- United States

- /

- Software

- /

- NasdaqGS:EGHT

If You Had Bought 8x8 (NYSE:EGHT) Shares Five Years Ago You'd Have Made 191%

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on the bright side, you can make far more than 100% on a really good stock. For example, the 8x8, Inc. (NYSE:EGHT) share price has soared 191% in the last half decade. Most would be very happy with that. It's also good to see the share price up 27% over the last quarter.

Check out our latest analysis for 8x8

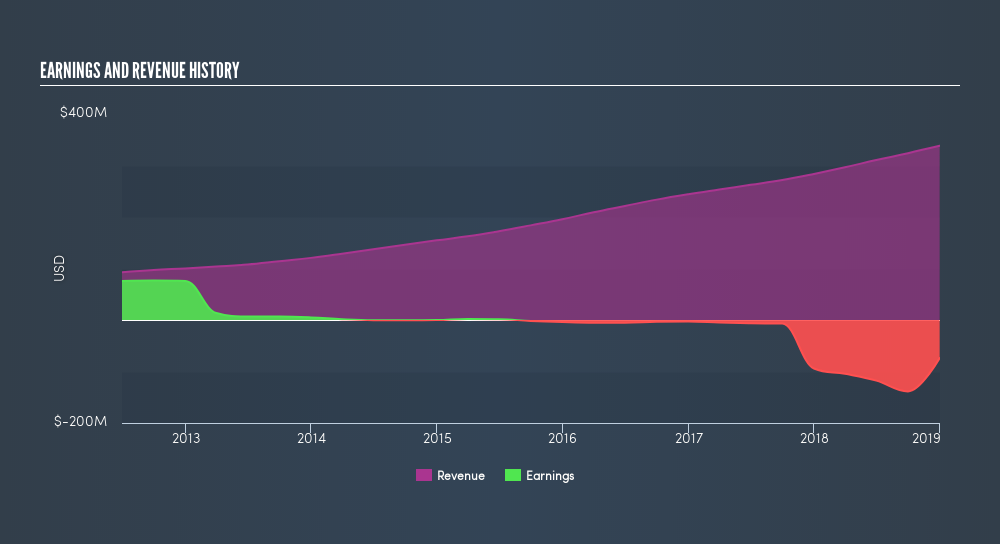

Given that 8x8 didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

For the last half decade, 8x8 can boast revenue growth at a rate of 20% per year. That's well above most pre-profit companies. So it's not entirely surprising that the share price reflected this performance by increasing at a rate of 24% per year, in that time. So it seems likely that buyers have paid attention to the strong revenue growth. To our minds that makes 8x8 worth investigating - it may have its best days ahead.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling 8x8 stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

8x8 provided a TSR of 6.7% over the year. That's fairly close to the broader market return. It has to be noted that the recent return falls short of the 24% shareholders have gained each year, over half a decade. Although the share price growth has slowed, the longer term story points to a business well worth watching. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

8x8 is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges. We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:EGHT

8x8

Provides contact center, voice, video, chat, and enterprise-class application programmable interface (API) solutions worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives