- United States

- /

- IT

- /

- NYSE:DXC

Assessing DXC Technology (DXC) Valuation After Recent Share Price Rebound

Why DXC Technology is on investors’ radar today

DXC Technology (DXC) has drawn attention after recent price moves, with the stock closing at $15.28 and showing contrasting short term gains against weaker multi year total returns.

For investors, that mix of recent momentum and longer term underperformance raises questions about how the company’s current valuation aligns with its fundamentals and whether the recent move reflects shifting expectations for the business.

See our latest analysis for DXC Technology.

Recent trading has been firm, with a 1 day share price return of 5.89% and a 90 day share price return of 12.85%. However, the 1 year total shareholder return of 30.58% and 3 year total shareholder return of 44.29% show that longer term holders have still faced sizeable losses, so recent strength looks more like a rebound than a firmly established trend.

If DXC’s move has you reassessing your watchlist, this could be a useful moment to broaden your search and look at high growth tech and AI stocks.

With DXC trading at $15.28, sitting close to analyst targets yet screening with a wide intrinsic discount and weaker recent profit and revenue trends, you have to ask: is this a genuine value opportunity, or is the market already pricing in any future recovery?

Most Popular Narrative: 5.4% Overvalued

DXC Technology’s most followed narrative anchors fair value at $14.50, which sits slightly below the current $15.28 share price and frames a cautious setup.

DXC's strong bookings momentum, with three consecutive quarters of double-digit growth and a sustained trailing 12-month book-to-bill ratio above 1.0, suggests improving deal flow linked to client demand for digital modernization, which should convert to organic revenue stabilization and growth over the next 12-18 months.

Want to understand why a shrinking top line, thinner margins and a higher future earnings multiple still support that valuation? The full narrative spells out the revenue path, earnings profile and discount rate that hold this price target together.

Result: Fair Value of $14.50 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, you still have to weigh persistent revenue declines and margin pressure, along with competition in cloud and AI services that could keep earnings and valuation under strain.

Find out about the key risks to this DXC Technology narrative.

Another angle on DXC’s valuation

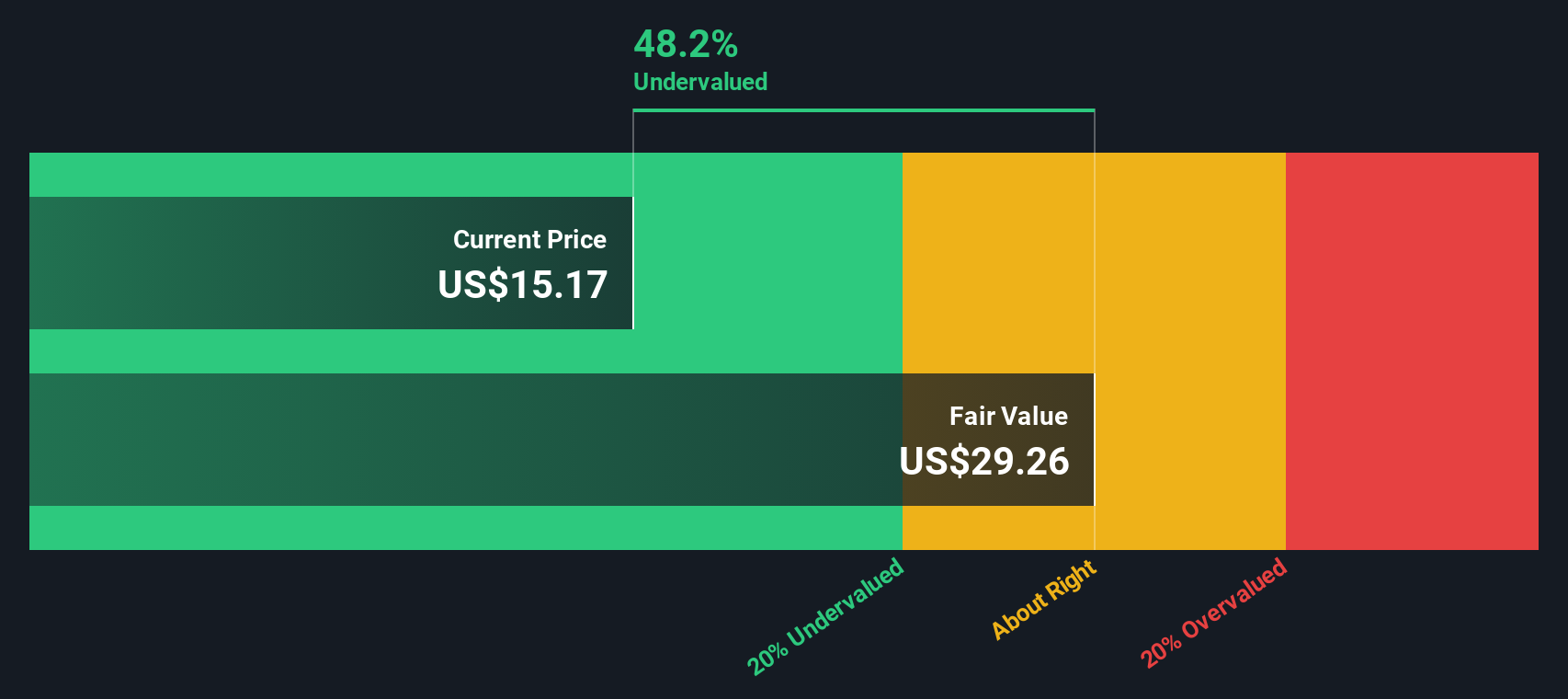

Our DCF model provides an estimate of future cash flow value of around $32.16 per share, compared to the current $15.28 price. That suggests DXC may be trading at a steep discount. This raises the question: is the cash flow outlook too generous, or is market sentiment unusually low?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DXC Technology Narrative

If you interpret the numbers differently or prefer to test your own assumptions, you can build a custom DXC view in minutes with Do it your way.

A great starting point for your DXC Technology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas beyond DXC?

If DXC has sharpened your focus, do not stop here. Widen your opportunity set now so you are not relying on a single story for potential returns.

- Target income-focused opportunities by scanning these 13 dividend stocks with yields > 3% that might suit a portfolio built around regular cash returns.

- Spot potential growth names early by reviewing these 3542 penny stocks with strong financials that already show solid underlying financials.

- Lean into future focused themes by checking these 22 quantum computing stocks that are working on quantum computing applications.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DXC

DXC Technology

Provides information technology services and solutions in the United States, the United Kingdom, the Rest of Europe, Australia, and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

The Green Consolidator

EDP as a safe capital allocation with a potential upside of 28% with steady dividends

#1 Silver Play with Positive Cashflow Gold Miner (Top Notch Team)

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I wrote the latest analysis on DSV, all I can say this is my #1 stock pick, my largest hold. Latest : https://simplywall.st/community/narratives/ca/materials/tsx-dsv/discovery-silver-shares/ha9axhmi-1-silver-play-with-positive-cashflow-gold-miner-top-notch-team-moui/updates/5-discovery-silver-corp-tsx-dsv-discovery-silver-is-now?utm_source=share&utm_medium=web