- United States

- /

- IT

- /

- NYSE:EPAM

EPAM Systems (NYSE:EPAM) Reports Revenue Growth But Decline In Net Income

Reviewed by Simply Wall St

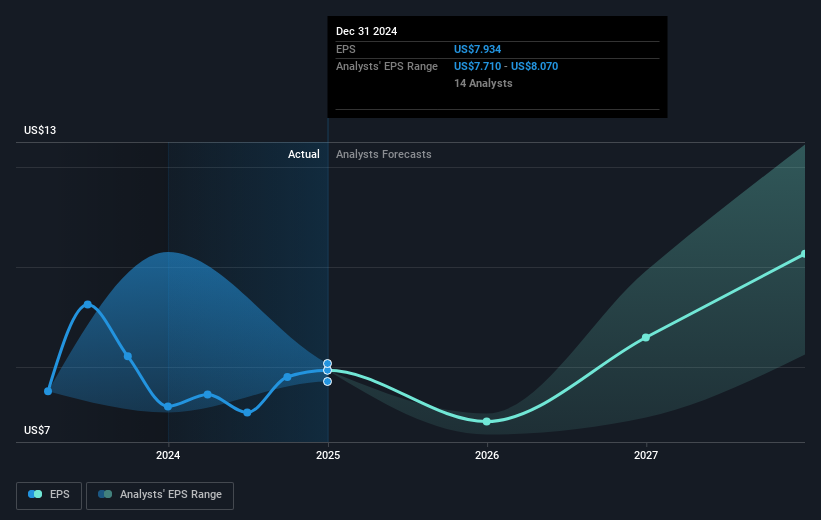

EPAM Systems (NYSE:EPAM) recently announced that its Principal Founder Arkadiy Dobkin will transition to Executive Chairman, while Balazs Fejes will assume the role of CEO later this year. This leadership change follows EPAM's Q1 earnings report, which showed increased sales but a drop in net income and EPS. The company's stock rose 10% over the last month, influenced by positive market trends driven by a new U.S.-U.K. trade deal. Additionally, EPAM's updated revenue guidance, projecting notable growth, and expanded collaboration with Amazon Web Services, likely added weight to the positive market movement.

Every company has risks, and we've spotted 1 weakness for EPAM Systems you should know about.

EPAM Systems' leadership transition, involving Arkadiy Dobkin and Balazs Fejes, arrives at a critical juncture as the company aims to expand its AI initiatives and global footprint. These changes could bolster its service offerings and revenue streams, aligning with the growing demand for AI transformation. However, geopolitical risks and pricing pressures pose challenges to these ambitions. The increased sales and partnerships mentioned earlier may positively impact future earnings forecasts, yet the company's long-term performance has been mixed. Over the past five years, EPAM's total return dropped by 24.91%, reflecting challenges in sustaining growth and profitability over the extended period.

In contrast, the company's performance relative to the US IT industry shows it underperformed, with the IT industry returning 18.3% over the past year compared to EPAM's own performance. A key issue is whether the updated revenue guidance and expansion strategy can support the analyst consensus price target of US$213.97. Given the current share price of US$157.88, there is a potential for a significant rise, but this depends on executing growth strategies amidst market uncertainties. Analysts forecast a slower expected annual profit growth of 9.1% per year, which is below the US market average of 13.9%, potentially tempering some enthusiasm about meeting or exceeding projected price targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade EPAM Systems, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives