Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, 8x8, Inc. (NYSE:EGHT) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for 8x8

How Much Debt Does 8x8 Carry?

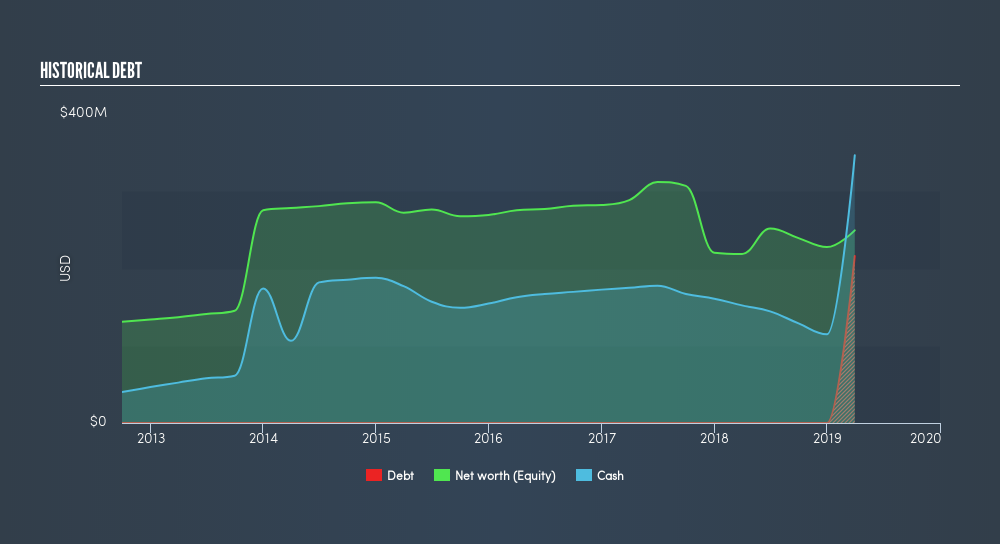

The image below, which you can click on for greater detail, shows that at March 2019 8x8 had debt of US$216.0m, up from none in one year. But on the other hand it also has US$346.5m in cash, leading to a US$130.4m net cash position.

How Healthy Is 8x8's Balance Sheet?

The latest balance sheet data shows that 8x8 had liabilities of US$74.7m due within a year, and liabilities of US$222.3m falling due after that. Offsetting these obligations, it had cash of US$346.5m as well as receivables valued at US$25.9m due within 12 months. So it can boast US$75.4m more liquid assets than total liabilities.

This surplus suggests that 8x8 has a conservative balance sheet, and could probably eliminate its debt without much difficulty. 8x8 boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if 8x8 can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

In the last year 8x8 managed to grow its revenue by 19%, to US$353m. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is 8x8?

We have no doubt that loss making companies are, in general, riskier than profitable ones. Anf the fact is that over the last twelve months 8x8 lost money at the earnings before interest and tax (EBIT) line. Indeed, in that time it burnt through US$50m of cash and made a loss of US$89m. But the saving grace is the US$346m on the balance sheet. That means it could keep spending at its current rate for more than five years. Even though its balance sheet seems sufficiently liquid, debt always makes us a little nervous if a company doesn't produce free cash flow regularly. When I consider a company to be a bit risky, I think it is responsible to check out whether insiders have been reporting any share sales. Luckily, you can click here ito see our graphic depicting 8x8 insider transactions.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:EGHT

8x8

Provides contact center, voice, video, chat, and enterprise-class application programmable interface (API) solutions worldwide.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion