- United States

- /

- Software

- /

- NYSE:FICO

The Bull Case For FICO Could Change Following PostFinance Fraud Tech Expansion – Learn Why

Reviewed by Sasha Jovanovic

- In recent days, PostFinance announced it will expand its use of FICO's Falcon Fraud Manager and Customer Communication Services to bolster fraud protection and customer engagement across 2.4 million Swiss customers and millions of transactions each day.

- This deepening collaboration highlights FICO's ability to secure growing transaction volumes with AI-powered solutions, reflecting continued demand for advanced fraud detection and real-time customer communication technologies in the global financial sector.

- We'll explore how FICO's expanded fraud protection partnership with PostFinance shapes the company's broader investment narrative and outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Fair Isaac Investment Narrative Recap

To hold Fair Isaac (FICO) stock, investors need confidence in the company's continued leadership in analytics-driven credit scoring and fraud detection, as well as its ability to adapt to evolving industry needs. The expanded PostFinance partnership strengthens FICO's global fraud prevention presence, but does not materially alter the primary catalyst, broad global adoption of FICO's next-generation Scores, or the biggest immediate risk, which remains potential regulatory-driven competition in US mortgage origination.

One directly relevant development is FICO's rollout of the Mortgage Direct License Program, which allows select partners to provide FICO Scores directly to lenders and aims to streamline credit evaluation in the US mortgage sector. This move could reinforce FICO's position as regulatory changes and competitive pressures create uncertainty around the future role of proprietary credit scoring models.

Yet, investors should also be aware that, in contrast, regulatory shifts threatening FICO's longstanding dominance in mortgage credit scoring represent an underappreciated challenge that could change the growth outlook...

Read the full narrative on Fair Isaac (it's free!)

Fair Isaac's outlook anticipates $2.9 billion in revenue and $1.1 billion in earnings by 2028. This is based on an expected 14.3% annual revenue growth and a $467 million earnings increase from current earnings of $632.6 million.

Uncover how Fair Isaac's forecasts yield a $2017 fair value, a 16% upside to its current price.

Exploring Other Perspectives

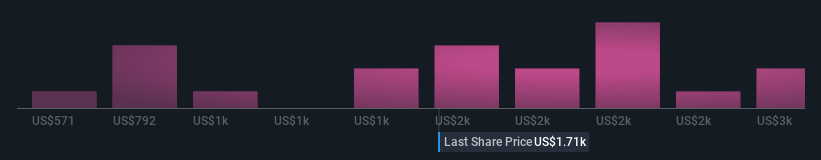

Seventeen fair value estimates from the Simply Wall St Community range from US$1,205 to US$2,628 per share, reflecting a wide spectrum of outlooks. While many investors see room for growth, ongoing regulatory challenges may shape FICO’s ability to sustain its competitive edge; consider these differing perspectives before deciding your next step.

Explore 17 other fair value estimates on Fair Isaac - why the stock might be worth as much as 51% more than the current price!

Build Your Own Fair Isaac Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fair Isaac research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fair Isaac research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fair Isaac's overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FICO

Fair Isaac

Develops software with analytics and digital decisioning technologies that enable businesses to automate, enhance, and connect decisions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Solid track record with limited growth.

Similar Companies

Market Insights

Community Narratives