- United States

- /

- IT

- /

- NYSE:DOCN

Is DigitalOcean Set for Growth After Recent Share Price Recovery in 2025?

Reviewed by Simply Wall St

If you have been following DigitalOcean Holdings lately, you are probably wondering whether now is the right time to make a move on the stock. Its share price has been anything but boring, dipping nearly 10% since the start of the year, yet showing signs of life with a steady 7% gain over the past three months. DigitalOcean’s swings seem to track with broader shifts in tech sentiment, but also suggest the market is wrestling with how to properly value this cloud-focused operator.

Despite the recent turbulence, there are reasons to believe that DigitalOcean may be overlooked by cautious investors. Looking at a variety of traditional valuation checks, the stock earns a score of 4 out of 6. This signals undervaluation in four key areas, which is not something you see every day, especially in a sector where growth and potential often drive prices higher than the underlying numbers might justify.

If you are trying to decide whether to hold, buy, or avoid DigitalOcean, these valuation metrics offer a great starting point. However, there is more to consider than just a checklist. Over the next sections, we will break down how these valuation methods stack up and highlight the most insightful ways to gauge value for a company like DigitalOcean. Stay tuned for the analysis as well as a perspective at the end that could change how you think about what this stock is really worth.

DigitalOcean Holdings delivered -17.4% returns over the last year. See how this stacks up to the rest of the IT industry.Approach 1: DigitalOcean Holdings Cash Flows

The Discounted Cash Flow (DCF) model offers a straightforward way to estimate a company's intrinsic value by projecting its future free cash flows and then discounting those values back to the present. Essentially, it asks what all those streams of money are worth in today's dollars.

For DigitalOcean Holdings, the most recent Free Cash Flow stands at $122.3 million. Analysts expect this figure to keep growing over the coming decade, with cash flows forecasted to reach about $311.5 million by 2035. This projection captures a steady, though slowing, trajectory in annual growth. The company is expected to continue expanding, but at a gradually moderating pace.

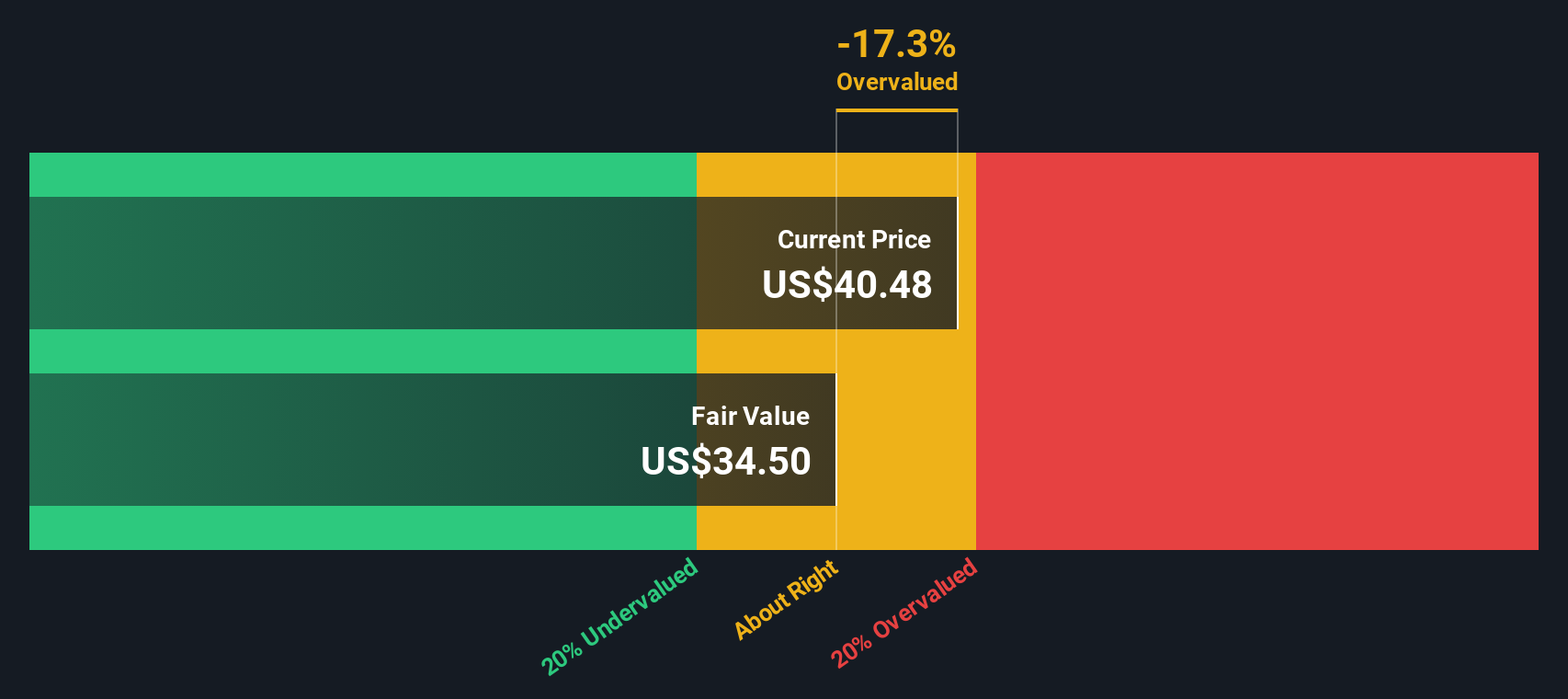

Using a two-stage Free Cash Flow to Equity model and the provided 10-year projections, DigitalOcean's intrinsic value comes out to $32.41 per share. Compared to the current share price, this puts the stock at 4.7% undervalued. In valuation terms, this is a modest discount. This suggests the market has largely priced in DigitalOcean's near-term prospects, but there is just enough of a gap to potentially interest value-minded investors.

Result: ABOUT RIGHT

Approach 2: DigitalOcean Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a classic way to value profitable companies because it directly ties a company’s share price to its bottom-line earnings. For most investors, the PE ratio is a quick litmus test for how much they are being asked to pay for a dollar of profit. This makes it especially useful when assessing companies with established earnings power like DigitalOcean.

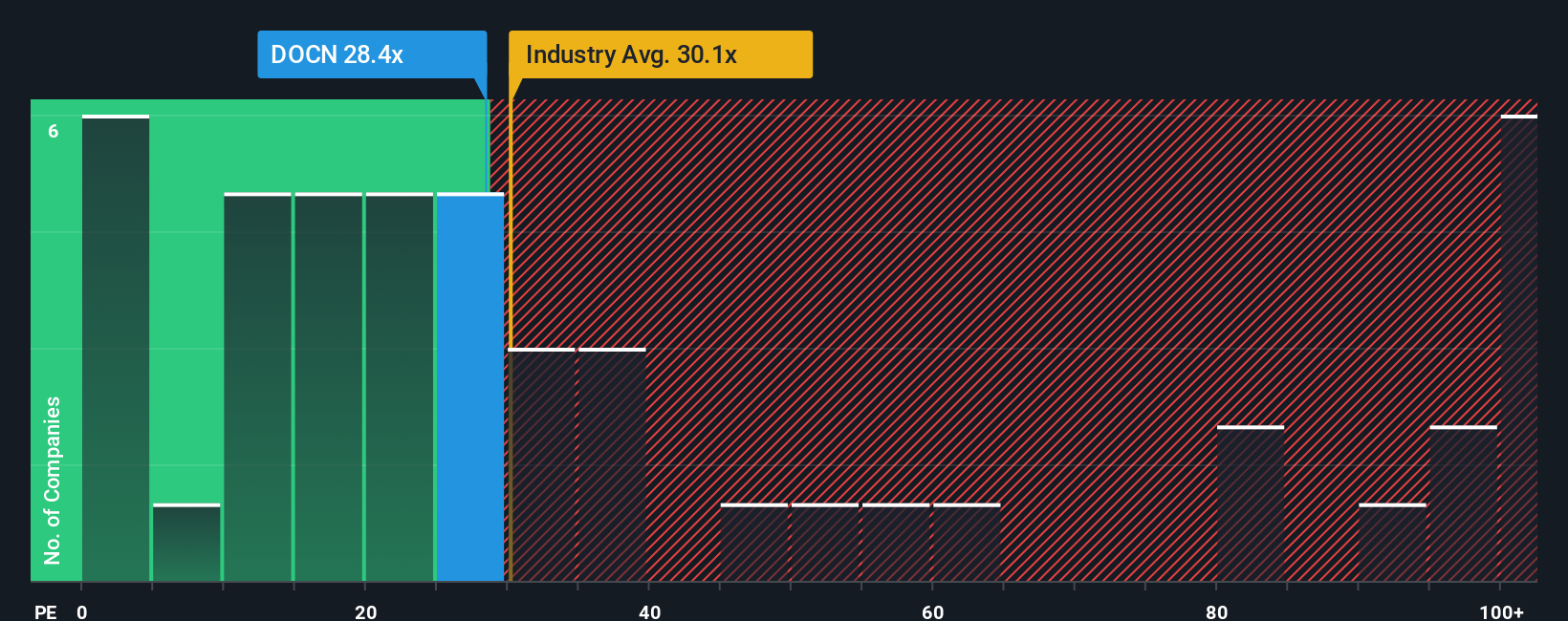

Growth expectations and risk play a major role in setting what is considered a "normal" or “fair” PE for any stock. Faster-growing or lower-risk companies usually justify higher PE multiples, while slower-growing or riskier ones tend to trade on the lower end. Comparing DigitalOcean’s current PE of 22.2x shows it sits well below both the IT industry average of 29.7x and the peer group average of 67.6x. This suggests that the market is taking a more measured view compared to its broader sector and direct competitors.

