- United States

- /

- Software

- /

- NYSE:DT

How Investors Are Reacting To Dynatrace (DT) Launching Advanced AI Observability on Microsoft Azure

Reviewed by Sasha Jovanovic

- Dynatrace recently unveiled advanced AI-driven enhancements to its cloud operations platform for Microsoft Azure and became the first observability platform to integrate with Microsoft's Azure SRE Agent, as announced in conjunction with Microsoft Ignite 2025.

- This set of announcements highlights Dynatrace's expanding influence in AI-powered automation and positions the company at the forefront of transforming large-scale digital operations on the Azure cloud.

- We'll now examine how this debut of cutting-edge AI observability on Azure may influence Dynatrace's investment narrative and market positioning.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Dynatrace Investment Narrative Recap

For investors considering Dynatrace, the core belief to hold is that the company can capture a growing share of enterprise digital transformation spend by delivering differentiated, AI-driven observability and automation. The recent Azure-focused product launches deepen Dynatrace’s cloud integration and AI capabilities, which can reinforce its standing among large clients, a key short-term catalyst, but may not fully address the risk of competitive pressure or potential slowdown in large enterprise deals.

The integration of Dynatrace with Microsoft's Azure SRE Agent stands out as the most relevant recent announcement. This collaboration positions Dynatrace as the first observability platform to tap into Azure’s AI-powered reliability assistant, enhancing automated detection and remediation for clients. As organizations increasingly demand seamless cloud platform integration and faster resolution times, this move strengthens Dynatrace’s offering around a central industry catalyst: faster innovation cycles driven by AI-based automation.

Yet, on the flip side, investors should be aware that as competitors ramp up their own cloud and AI integrations, the risk of pricing pressure and slower deal cycles may grow…

Read the full narrative on Dynatrace (it's free!)

Dynatrace's outlook forecasts $2.7 billion in revenue and $521.4 million in earnings by 2028. This assumes a 15.2% annual revenue growth rate and a $28.4 million increase in earnings from the current $493.0 million.

Uncover how Dynatrace's forecasts yield a $61.79 fair value, a 32% upside to its current price.

Exploring Other Perspectives

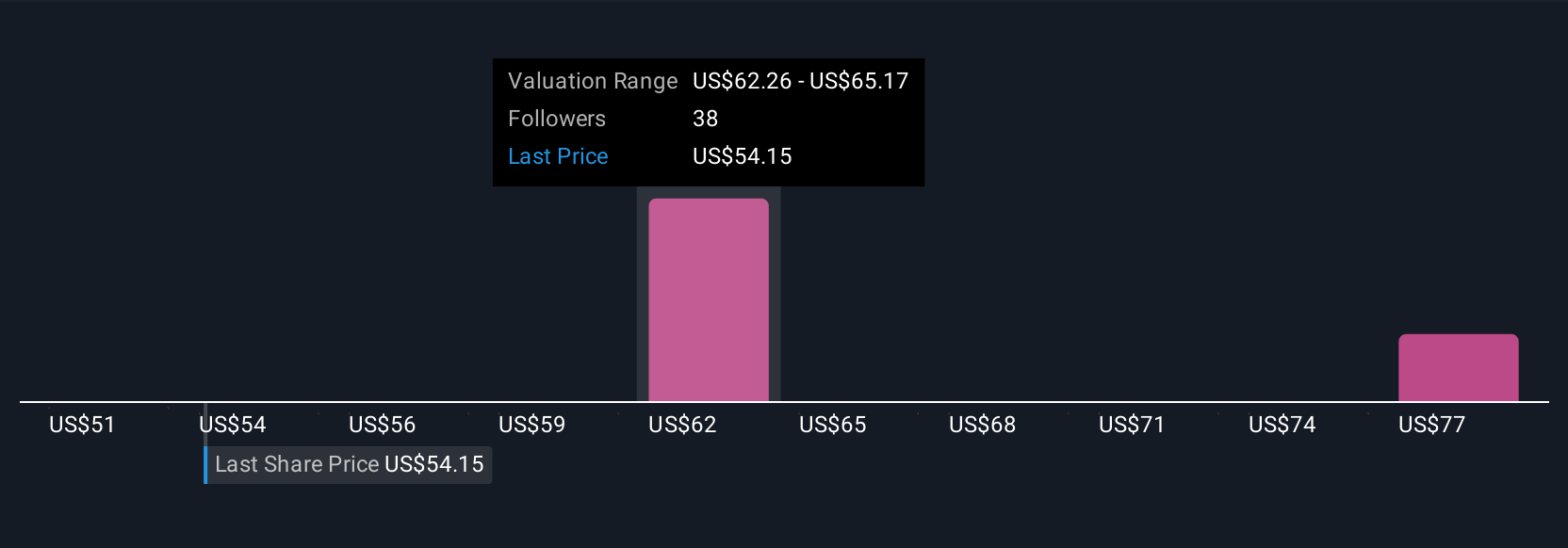

Five community members at Simply Wall St estimate Dynatrace’s fair value between US$50.62 and US$72.79 per share. With strong AI-based product expansion seen as a growth catalyst, opinions vary widely, see how your expectations compare.

Explore 5 other fair value estimates on Dynatrace - why the stock might be worth as much as 55% more than the current price!

Build Your Own Dynatrace Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dynatrace research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Dynatrace research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dynatrace's overall financial health at a glance.

Want Some Alternatives?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DT

Dynatrace

Engages in the advancement of observability for digital businesses, which transforms the complexity of modern digital ecosystems in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives