estimate of fair value, which stands at $19.69. This suggests the stock may be overvalued by this method. Can both stories be true, or is the market weighing risks and rewards differently than investors expect?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Figma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Figma Narrative

If you have a different perspective or want to test your own thesis, you can easily build a new Figma narrative in just a few minutes. Do it your way

A great starting point for your Figma research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for smarter investing by searching beyond the obvious. Some of the best opportunities come from looking where others are not. Don’t let untapped ideas slip by.

- Spot the next wave of high-yield potential when you scan through these 14 dividend stocks with yields > 3% that are paying generous dividends above 3%.

- Uncover early trends in artificial intelligence and see what is rising faster than the headlines with these 25 AI penny stocks.

- Accelerate your search for undervalued bargains by checking out these 927 undervalued stocks based on cash flows packed with stocks trading below their cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIG

Figma

Develops a browser-based tool for designing user interfaces that helps design and development teams build various products.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026