- United States

- /

- Software

- /

- NYSE:FIG

Figma (FIG): Assessing Valuation After Landmark ServiceNow Integration and New AI-Driven Product Strategy

Reviewed by Simply Wall St

Figma (FIG) is capturing attention after announcing a major integration with ServiceNow. This integration enables designers to turn visual concepts into fully functional enterprise apps using AI automation. This collaboration marks a new chapter for Figma’s enterprise strategy.

See our latest analysis for Figma.

Even with the buzz around Figma’s ambitious ServiceNow integration and impressive revenue growth forecasts, the company’s momentum has faded fast. Share price return is down more than 68% year-to-date, with particularly sharp declines over the past month. Mixed signals from executive share sales and new leadership appointments hint at both challenges and longer-term growth potential as Figma pushes ahead with enterprise innovation.

Curious about other tech disruptors with unique growth stories? Now’s the perfect moment to explore See the full list for free.

With expectations running high and valuation now nearly a quarter below analyst targets, does Figma’s recent price drop signal an overlooked buying opportunity? Or is the market already factoring in all future upside?

Most Popular Narrative: 44% Undervalued

With Figma’s fair value estimated at $65.70, nearly double its recent closing price of $36.76, bullish sentiment around future growth and expanding margins is running high, according to TickerTickle.

AI-driven product expansion: Buzz, Make, Sites, Slides, and Draw launched with AI features and deep integration. Enterprise adoption includes over 13 million active users and approximately 95% of Fortune 500 companies using Figma.

Why are so many investors betting on such a leap in value? The full narrative reveals the aggressive assumptions and strategic bets fueling this bullish outlook, but only if you’re ready to dig into the details behind the numbers.

Result: Fair Value of $65.7 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Figma’s high valuation and intensifying competition in AI-powered design could trigger rapid sentiment shifts if growth expectations fall short.

Find out about the key risks to this Figma narrative.

Another View: SWS DCF Model Comes to a Different Conclusion

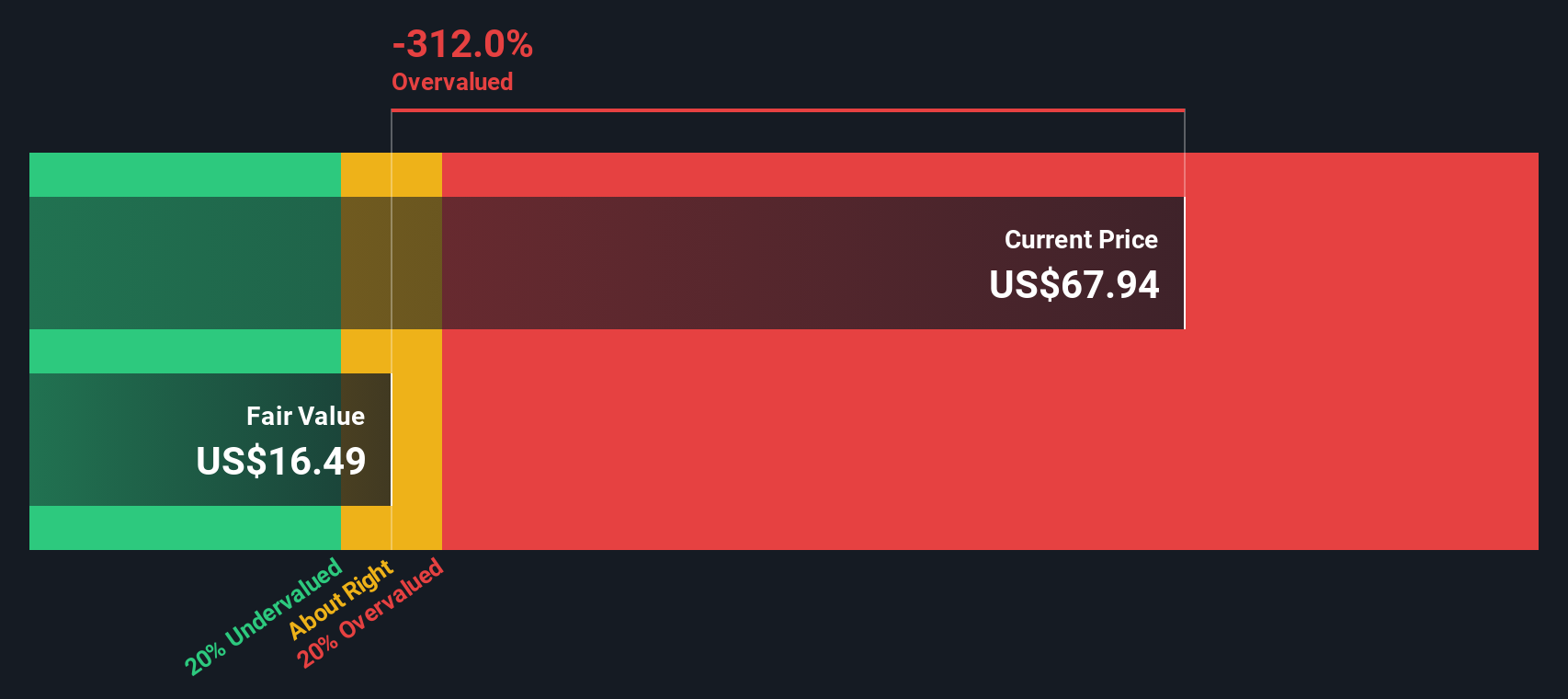

While bullish narratives see Figma as significantly undervalued, our SWS DCF model suggests a different story. By forecasting future cash flows, the model calculates Figma's fair value at $19.74, which is well below its current $36.76 share price. Could this signal the market is still too optimistic about growth?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Figma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Figma Narrative

If these valuations or forecasts don’t fit your outlook, why not dive into the data yourself and craft your own view in just minutes? Do it your way

A great starting point for your Figma research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on what’s next. If you’re ready to act, here are standout opportunities you shouldn't let pass you by:

- Accelerate your search for steady income by reviewing these 18 dividend stocks with yields > 3%, which offers top payouts above 3% and is backed by healthy balance sheets.

- Catch the momentum in artificial intelligence by checking out these 27 AI penny stocks, which are positioned to fuel the next stage of tech-driven growth.

- Take advantage of mispriced gems that could bounce higher by scanning these 905 undervalued stocks based on cash flows for potential bargains trading below their cash flow value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FIG

Figma

Develops a browser-based tool for designing user interfaces that helps design and development teams build various products.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives