- United States

- /

- IT

- /

- NYSE:DXC

Did Changing Sentiment Drive DXC Technology's (NYSE:DXC) Share Price Down A Worrying 65%?

The nature of investing is that you win some, and you lose some. And there's no doubt that DXC Technology Company (NYSE:DXC) stock has had a really bad year. The share price is down a hefty 65% in that time. Notably, shareholders had a tough run over the longer term, too, with a drop of 34% in the last three years. The falls have accelerated recently, with the share price down 39% in the last three months.

View our latest analysis for DXC Technology

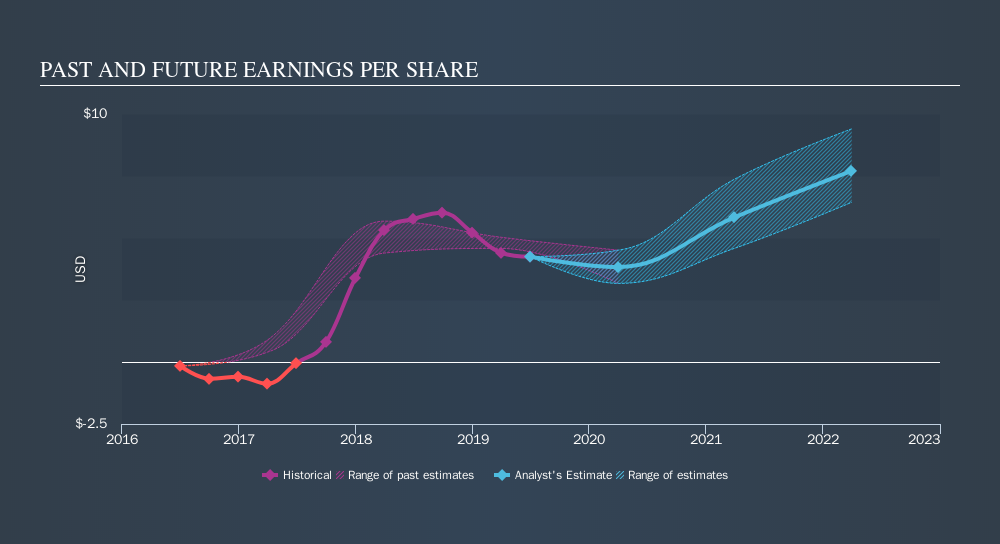

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unfortunately DXC Technology reported an EPS drop of 26% for the last year. The share price decline of 65% is actually more than the EPS drop. So it seems the market was too confident about the business, a year ago. The P/E ratio of 7.69 also points to the negative market sentiment.

It is of course excellent to see how DXC Technology has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at DXC Technology's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between DXC Technology's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. DXC Technology's TSR of was a loss of 64% for the year. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Investors in DXC Technology had a tough year, with a total loss of 64% (including dividends) , against a market gain of about 4.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. If you would like to research DXC Technology in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the rest of Europe, Australia, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives