- United States

- /

- Software

- /

- NYSE:CXM

Is Sprinklr a Bargain After 15% Drop and Growing Sector M&A Activity?

Reviewed by Bailey Pemberton

- Wondering if Sprinklr stock could be great value right now? You are not alone, as changing tech trends and shifting investor sentiment have put it back in the spotlight.

- Sprinklr's shares have dipped by 2.9% over the past week and nearly 15% year-to-date, suggesting that the market is re-evaluating its growth potential or risks.

- A surge in sector-wide M&A activity and evolving digital customer experience trends have drawn attention recently, impacting sentiment across cloud software companies. These developments have raised new questions about which platforms offer real long-term value and resilience in the face of industry changes.

- Sprinklr currently scores a 4 out of 6 on our valuation checks, meaning it appears undervalued in most, but not all, key areas. Let us review the traditional valuation approaches next, and later we will introduce another way to assess whether the stock deserves your attention.

Find out why Sprinklr's -5.7% return over the last year is lagging behind its peers.

Approach 1: Sprinklr Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting them back to today's value. This approach helps investors judge whether a stock price reflects or deviates from its future earning potential.

For Sprinklr, the latest reported Free Cash Flow is $112.79 million. Analyst estimates project steady growth, with Free Cash Flow expected to rise to $165.4 million by 2028. Looking further ahead, extended projections suggest cash flows could reach about $262.8 million by 2035. These estimates are based on a blend of analyst forecasts for the next few years, then extrapolated by Simply Wall St for the longer-term outlook.

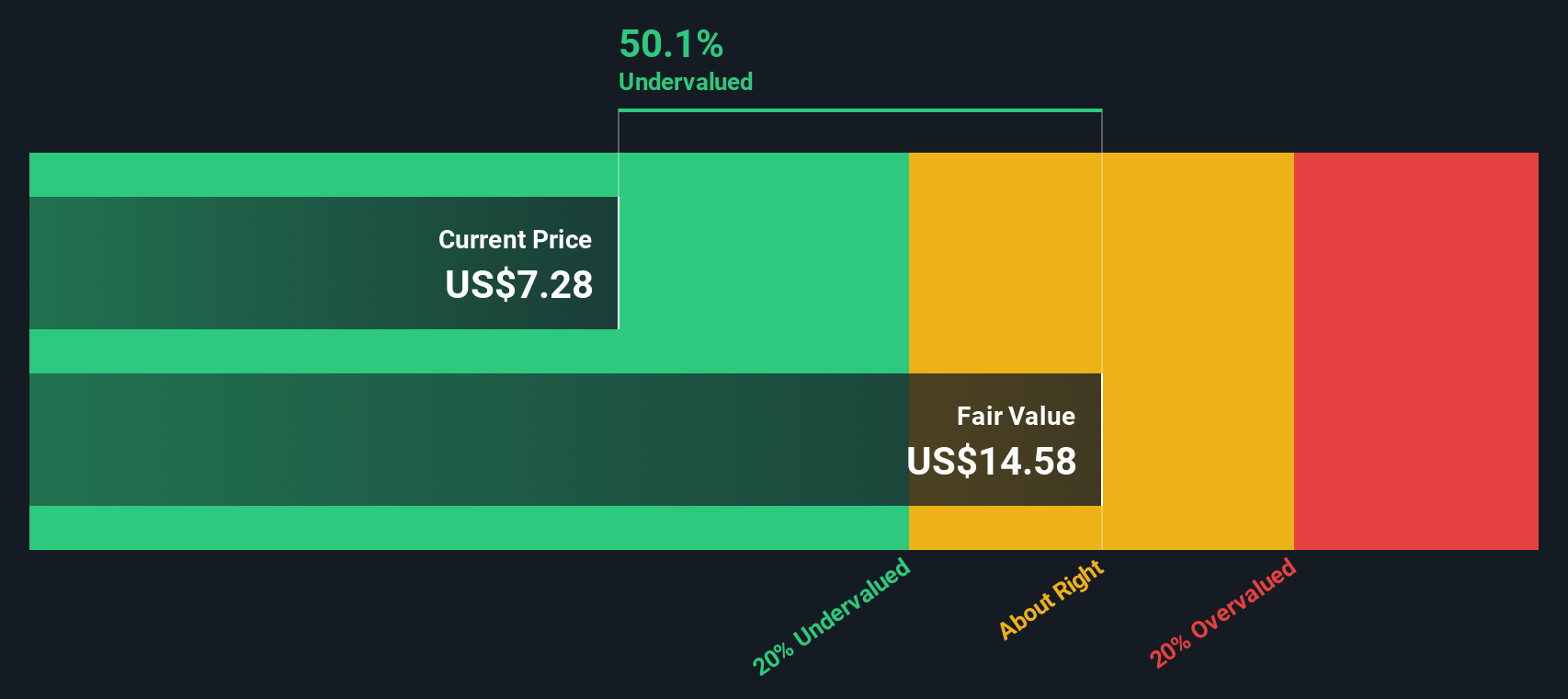

Using the 2 Stage Free Cash Flow to Equity DCF model, the intrinsic value per share is calculated at $14.53. This represents a 49.8% discount to the current market price, indicating that Sprinklr’s shares are trading well below what the underlying cash flow projections suggest.

Overall, the DCF model points to Sprinklr being notably undervalued based on its cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sprinklr is undervalued by 49.8%. Track this in your watchlist or portfolio, or discover 870 more undervalued stocks based on cash flows.

Approach 2: Sprinklr Price vs Earnings (P/E)

The Price-to-Earnings (P/E) ratio is a popular way to value profitable companies, as it reflects how much investors are willing to pay for each dollar of current earnings. Since Sprinklr is generating positive earnings, using the P/E ratio gives us a relevant snapshot of market expectations around its profitability.

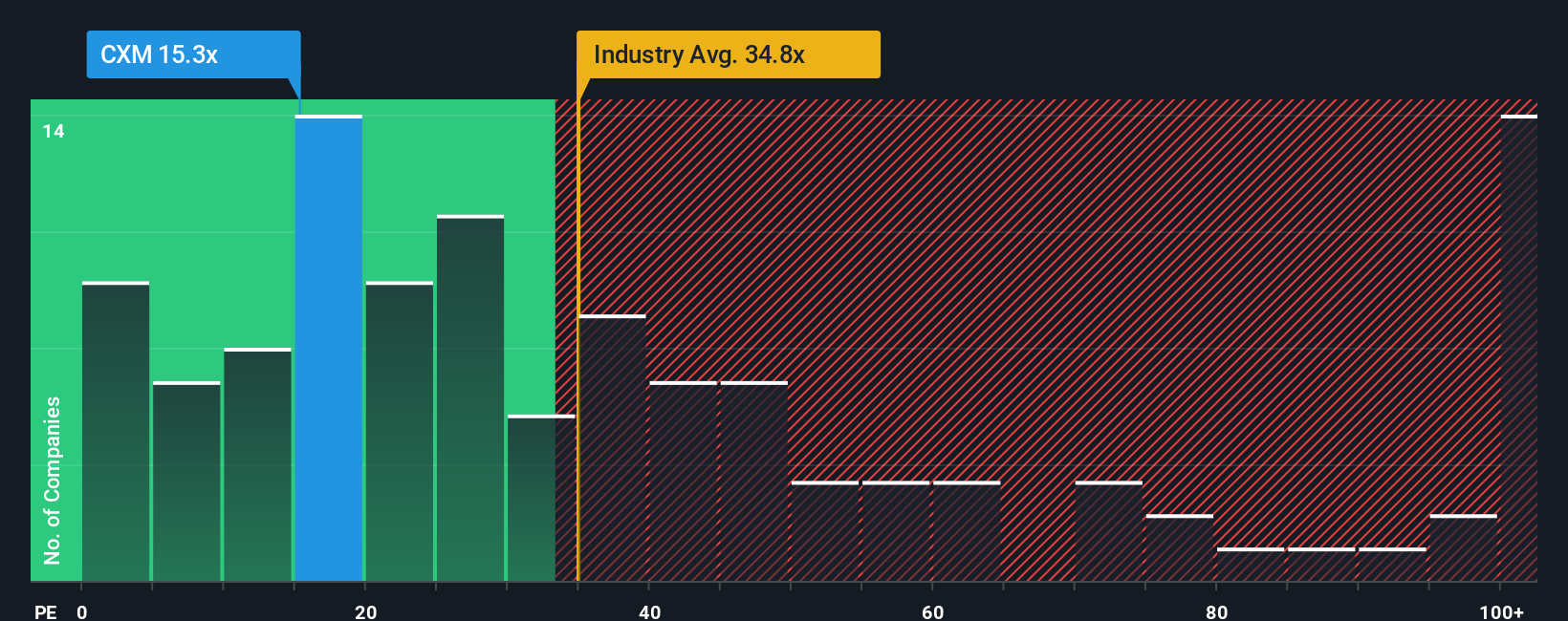

Normally, companies with higher growth prospects or lower risk command higher P/E ratios, while slower growth or elevated risks lead to lower P/Es. For context, Sprinklr currently trades at a P/E ratio of 14.8x. In comparison, the average software industry P/E sits at 31.5x, and the broader peer group averages an even higher 75.4x. This positions Sprinklr well below both benchmarks, which might catch the attention of value-focused investors.

