- United States

- /

- IT

- /

- NYSE:DXC

DXC Technology Company's (NYSE:DXC) Business And Shares Still Trailing The Industry

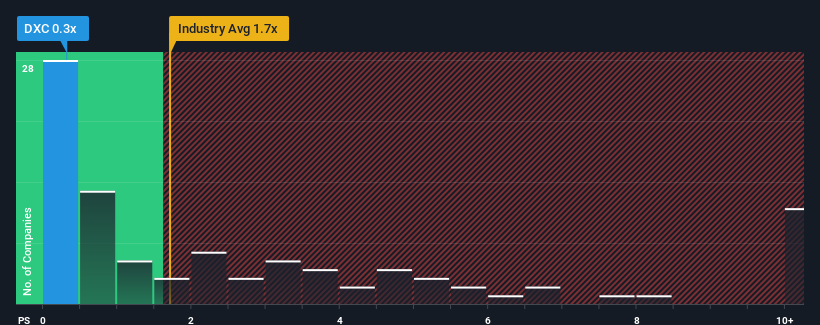

With a price-to-sales (or "P/S") ratio of 0.3x DXC Technology Company (NYSE:DXC) may be sending bullish signals at the moment, given that almost half of all the IT companies in the United States have P/S ratios greater than 1.7x and even P/S higher than 5x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for DXC Technology

How Has DXC Technology Performed Recently?

While the industry has experienced revenue growth lately, DXC Technology's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think DXC Technology's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For DXC Technology?

There's an inherent assumption that a company should underperform the industry for P/S ratios like DXC Technology's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 8.7%. This means it has also seen a slide in revenue over the longer-term as revenue is down 26% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 3.5% during the coming year according to the analysts following the company. Meanwhile, the broader industry is forecast to expand by 10%, which paints a poor picture.

With this in consideration, we find it intriguing that DXC Technology's P/S is closely matching its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that DXC Technology's P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, DXC Technology's poor outlook justifies its low P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for DXC Technology with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the rest of Europe, Australia, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives