- United States

- /

- IT

- /

- NYSE:DOCN

Why DigitalOcean Holdings (DOCN) Is Up 6.5% After Expanding AI Partnerships With OpenAI and NVIDIA

Reviewed by Sasha Jovanovic

- At its recent Deploy London conference, DigitalOcean announced a major expansion of its AI Ecosystem and formally introduced the DigitalOcean AI Partner Program, offering customers new integrations and access to leading AI models and hardware from companies like OpenAI, Meta, AMD, and NVIDIA.

- This move aims to create a comprehensive, flexible platform for AI-native startups and digital native enterprises, strengthening DigitalOcean's position as an enabler for next-generation AI application development through unified tooling and developer-focused partnerships.

- We'll explore how DigitalOcean's expanded AI partnerships and developer ecosystem could impact its growth outlook and investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

DigitalOcean Holdings Investment Narrative Recap

To own shares in DigitalOcean, you need to believe in its ability to capture a meaningful share of the next wave of cloud and AI platform growth, particularly with digital native enterprises and AI-native customers. The recent expansion of the AI Ecosystem and Partner Program is positive for broadening DigitalOcean’s AI platform appeal, but its short-term impact on revenue growth and the company’s biggest near-term catalyst, accelerated adoption among AI-first developers, remains to be seen, while the most important risk continues to be intense hyperscaler competition and the challenge of scaling enterprise sales efficiently.

Among recent announcements, the partnership with Laravel, which brought Laravel VPS to over 1 million developers, stands out as building stickier integrations in the developer community. This move complements the new AI initiatives, highlighting a consistent focus on lowering barriers to cloud and AI adoption and potentially boosting customer retention and migration from competitors as a growth lever.

Yet while these platform expansions illustrate upside, investors should also be mindful that, unlike larger rivals, DigitalOcean still faces the risk of...

Read the full narrative on DigitalOcean Holdings (it's free!)

DigitalOcean Holdings' outlook anticipates $1.3 billion in revenue and $182.0 million in earnings by 2028. This is based on analysts projecting 14.6% annual revenue growth and a $55.6 million increase in earnings from the current $126.4 million.

Uncover how DigitalOcean Holdings' forecasts yield a $41.60 fair value, a 11% upside to its current price.

Exploring Other Perspectives

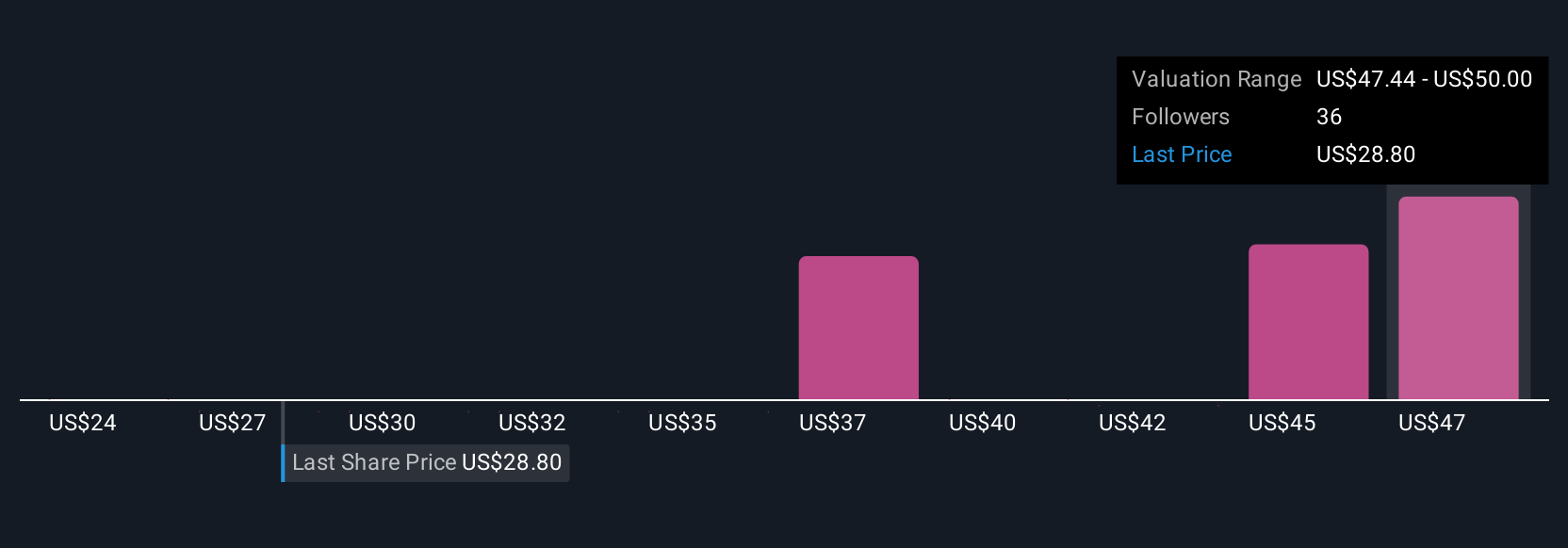

Eleven members of the Simply Wall St Community estimate DigitalOcean’s fair value between US$24.42 and US$50, reflecting considerable differences in outlook. Ongoing competition from major cloud platforms could have a significant impact on the company’s ability to sustain momentum, so it pays to consider many views.

Explore 11 other fair value estimates on DigitalOcean Holdings - why the stock might be worth as much as 34% more than the current price!

Build Your Own DigitalOcean Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DigitalOcean Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DigitalOcean Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DigitalOcean Holdings' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Proven track record with slight risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026