- United States

- /

- Software

- /

- NYSE:FIG

Figma (FIG): Evaluating Valuation After New AI Product Launches and Rising Investor Interest

Reviewed by Simply Wall St

Figma (FIG) is attracting fresh interest after recent reports highlighted its strong profitability, impressive growth, and rollout of AI-driven design products, including a high-profile integration with ChatGPT. The company’s independent status is also drawing extra curiosity.

See our latest analysis for Figma.

Figma’s 90-day share price return of -59.15% is hard to ignore, reflecting big swings in sentiment even as new product launches and that blockbuster ChatGPT integration have hit the headlines. Short-term momentum is still shaky, but investors seem to be watching closely for signs that Figma’s long-term growth could reassert itself once the market digests all the volatility.

If today’s burst of AI innovation from Figma has you rethinking opportunities elsewhere, now is the perfect time to discover See the full list for free.

With shares still well below analyst price targets, but momentum this volatile, the real question is whether Figma is truly undervalued or if investors have already priced in all the upside from its rapid AI-driven growth.

Most Popular Narrative: 24% Undervalued

Figma's most-followed narrative suggests that fair value is significantly higher than the current share price, highlighting strong potential following the recent selloff.

AI-driven product expansion: Buzz, Make, Sites, Slides, and Draw launched with AI features and deep integration. Enterprise adoption: 13M+ active users and approximately 95% of Fortune 500 companies use Figma.

Interested in what drives this bold price target? This narrative relies on ambitious margin gains and future multiples often associated with major software companies. If you're curious about the assumptions behind this optimistic outlook, explore the factors that contribute to Figma’s valuation.

Result: Fair Value of $65.7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a slowdown in Figma’s growth or aggressive moves from well-funded competitors could quickly challenge the upbeat undervaluation story that investors are weighing.

Find out about the key risks to this Figma narrative.

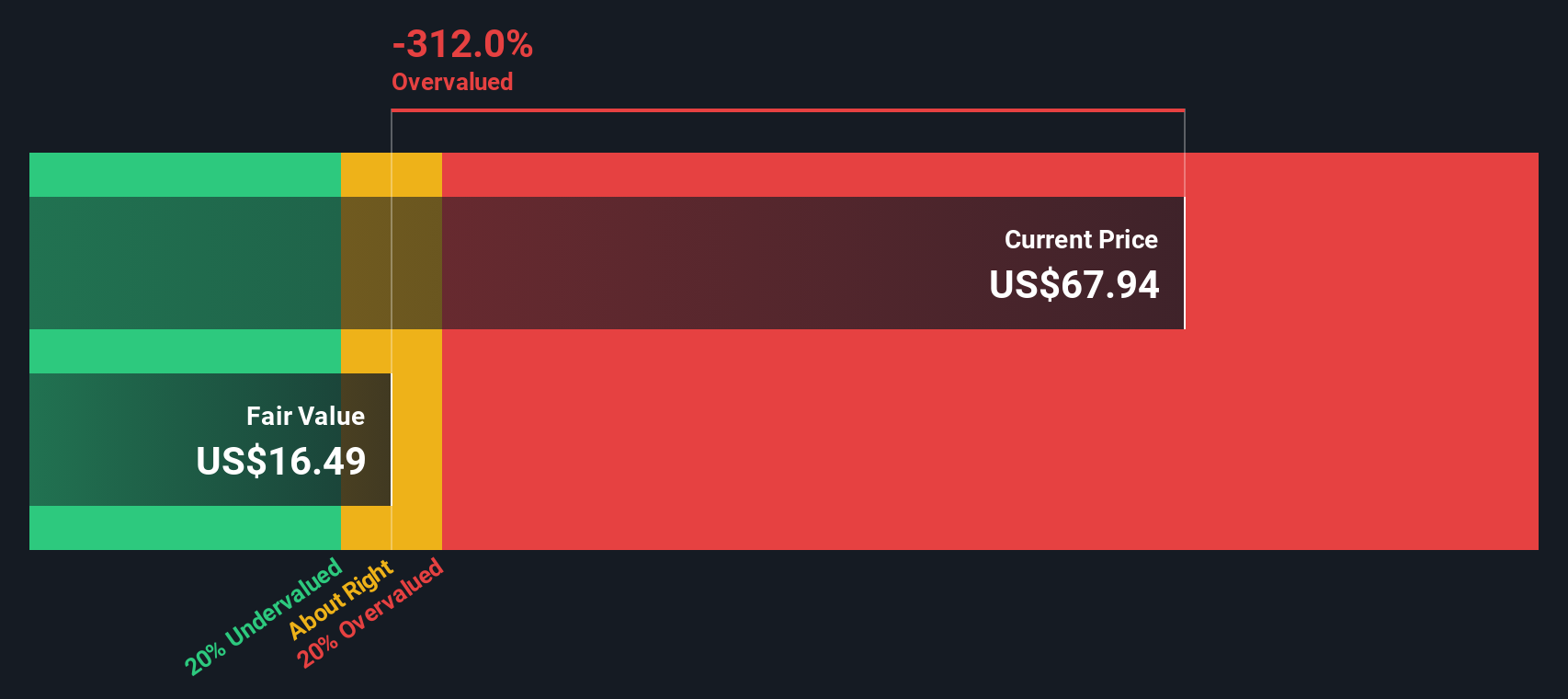

Another View: SWS DCF Model Challenges the Optimism

While the popular narrative sees Figma as undervalued, our SWS DCF model paints a much more cautious picture. It estimates fair value at just $16.57, which is well below today’s share price of $49.84. This sizable gap makes us question if the upbeat outlook has run ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Figma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 832 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Figma Narrative

If you have a different perspective or want to uncover your own insights using the numbers, try assembling your own narrative in just a few minutes. Do it your way.

A great starting point for your Figma research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by acting on new opportunities before they are obvious to everyone else. Do not miss your chance to spot tomorrow’s leaders. Make your next move today.

- Boost your portfolio’s yield and stability by checking out these 22 dividend stocks with yields > 3% that pay attractive dividends backed by robust fundamentals.

- Tap into high-potential tech by browsing these 26 AI penny stocks where artificial intelligence is set to transform entire industries.

- Uncover hidden gems flying under the radar through these 832 undervalued stocks based on cash flows based on strong cash flow signals and value metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIG

Figma

Develops a browser-based tool for designing user interfaces that helps design and development teams build various products.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives