- United States

- /

- IT

- /

- NYSE:EPAM

EPAM Systems (EPAM): Examining Valuation Following BOSS Collaboration and Apple Vision Pro Launch

Reviewed by Kshitija Bhandaru

EPAM Systems (EPAM) recently teamed up with BOSS to launch an immersive motorsport experience powered by Apple Vision Pro. Announced just ahead of a major Formula 1 event, this project highlights EPAM’s expertise in next-generation digital solutions.

See our latest analysis for EPAM Systems.

Momentum around EPAM Systems has been shaped by its push into AI-driven, immersive experiences, such as the just-launched Apple Vision Pro project with BOSS, and a recent rebranding of its European operations. While near-term share price returns have been modest, the stock’s 1-year total shareholder return remains slightly negative, signaling a longer-term performance that has been under some pressure even as the company makes innovative moves.

If EPAM's digital innovation streak has you curious, now might be the right moment to expand your radar and find opportunities with fast growing stocks with high insider ownership

With analyst price targets suggesting meaningful upside and the stock trading at a notable discount, could EPAM Systems represent an undervalued growth play? Or are markets already accounting for its future innovation-driven gains?

Most Popular Narrative: 27% Undervalued

With EPAM Systems last closing at $154.12 and the most-followed narrative placing fair value at $211.12, consensus points to a striking gap between market price and projected worth. The narrative’s forward-looking assumptions, combined with a modest discount rate of 8.84%, set the stage for debate.

The accelerating enterprise adoption of AI is driving a surge in demand for advanced data engineering, cloud migration, and platform modernization projects. These are areas where EPAM holds deep technical expertise, leading to increased revenue from larger and more complex client engagements. EPAM's strategic investments in AI-native services, proprietary platforms (such as DIAL and AI/RUN), and upskilling of over 80% of its workforce have positioned it as a transformation partner for clients moving beyond pilot AI programs to large-scale deployments. This supports sustainable revenue growth and the potential for improved net margins as EPAM moves up the value chain.

Ready to discover the bold assumptions powering this premium? The narrative relies on strong earnings and margin expansion, suggesting an unexpected growth engine that could redefine EPAM’s valuation story. Explore the strategic moves and forecasted milestones analysts are considering. What fuels these ambitious projections? Dive in to connect the dots.

Result: Fair Value of $211.12 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising automation and ongoing talent cost pressures could threaten EPAM’s margins. This raises questions about the sustainability of its current growth expectations.

Find out about the key risks to this EPAM Systems narrative.

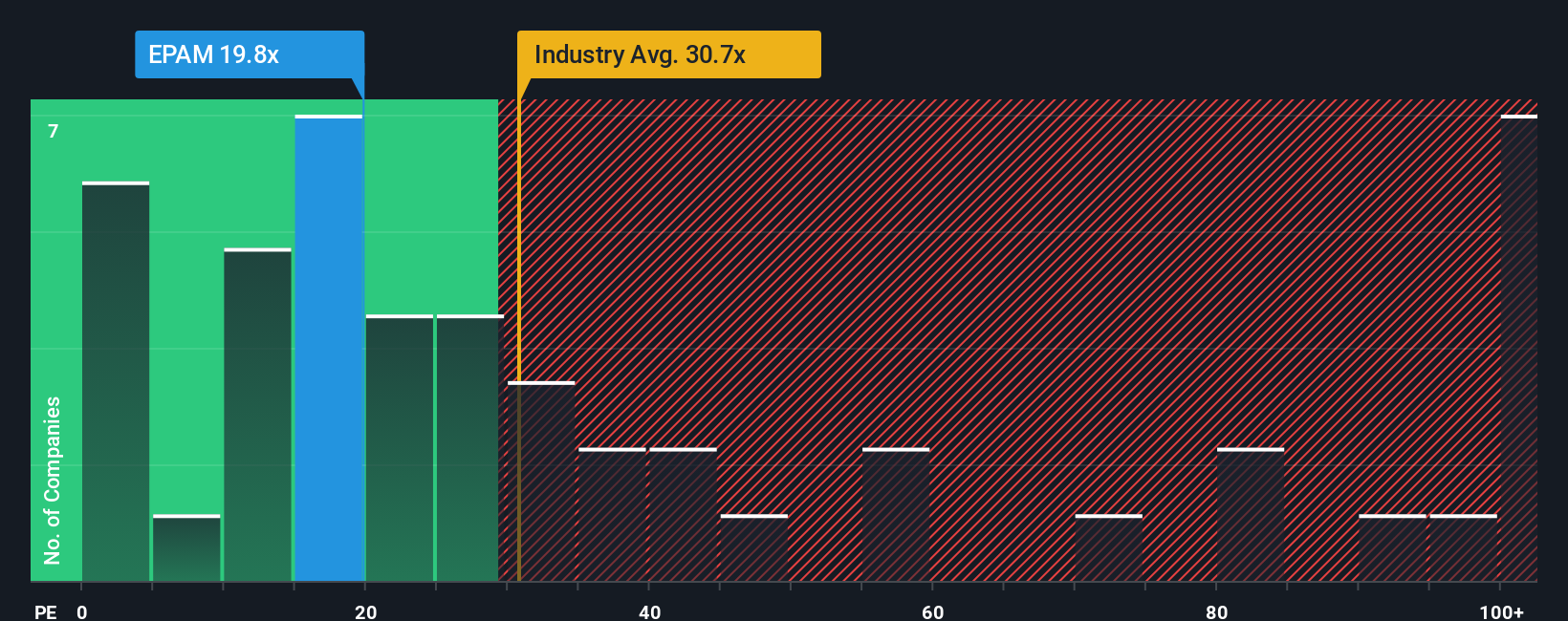

Another View: What Do Earnings Ratios Suggest?

While the fair value estimate based on future cash flows points to EPAM Systems being undervalued, the market’s current price-to-earnings ratio of 21.4x is actually higher than its peer average of 17.2x. However, this is still well below the fair ratio of 31.9x. This gap highlights both a possible value opportunity and a reminder that investor sentiment can shift, quickly changing what counts as “cheap” or “expensive.” Which way will investors lean next?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own EPAM Systems Narrative

If you see things differently or want to dig into the numbers on your own, you can craft your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding EPAM Systems.

Looking for More Investment Ideas?

Don’t let unique opportunities pass you by. Expand your perspective with targeted stock ideas hand-picked to match evolving market trends and future growth themes.

- Capture the growth potential of tomorrow's digital health innovators by checking out these 31 healthcare AI stocks offering advanced AI solutions for better patient outcomes and efficiency.

- Tap into high-yield opportunities by viewing these 19 dividend stocks with yields > 3% that deliver attractive returns with reliable dividends above 3%.

- Harness the disruptive momentum in artificial intelligence and machine learning with these 24 AI penny stocks setting new standards in automation, analytics, and data-driven insights.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EPAM Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EPAM

EPAM Systems

Provides digital platform engineering and software development services worldwide.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026