- United States

- /

- Software

- /

- NYSE:CRCL

What the Recent 2.7% Drop Means for Circle Internet Group’s 2025 Valuation

Reviewed by Bailey Pemberton

If you are debating what to do with your Circle Internet Group stock, you are not alone. Investors have seen quite a ride lately, and it's completely normal to wonder whether now is the right time to buy, hold, or take profits. Over the past week, the stock lost 2.7%, and in the last month, it shed 9.2%. If you zoom out just a bit, the full year-to-date performance shows an impressive 57.2% gain. This tells a different story about momentum and market optimism for the company. While one-year and longer-term returns aren't available yet, the recent price swings certainly add both intrigue and risk for anyone on the sidelines or current shareholders.

One factor contributing to recent market movement has been increased attention on Circle Internet Group's expansion into new strategic partnerships. The company's business model is under the spotlight as industry trends shift. This brings a new focus on its role in the digital finance landscape. Investors are watching carefully to see how these developments play out and how they might impact Circle’s underlying value in the medium to long term.

If we start sizing up Circle Internet Group using traditional valuation checks, it currently earns a value score of just 1 out of a possible 6. On the surface, that suggests the stock is not a strong bargain given the typical metrics analysts use to find undervalued companies. However, as you’ll see in the next section, there is more to valuation than a single score from standard methods. There might be a smarter way to think about what the market is truly pricing in.

Circle Internet Group scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Circle Internet Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model forecasts a company’s future cash flows and then discounts them back to today’s dollars to estimate what the business is really worth. For Circle Internet Group, this means looking beyond short-term swings and focusing on what the business can generate for shareholders over the next decade and beyond.

Currently, Circle’s Free Cash Flow (FCF) stands at $461 million. Analyst estimates see this figure climbing rapidly over the coming years, reaching $1.42 billion by 2029. The DCF model, using a 2 Stage Free Cash Flow to Equity approach, relies on both these analyst-supplied forecasts and further projections. Simply Wall St extrapolates expected FCF out to 2035, showing a sustained growth trend in the company’s ability to generate cash.

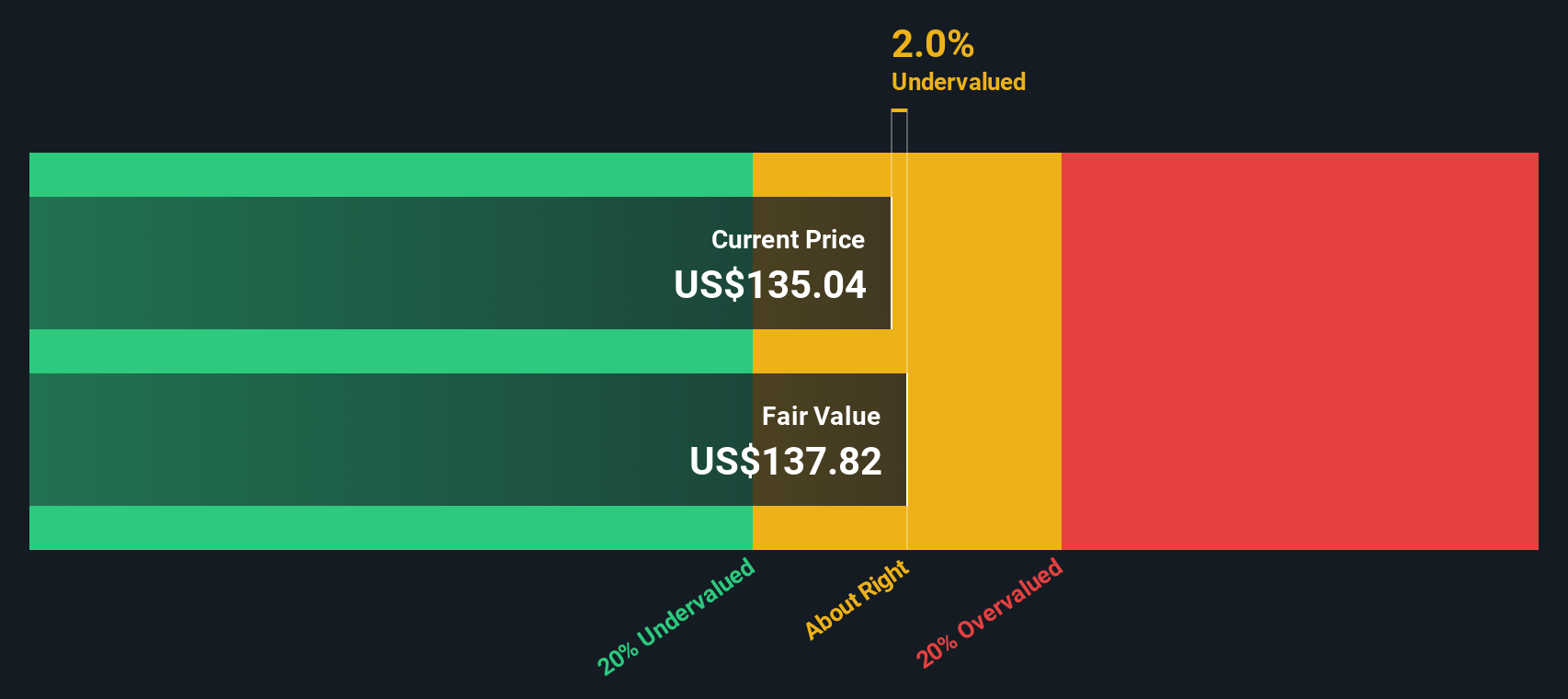

By discounting all these future cash flows back to today, the model arrives at an estimated intrinsic value of $138.27 per share. When compared with the company’s current share price, this valuation implies Circle Internet Group is trading at a 5.4% discount to its fair value. In other words, the stock might be just slightly undervalued at present, based on reasonable long-term assumptions about its business performance.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Circle Internet Group's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Circle Internet Group Price vs Sales

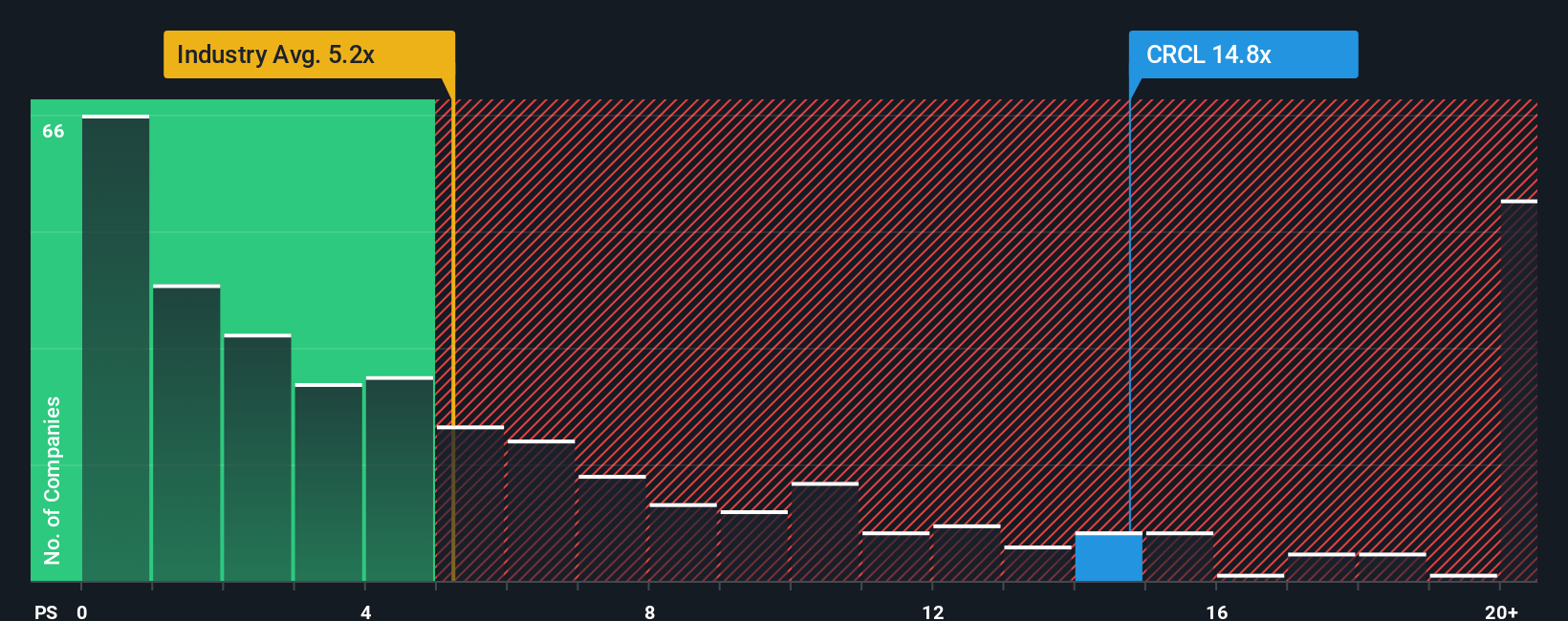

Another important way to value Circle Internet Group is by looking at its Price-to-Sales (P/S) ratio. This metric is often preferred for high-growth software companies that may not always have steady earnings. The P/S ratio is useful because it values the company based on revenues instead of profits, making it more reliable for firms that are investing heavily in future growth or are not yet consistently profitable.

Growth expectations and perceived risks influence what a fair P/S ratio should be. Higher growth rates or strong margins can justify a higher P/S multiple, while greater uncertainty or risk might warrant a lower one. Circle Internet Group currently trades at a P/S ratio of 14.3x, which is above both its peer average of 12.9x and the software industry average of 5.1x. This suggests that investors are willing to pay a premium for Circle’s sales, likely due to its promising growth profile and strategic positioning.

Simply Wall St’s “Fair Ratio” is a proprietary benchmark that evaluates what a reasonable P/S ratio should be for a stock by factoring in growth forecasts, profit margins, industry characteristics, risk exposures, and market cap. This holistic approach is more insightful than simply comparing to peers or industry averages, since it tailors the fair valuation to Circle’s specific circumstances and prospects. In this case, Circle’s actual P/S ratio is very close to its Fair Ratio, which means the stock’s share price reflects its unique attributes and outlook.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

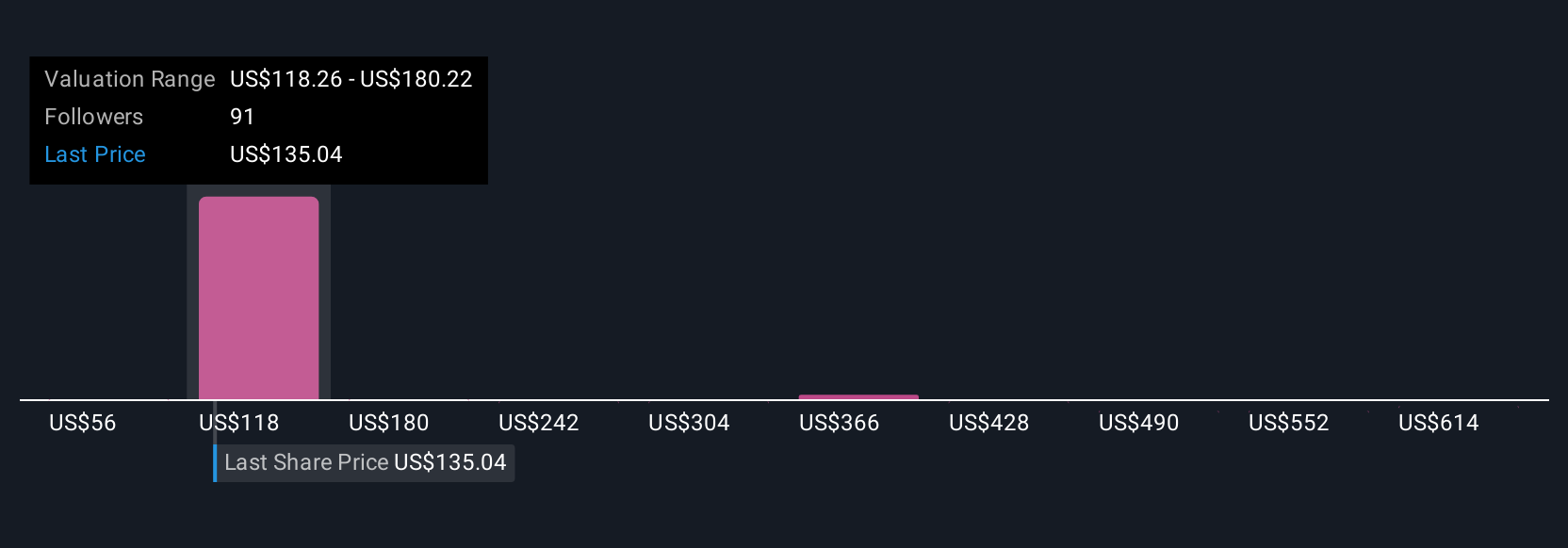

Upgrade Your Decision Making: Choose your Circle Internet Group Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a personal story or thesis about a company that connects your view of its future, such as expected revenue, margins, and business direction, to a fair value estimate. This gives you context for your investment decisions beyond raw numbers. Narratives make stock analysis more accessible by allowing you to anchor the company's story to a forecast and then directly see if its current price lines up with your outlook. On Simply Wall St’s platform, millions of investors share and update their Narratives on the Community page, and you can easily browse different perspectives any time news or earnings change the story. You might see, for example, some investors estimating Circle Internet Group’s fair value as high as $326 per share, while others are more cautious, placing it closer to $122 per share. This illustrates the real-world range of conviction at play. Narratives help you decode whether you are buying into optimism or caution, and ensure your decision moves with the facts.

Do you think there's more to the story for Circle Internet Group? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives