- United States

- /

- Software

- /

- NYSE:ESTC

A Fresh Look at Elastic (ESTC) Valuation Following Agent Builder AI Platform Launch

Reviewed by Simply Wall St

Elastic (NYSE:ESTC) just rolled out Agent Builder, a suite of features designed to help developers rapidly create, configure, and manage custom AI agents within Elasticsearch. This streamlines enterprise workflows and data exploration.

See our latest analysis for Elastic.

After some major product rollouts and a $500 million buyback announcement this month, Elastic’s 1-year total shareholder return stands at 10.9%, well ahead of its 13% year-to-date decline in the share price. Momentum has been mixed, but continued investment in AI tools is fueling long-term interest despite some recent volatility.

If Elastic’s latest AI moves have you tracking what’s next in tech, there has never been a better moment to discover See the full list for free.

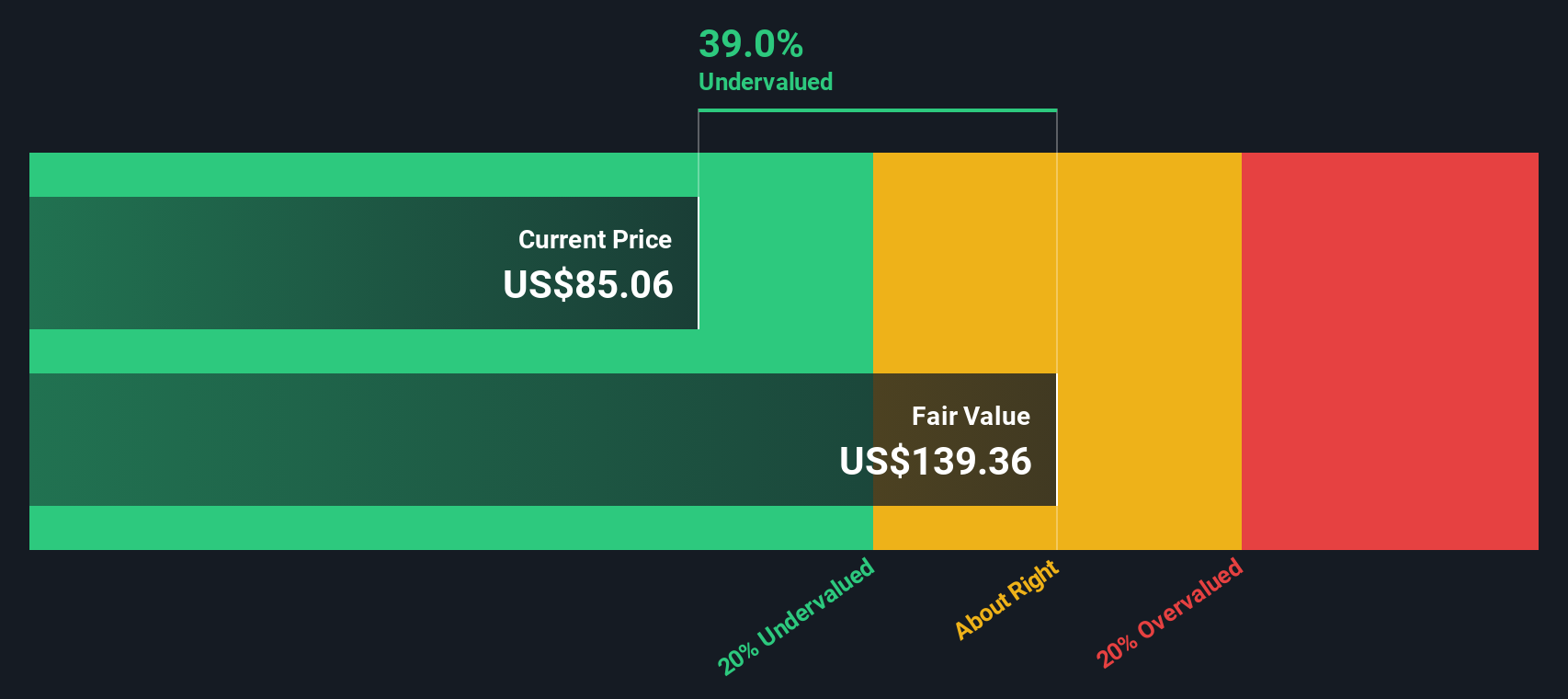

With shares trading nearly 39% below Wall Street’s consensus price target and strong fundamentals supporting its AI expansion, is Elastic an overlooked value buy right now, or is the market already taking future growth into account?

Most Popular Narrative: 28.4% Undervalued

With the most widely followed narrative placing Elastic's fair value at $120.16 compared to a last close price of $86.07, the gap is drawing attention. Market participants are watching key trends that could be pivotal for the company's valuation story.

Ongoing platform consolidation trends, where enterprises seek unified solutions for search, observability, and security, are enabling Elastic to displace legacy providers and drive cross-selling of its integrated offerings. This leads to deeper customer relationships and improved net dollar retention rates.

How can Elastic’s unified platform fuel deeper customer ties and financial momentum? The narrative’s bold valuation rests on optimistic projections around growth and margin expansion. See exactly which assumptions could send this stock soaring beyond expectations.

Result: Fair Value of $120.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from leading cloud providers and pricing pressure on open source tools could quickly undermine Elastic’s long-term earnings trajectory.

Find out about the key risks to this Elastic narrative.

Another View: What Does the DCF Model Say?

Looking through the lens of our SWS DCF model, Elastic appears even more undervalued than the market suggests. The DCF points to a fair value of $140 per share, which is well above both the current share price and analyst targets. Could this deeper discount represent a rare value opportunity, or do market headwinds justify the caution?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Elastic Narrative

Curious to see if a different conclusion makes sense for you? Dive into the numbers and shape your own take in under three minutes. Do it your way

A great starting point for your Elastic research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Level up your portfolio by seizing opportunities others might overlook. The Simply Wall Street Screener gives you access to powerful strategies designed for today’s market. Don’t let great ideas pass you by. Check out these hand-picked avenues for your next move:

- Supercharge your returns by targeting undervalued opportunities with strong upside using these 872 undervalued stocks based on cash flows, which highlights hidden gems missed by the crowd.

- Grow your income stream by tapping into these 17 dividend stocks with yields > 3%, showcasing companies with robust dividend yields and compelling financial strength.

- Ride the AI momentum and stay at the forefront of innovation by acting on these 26 AI penny stocks, which are primed for rapid growth in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elastic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ESTC

Elastic

A search artificial intelligence (AI) company, provides software platforms to run in hybrid, public or private clouds, and multi-cloud environments in the United States and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives