- United States

- /

- Software

- /

- NYSE:ESTC

Elastic (ESTC) Jumps After Revenue Beat and AI Upside Guidance—Is Its Platform Strategy Paying Off?

Reviewed by Sasha Jovanovic

- Elastic N.V. recently reported second-quarter revenue of US$423.48 million, exceeding analyst expectations and raising its full-year guidance to US$1.72 billion, fueled by robust demand for its AI and generative AI platform solutions.

- The company also launched new AI and observability features, including enhanced OpenTelemetry capabilities and support for PHP, further strengthening its positioning in the technology sector.

- We'll explore how Elastic’s improved revenue outlook, underpinned by new AI-driven product releases, shapes its current investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Elastic Investment Narrative Recap

To be an Elastic shareholder today, you have to believe that continued enterprise adoption of AI and generative AI will drive substantial growth in the company’s multi-cloud search, observability, and security platforms. The latest quarter’s revenue beat and guidance raise reinforce momentum for these AI-driven catalysts, but do not materially diminish the short-term risk from intensifying competition with hyperscale cloud providers, which could still weigh on pricing and margins.

The rollout of new features in the Elastic Distribution of OpenTelemetry (EDOT) SDK, including PHP support, stands out as timely, given the company’s push into AI-powered solutions for enterprise observability. This announcement highlights Elastic’s efforts to consolidate its platform and deliver operational improvements that could help address the competitive pressures and scale requirements linked to recent customer and workload growth.

Yet, if competitive pressure from cloud-native platform providers accelerates faster than Elastic’s product innovation and adoption...

Read the full narrative on Elastic (it's free!)

Elastic's outlook anticipates $2.3 billion in revenue and $50.5 million in earnings by 2028. This is based on an expected annual revenue growth rate of 13.9% and a $134 million increase in earnings from a current loss of $83.5 million.

Uncover how Elastic's forecasts yield a $120.16 fair value, a 46% upside to its current price.

Exploring Other Perspectives

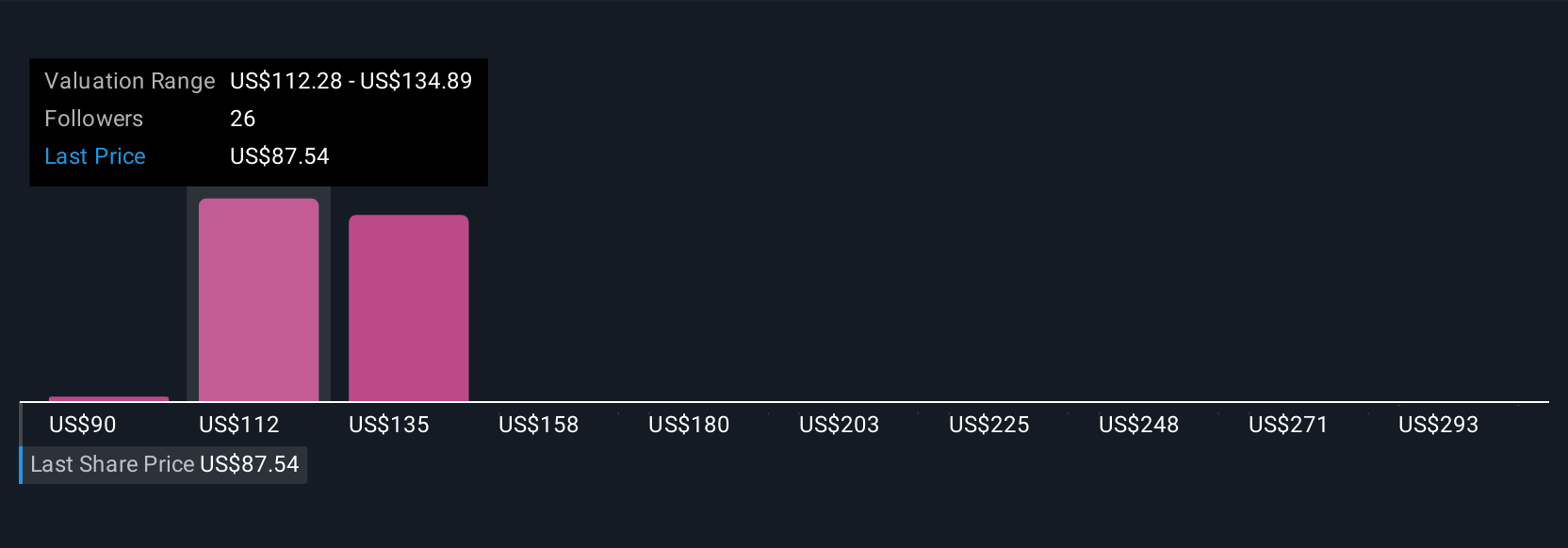

Simply Wall St Community members have published seven different fair value estimates for Elastic, ranging from US$89.66 to US$315.80 per share. While many see upside tied to enterprise AI adoption, there is still meaningful concern about Elastic’s ability to maintain pricing power as competition from hyperscalers increases.

Explore 7 other fair value estimates on Elastic - why the stock might be worth over 3x more than the current price!

Build Your Own Elastic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Elastic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Elastic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Elastic's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 38 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, provides software platforms to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives