- United States

- /

- Software

- /

- NYSE:CWAN

Does Clearwater Analytics Offer Value After 39% Drop and New Financial Partnerships in 2025?

Reviewed by Bailey Pemberton

- Wondering if Clearwater Analytics Holdings is attractively priced, or if there is hidden value waiting to be uncovered? You are not alone, and making the right call on valuation can make a significant difference.

- After a sluggish year with the stock down 39.4%, recent price moves suggest that investor sentiment may be shifting. However, there is still plenty of debate about the outlook.

- Market watchers have noted that recent partnerships and expanded integrations with financial institutions are making headlines for the company. These developments help provide more context around the recent price dips and renewed optimism for growth. The steady pace of customer wins and product developments has been a positive narrative in recent weeks.

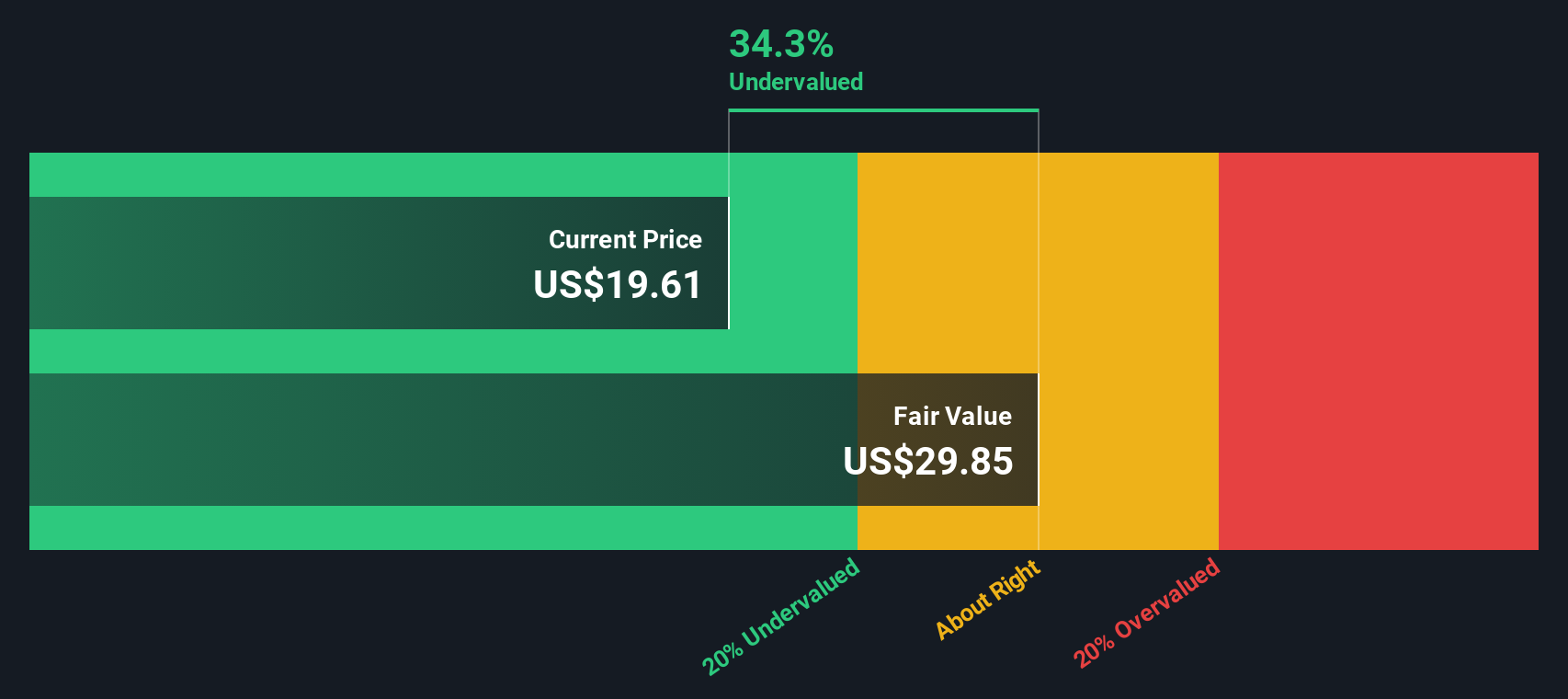

- Clearwater Analytics Holdings currently scores 6 out of 6 on our valuation checklist, meaning it appears undervalued against every key measure we track. Next, we will break down the main ways analysts arrive at these numbers, and at the end we will share an even more insightful way to judge if the stock is truly worth considering.

Approach 1: Clearwater Analytics Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the true value of a company by projecting its expected future cash flows and then discounting them back to today to account for risk and the time value of money. This approach offers a direct measure of what the business is fundamentally worth based on its ability to generate cash.

Clearwater Analytics Holdings currently reports Free Cash Flow of $83.8 million. Analyst forecasts suggest a significant increase in Free Cash Flow over the next five years, with projections rising to $434 million by 2029. Since analysts only supply five years of detailed estimates, further projections are extrapolated to model longer-term trends using Simply Wall St's methodology.

Based on these projected cash flows, the DCF model estimates Clearwater Analytics Holdings' intrinsic value at $32.11 per share. With a calculated discount of 46.1% compared to the current share price, this suggests the stock is substantially undervalued. In summary, the DCF approach points to a sizable margin of safety for prospective investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Clearwater Analytics Holdings is undervalued by 46.1%. Track this in your watchlist or portfolio, or discover 838 more undervalued stocks based on cash flows.

Approach 2: Clearwater Analytics Holdings Price vs Earnings

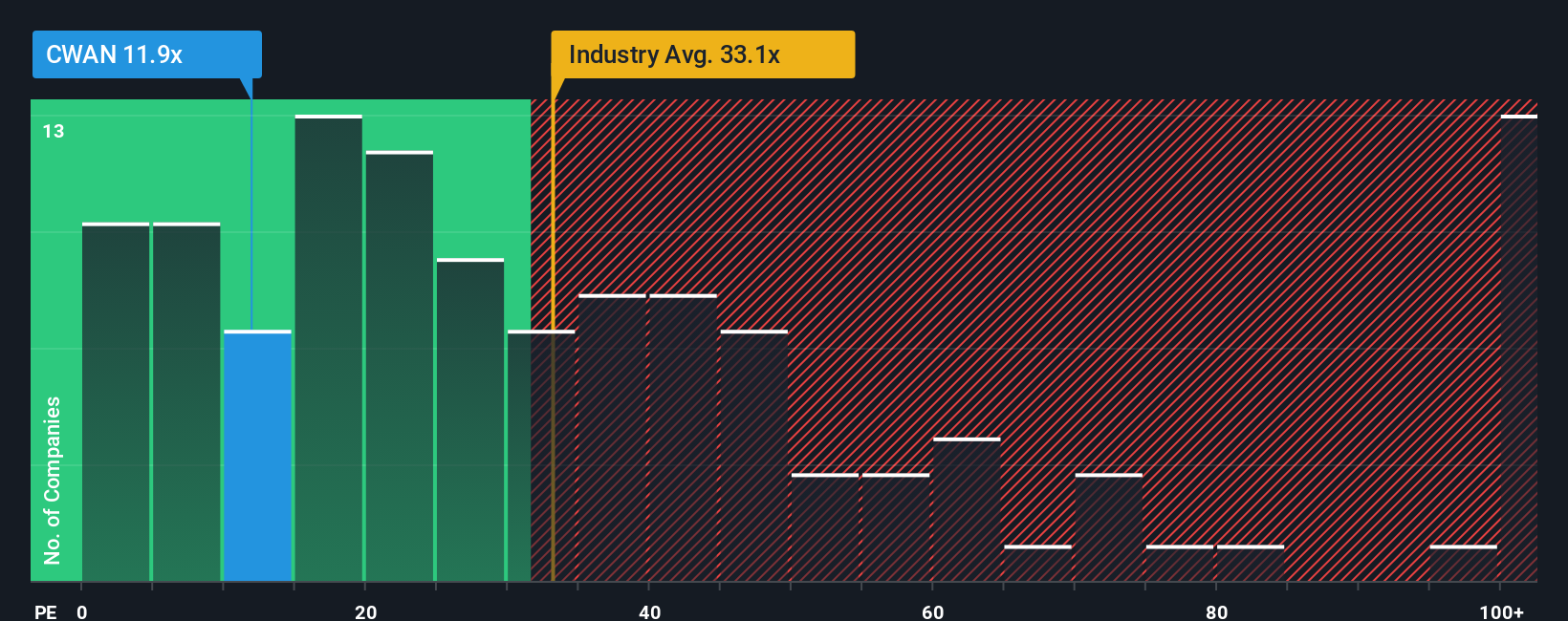

For profitable companies like Clearwater Analytics Holdings, the Price-to-Earnings (PE) ratio is a widely trusted valuation metric. The PE ratio reflects how much investors are willing to pay today for a dollar of the company’s earnings, making it especially useful for companies with positive and consistent profits.

The "right" PE ratio for a stock is influenced by several factors. Strong expected earnings growth or lower risk typically justifies a higher PE, while slower growth or greater risk tends to drive the ratio lower. Market standards for software companies are often guided by the industry average and by peer comparisons.

Clearwater Analytics Holdings currently trades at a PE ratio of 12.27x. This is noticeably lower than both the average PE ratio of its peers, 16.33x, and the broader Software industry average of 35.16x. On the surface, this suggests the stock may be undervalued versus similar businesses.

However, the proprietary "Fair Ratio" method from Simply Wall St offers a more tailored benchmark. By factoring in Clearwater’s unique growth prospects, profit margins, business risks, industry trends, and company size, the Fair Ratio evaluates what the company’s PE ratio truly should be. In this case, the Fair Ratio is calculated at 21.09x, which sits well above both the actual and peer multiples. Unlike standard industry or peer comparisons, the Fair Ratio provides a more nuanced and holistic perspective tailored specifically to Clearwater Analytics Holdings, instead of relying on broad averages that may not fit the company’s actual performance or risk profile.

Since Clearwater Analytics Holdings’ PE of 12.27x is significantly below its Fair Ratio of 21.09x, the stock appears attractively undervalued by this approach as well.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Clearwater Analytics Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives.

A Narrative is a simple, intuitive tool that lets you describe the story behind a company by connecting your own assumptions about its future revenue, earnings, and margins to a personalized fair value calculation. Rather than just relying on historical numbers or analyst forecasts, Narratives help you define your perspective about what will drive Clearwater Analytics Holdings’ future, then project those beliefs into a forecast and see how they compare with the current share price.

On Simply Wall St's Community page, used by millions of investors, you can easily create or select a Narrative. This makes it a highly accessible way for any investor to test their own thesis. Narratives dynamically update as new news or earnings emerge, ensuring your viewpoint remains relevant and timely.

For Clearwater Analytics Holdings, an optimistic Narrative might factor in continued global expansion and successful integration of new technologies, resulting in a higher fair value, much like the $36.00 target from the most bullish analysts. In contrast, a more conservative Narrative could focus on potential integration risks and margin pressures, arriving at a much lower fair value, similar to the $23.00 target from the most bearish outlook. Narratives make it easy to visualize how your unique fair value compares to today’s price, helping you invest with confidence and clarity.

Do you think there's more to the story for Clearwater Analytics Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CWAN

Clearwater Analytics Holdings

Develops and provides a Software-as-a-Service (SaaS) solution for automated investment data aggregation, reconciliation, accounting, and reporting services to insurers, investment managers, corporations, institutional investors, and government entities in the United States and internationally.

Very undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives