- United States

- /

- IT

- /

- NYSE:DOCN

How DigitalOcean Holdings' (DOCN) $550 Million Convertible Note Offering May Shape Its Growth and Risk Profile

Reviewed by Simply Wall St

- Earlier this month, DigitalOcean Holdings completed a US$550 million zero coupon senior unsecured convertible note offering due in 2030, providing additional financial flexibility as the company continues to expand its cloud platform.

- This financing move introduces potential dilution and highlights DigitalOcean's intention to support ongoing product and AI infrastructure investments amid growing competition in the cloud market.

- We'll explore how this substantial convertible note offering may reshape DigitalOcean's investment narrative around funding for growth and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

DigitalOcean Holdings Investment Narrative Recap

To be a DigitalOcean shareholder is to believe in the company’s ability to carve out a profitable niche in cloud infrastructure for small and medium-sized businesses by delivering rapid product innovation, expanding its AI platform, and competing effectively despite pressure from much larger hyperscale providers. The recent US$550 million convertible note offering supplies additional capital, but the main near-term catalyst remains customer growth in cloud and AI services, while the biggest risk, ongoing competition and customer churn, remains largely unchanged by this financing event.

Among recent announcements, the launch of DigitalOcean’s managed AI platform, GradientAI™, is directly tied to the company’s growth strategy. This move connects to both the new capital raise and the key catalyst of AI adoption, as it positions DigitalOcean to attract and retain developers and businesses seeking cost-effective, easy-to-use AI solutions amid intensifying sector competition.

In contrast, investors should also be aware that despite recent expansions, the risk of heightened customer churn from bigger cloud rivals remains a lingering question...

Read the full narrative on DigitalOcean Holdings (it's free!)

DigitalOcean Holdings is projected to reach $1.3 billion in revenue and $172.6 million in earnings by 2028. This outlook assumes a 14.5% annual revenue growth rate and a $46.2 million increase in earnings from the current $126.4 million.

Uncover how DigitalOcean Holdings' forecasts yield a $41.18 fair value, a 31% upside to its current price.

Exploring Other Perspectives

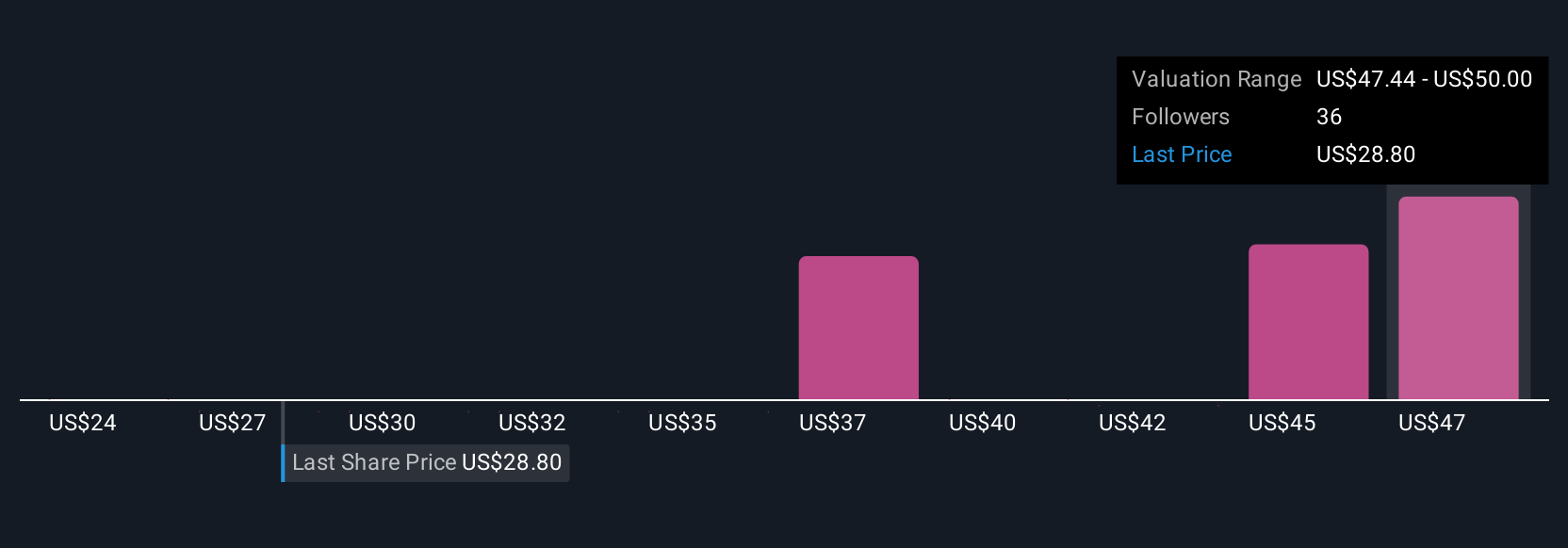

Retail investors in the Simply Wall St Community offered ten different fair value estimates for DOCN, ranging from US$24.42 to US$50. This diversity of views comes as competition from large hyperscale cloud providers continues to threaten DigitalOcean’s future growth and customer retention, highlighting just how differently performance risks can be weighed.

Explore 10 other fair value estimates on DigitalOcean Holdings - why the stock might be worth as much as 59% more than the current price!

Build Your Own DigitalOcean Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DigitalOcean Holdings research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DigitalOcean Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DigitalOcean Holdings' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 28 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DOCN

DigitalOcean Holdings

Through its subsidiaries, operates a cloud computing platform in North America, Europe, Asia, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives