- United States

- /

- IT

- /

- NYSE:DXC

DXC Technology (DXC) Profit Margin Rebound Challenges Bearish Narratives Despite One-Off $188M Loss

Reviewed by Simply Wall St

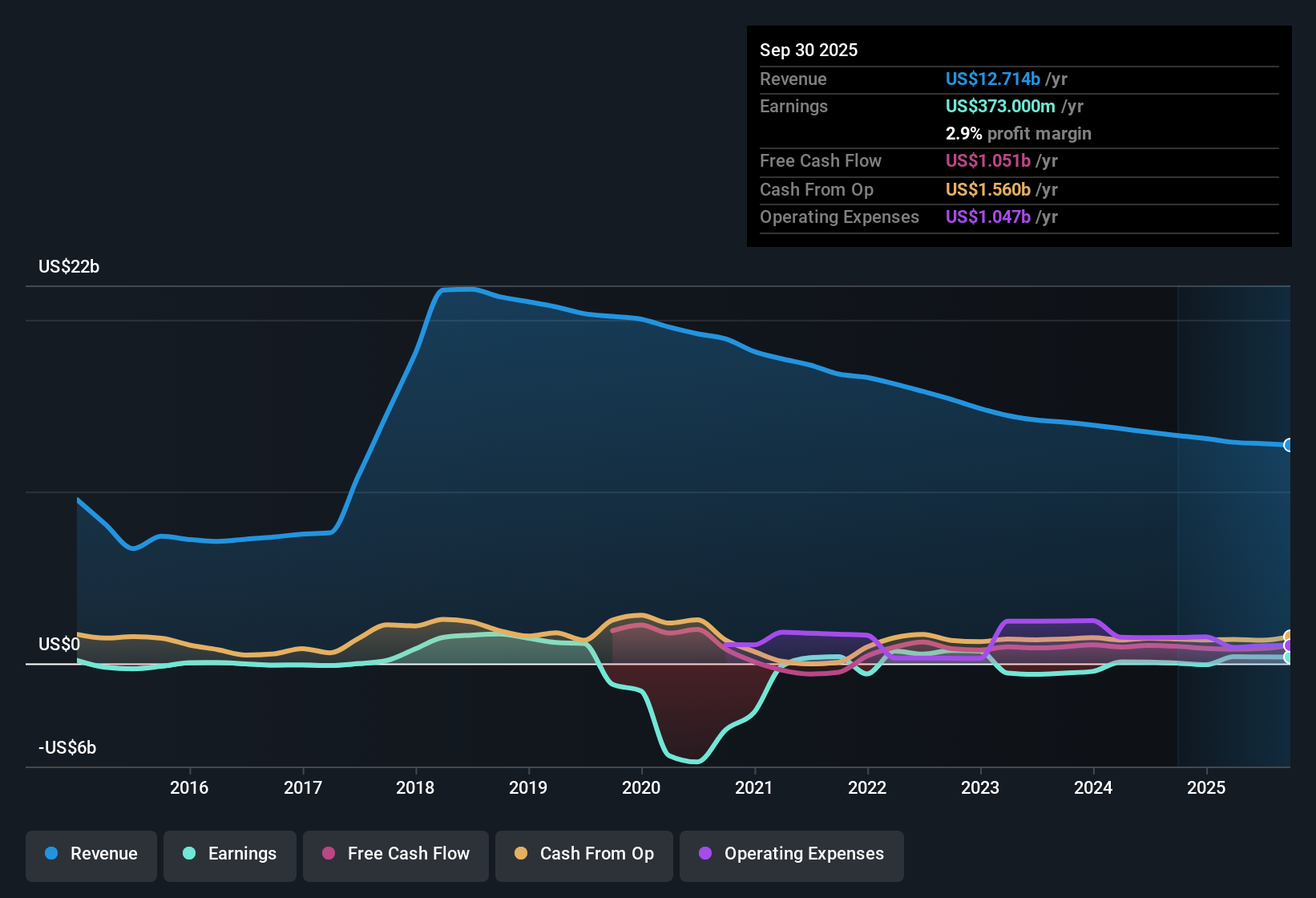

DXC Technology (DXC) delivered a sharp turnaround in its latest earnings, posting a net profit margin of 3%, up from just 0.6% last year, as the company’s profitability strengthened. Earnings grew a striking 367.9% over the past year, far outpacing the already robust five-year average of 49.3% per year. Despite a notable one-off loss of $188.0 million weighing on the results for the 12 months leading up to September 30, 2025, shares now trade at $14.20, significantly below the estimated fair value of $28.98. With a Price-to-Earnings ratio of 6.7x, which is lower than industry and peer averages, DXC looks attractively priced for value-focused investors, though revenue is projected to decline by 1.9% per year over the next three years.

See our full analysis for DXC Technology.The real test is how these numbers stack up against the prevailing market narratives. Some views will get reinforced, while others may be challenged in the sections ahead.

See what the community is saying about DXC Technology

Bookings Momentum and Deal Flow Strength

- DXC recorded three straight quarters of double-digit bookings growth, with its trailing 12-month book-to-bill ratio staying above 1.0. This indicates growing demand for digital transformation even as near-term revenue declines persist.

- According to analysts' consensus view, this sustained bookings performance signals that client demand for DXC's modernization solutions could help offset organic revenue shrinkage.

- Deal momentum, if successfully converted, has the potential to stabilize revenues despite management's ongoing guidance for a 3 to 5 percent organic decline in full-year fiscal 2026.

- Consensus narrative also highlights operational efficiency and workforce investments as factors likely to enhance margins and deliver incremental free cash flow, provided that delayed or cancelled contracts do not undermine backlog conversion.

- For a deeper look at how analysts weigh these opportunities against growing industry risks, see the full consensus market view. 📊 Read the full DXC Technology Consensus Narrative.

Margin Outlook Faces Downward Pressure

- Profit margins are forecast to contract from 3.0 percent currently to just 1.7 percent in three years, reflecting both competitive and structural headwinds for DXC's core business lines.

- Consensus narrative notes that while cost cutting and strategic partnerships should drive efficiency, GIS segment decline and wage inflation remain challenging:

- With the GIS segment making up more than half of total revenues and continuing to decline at mid-single-digit rates, any further loss in profitability here poses a risk to company-wide net margins.

- Ongoing investments in AI-driven internal processes are expected to deliver margin support, yet analysts remain cautious about achieving sufficient savings to fully offset macro and sector pressures.

Valuation Discount Versus DCF Fair Value

- Shares currently trade at $14.20, far below the DCF fair value estimate of $28.98, and at a price-to-earnings ratio of 6.7x, materially undercutting US IT industry peers.

- Analysts' consensus view argues that despite weak revenue projections and a large one-off loss, the discounted valuation could offer opportunity for investors with a long-term outlook.

- Consensus price target stands at $14.88, roughly 5 percent above today’s share price, suggesting some see value even with muted EPS growth expected by 2028.

- This gap between DCF fair value and analysts' targets shows that valuation upside hinges on DXC's ability to deliver on cost initiatives and win lasting transformation deals, not just short-term profit jumps.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for DXC Technology on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the numbers others might miss? It takes just moments to craft your unique take and add to the story. Do it your way

A great starting point for your DXC Technology research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

DXC faces mounting pressure from revenue declines, shrinking margins, and risks tied to its core GIS segment’s ongoing weakness and lack of stability.

If steadier results appeal more, consider stable growth stocks screener (2103 results) to target companies with consistent growth and greater resilience through shifting market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the Rest of Europe, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)