To analyze further, Simply Wall St calculates a “Fair Ratio” of 31.2x for DigitalOcean, using factors like the company’s growth outlook, profitability, and sector risks. With the actual PE notably below this fair benchmark, the stock appears to be modestly undervalued, potentially giving investors some margin of safety if current fundamentals hold steady.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your DigitalOcean Holdings Narrative

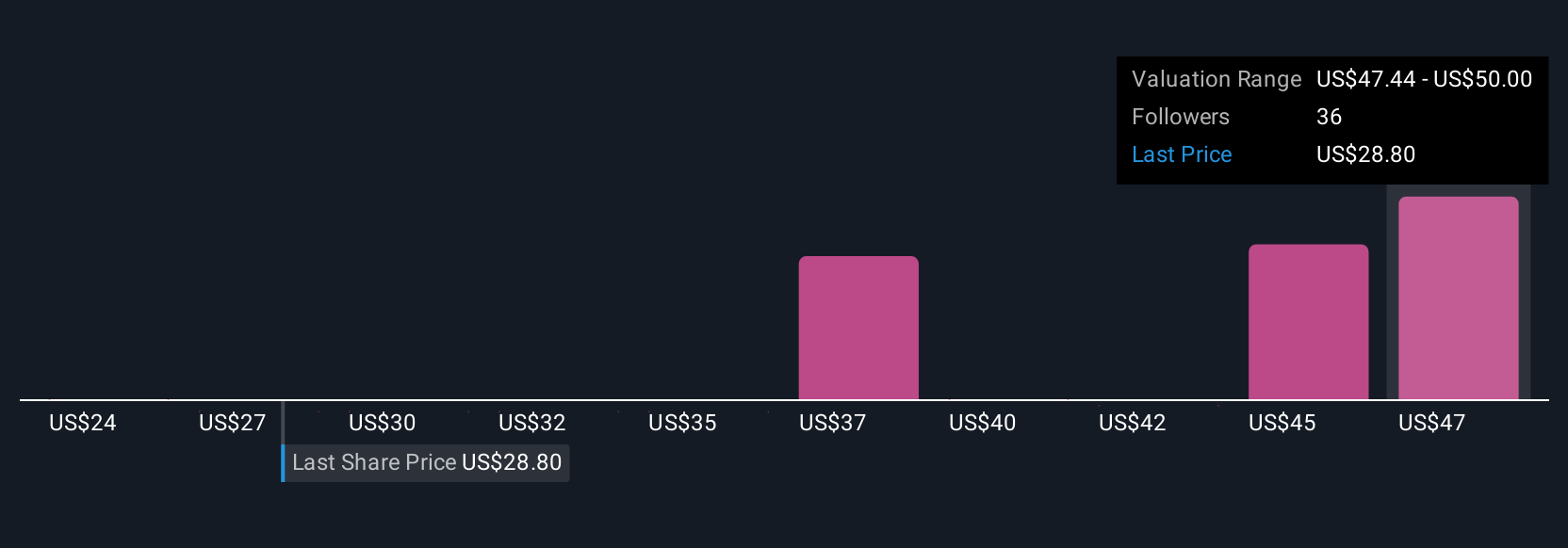

Narratives are personal stories behind the numbers, letting you combine your own perspective on a company’s future, including your assumptions about how DigitalOcean’s revenue, earnings, and margins will evolve, with a forecast that leads directly to a custom fair value.

This approach creates a bridge between what you believe about a business and what the numbers indicate, giving you deeper context for every investment decision. Within the Simply Wall St platform and its active investor community, Narratives are a practical tool that is easy to create, share, and update, making sophisticated valuation accessible to everyone, not just finance professionals.

By comparing your Narrative fair value to the current market price, you gain a clear framework for deciding when to buy, hold, or sell. In addition, because Narratives update automatically when new information or news is released, your view of value stays current and actionable.

For example, one DigitalOcean Narrative sets the company’s fair value at $50 based on strong long-term growth in AI and recurring revenue, while another pegs it at $32 due to concerns about competition and margin pressure. This demonstrates how the same stock can inspire very different, but equally data-driven, perspectives.

Do you think there's more to the story for DigitalOcean Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Solid track record and fair value.

Similar Companies

Market Insights

Community Narratives