However, simply benchmarking against the industry or peers does not always capture a company's full story. That is where Simply Wall St's "Fair Ratio" comes in. This proprietary metric is designed to calculate the preferred multiple for Sprinklr by adjusting for its unique growth outlook, profit margin, market cap, and potential risks. This approach gives a more tailored view than a one-size-fits-all comparison.

For Sprinklr, the Fair Ratio based on these factors is 6.7x, which is below the company’s actual P/E of 14.8x. That suggests the market is currently valuing Sprinklr more richly than what its fundamentals justify relative to these tailored benchmarks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1398 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sprinklr Narrative

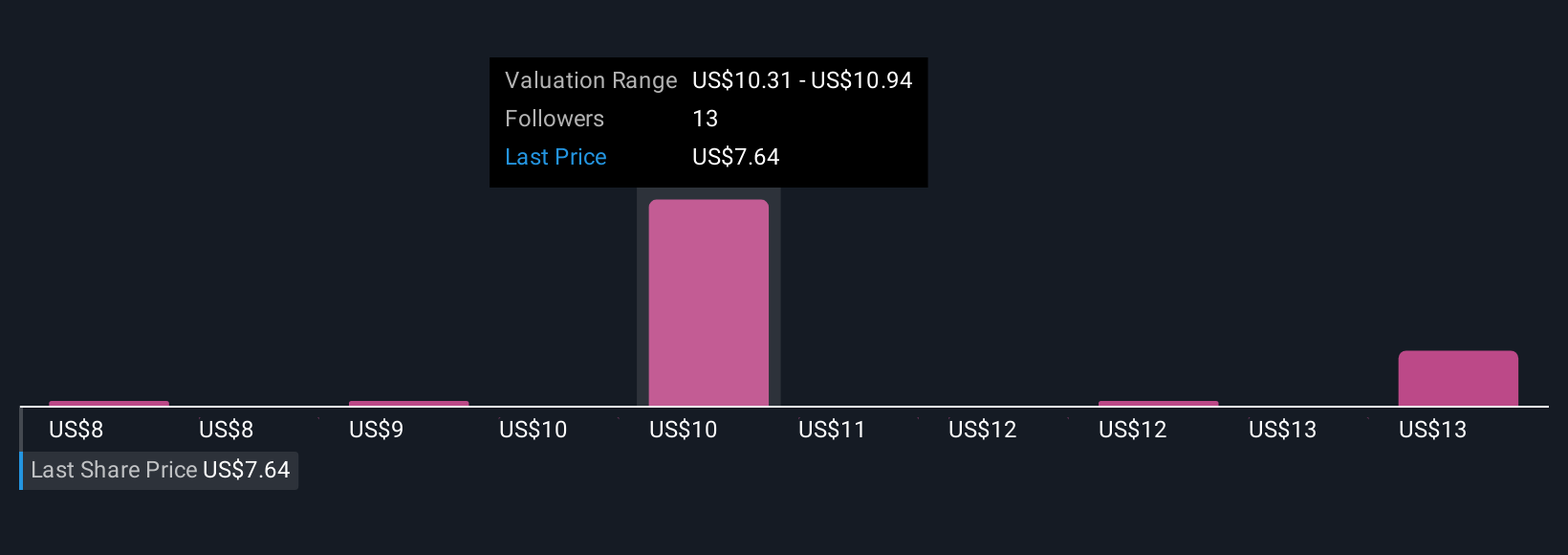

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a user’s story or unique perspective on a company, backed up by their own financial assumptions such as fair value, estimates of revenue, earnings, and margins. Narratives connect the key themes and catalysts driving a company’s story directly to financial forecasts and ultimately to what the stock is really worth.

On Simply Wall St, Narratives are a simple but dynamic tool available within the Community page, used by millions of investors. By comparing your own Narrative’s Fair Value with the current market Price, you can decide when to buy or sell a stock based on what you actually believe will drive its future. Narratives automatically update to reflect the latest news and financial results, making them an ongoing, living investment thesis.

For example, with Sprinklr today, a bullish Narrative expects sustained AI-driven growth and sets a price target as high as $17 per share, while the most bearish view points to competition, margin pressures, and leadership changes and values it at just $8. Narratives allow you to weigh these diverse perspectives and create your own, helping you invest with clarity and conviction.

Do you think there's more to the story for Sprinklr? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CXM

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives