- United States

- /

- Software

- /

- NYSE:CRCL

Circle Internet Group Drops 23% Amid Fintech Partnership Buzz—Is the Price Now Justified?

Reviewed by Bailey Pemberton

- Curious whether Circle Internet Group is a hidden gem or overpriced in today’s market? You’re in the right place to dig into what makes this stock tick and whether the price tag matches its underlying value.

- Recently, the stock has been on a wild ride, climbing 33.7% year-to-date but pulling back sharply with drops of 18.3% just this past week and 23.7% over the last month.

- Much of this action has followed industry chatter about digital payments sector shakeups and speculation over upcoming regulatory changes. Both of these factors have fueled excitement and caution among investors. There has been a flurry of news about strategic partnerships in fintech, making now an especially interesting time to reassess the company's prospects.

- On our valuation check, Circle Internet Group scores a modest 2 out of 6. This suggests some real room for improvement but also highlights areas where value could be hiding. Stick with us as we explore the classic valuation approaches, and stay tuned for an even smarter perspective on the company’s true worth at the end of this article.

Circle Internet Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Circle Internet Group Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting these sums back to today, capturing the present value of what the business is expected to generate. This approach is widely used for growth companies like Circle Internet Group that may not reliably post profits each year but have promising future cash flow growth.

For Circle Internet Group, the most recently reported Free Cash Flow is $461 million. Analysts forecast a noticeable uptick in future cash flows over the next few years, with projections climbing to $1.4 billion by 2029. Beyond the analyst window, forecasts are extended using customary industry growth rates and methodologies.

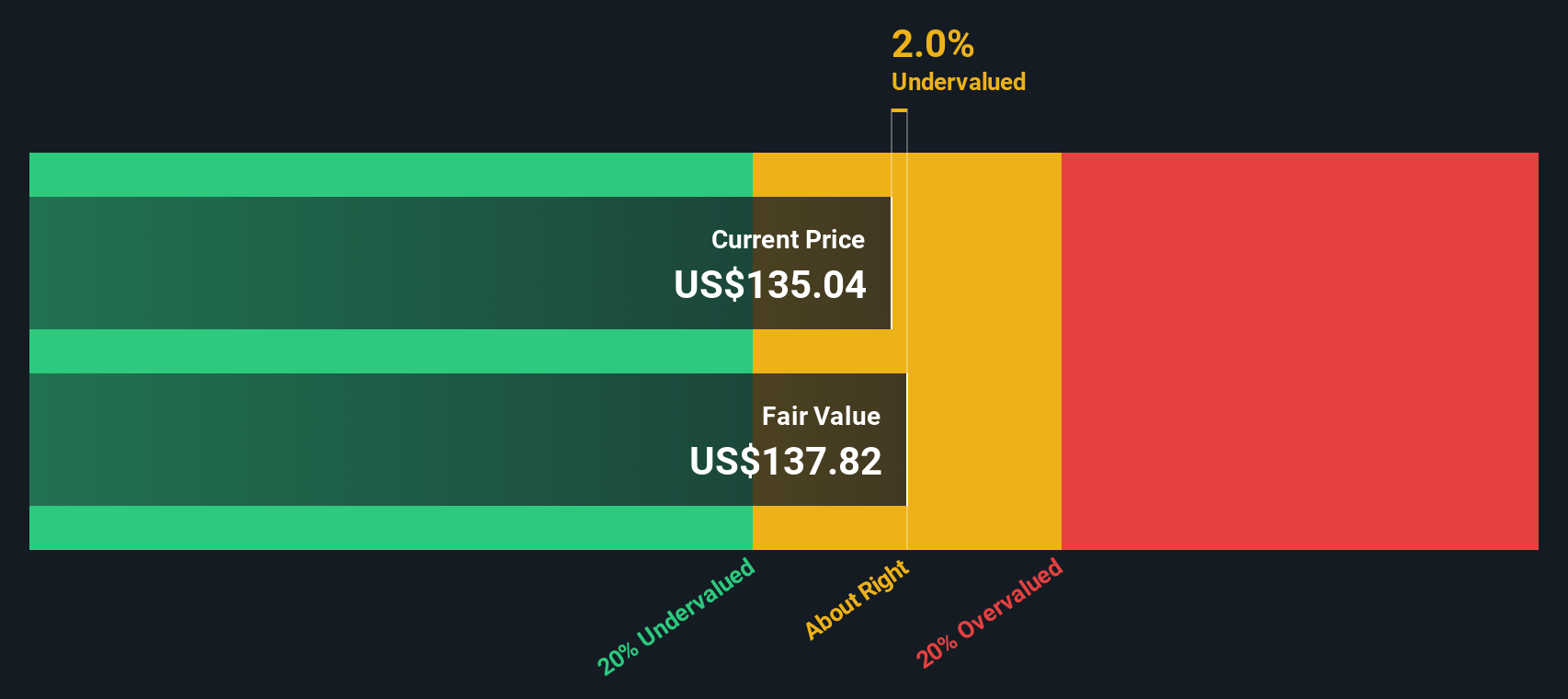

The DCF analysis values Circle Internet Group at $141.59 per share, using a two-stage model that incorporates both near-term analyst forecasts and longer-term projections as extrapolated by Simply Wall St. Currently, the DCF model suggests the company’s shares trade at a 21.4% discount to their fair value. According to this method, the stock appears undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Circle Internet Group is undervalued by 21.4%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: Circle Internet Group Price vs Sales

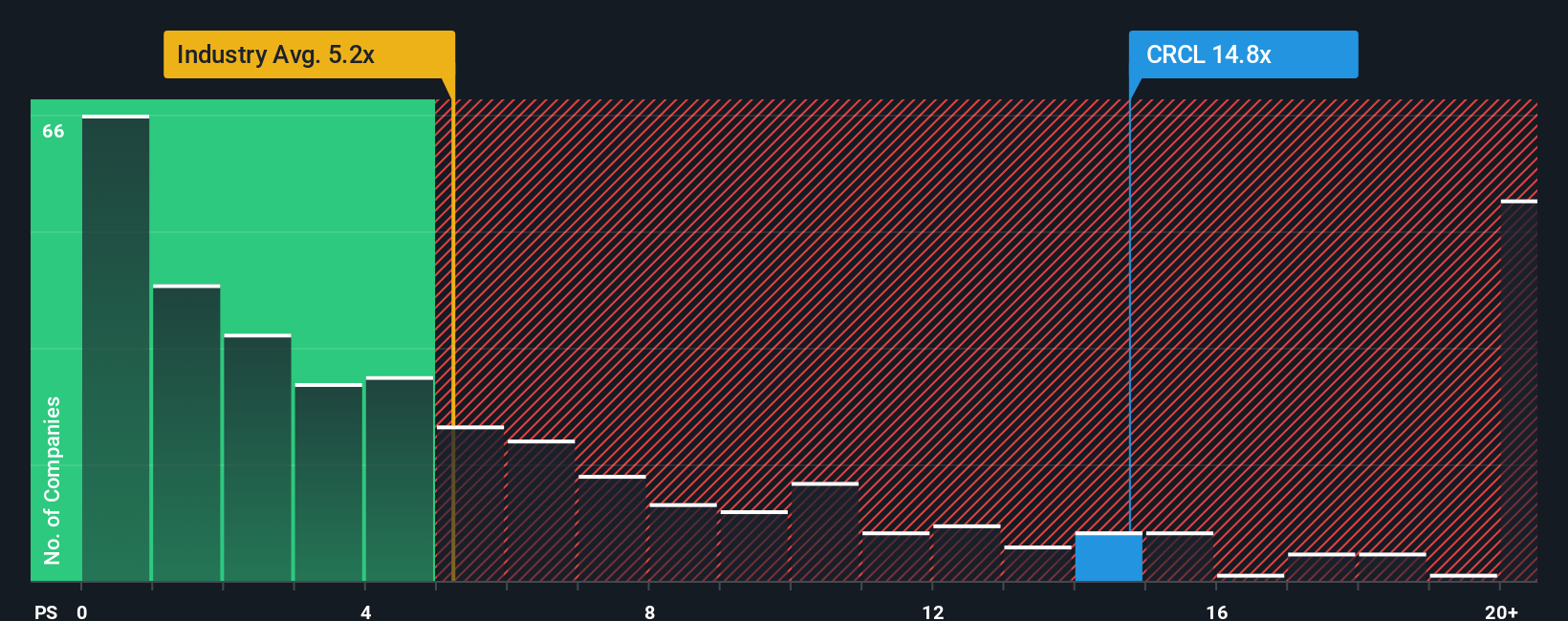

For high-growth or early-stage companies like Circle Internet Group, the Price-to-Sales (PS) ratio is often the most appropriate valuation metric. This is especially true when profits are limited or negative, since it allows us to compare companies based on their current revenue generation potential rather than volatile earnings. The PS ratio is also favored in rapidly evolving sectors like software and fintech, where topline growth is often prioritized by investors and management alike.

However, a “fair” PS ratio varies depending on factors such as growth expectations, risks, and the competitive landscape. Typically, the faster a company can grow its revenue, the higher a justified PS ratio could be. On the other hand, higher risks or slower growth may necessitate a lower multiple to compensate investors.

Circle Internet Group currently trades at a PS ratio of 12.2x, higher than both the software industry average of 5.09x and its peer average of 10.39x. At a glance, this suggests the company is priced at a premium to benchmark groups. This is where Simply Wall St's proprietary “Fair Ratio” comes in, a custom multiple tailored for Circle, factoring in not only the industry standards but also growth rates, profit margins, market cap, and unique company risks. Unlike basic peer comparisons, the Fair Ratio delivers a more accurate sense of value by weighing what really matters for this specific business.

When we compare Circle’s PS ratio directly against its Fair Ratio, the two numbers are nearly matched, with less than a 0.10 difference. This points to a stock that is priced about right in today's market, neither undervalued nor overvalued when considering both its current position and future prospects.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Circle Internet Group Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. Narratives are simply a story you create to express your view of a company by tying together your assumptions about its future revenue, profits, margins, and ultimately, what you believe its fair value should be. This approach lets you see not just the numbers, but the reasoning behind them, linking the company’s big picture to grounded financial forecasts and value estimates.

Narratives make investing more accessible by allowing anyone to build and share their perspective. They are available right now on Simply Wall St’s Community page, where millions of investors contribute. Best of all, Narratives are living and dynamic, automatically updating as new information or breaking news comes in, keeping your investment viewpoint relevant with minimal effort.

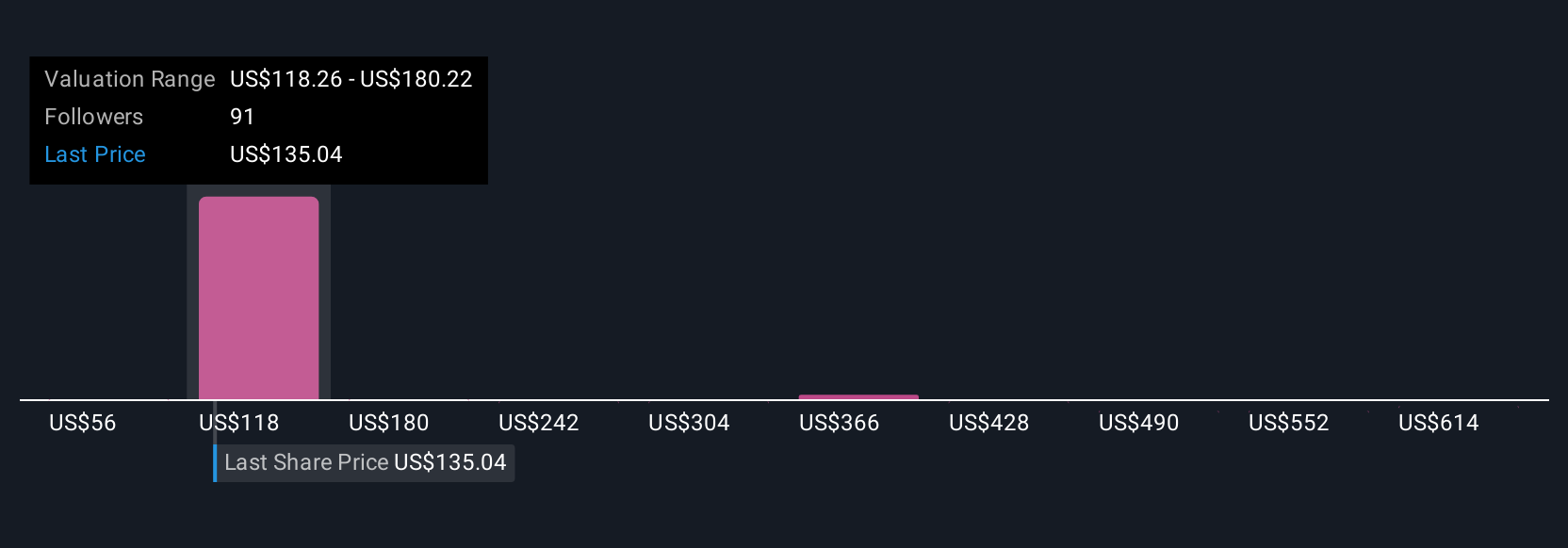

This means you can compare your estimate of Circle Internet Group’s fair value against today’s share price, helping you make timely buy or sell decisions with added context. For example, some investors in the Community believe Circle’s fair value is as low as $122 per share, focusing on rising costs and shifting regulation, while others project it as high as $326, betting on new products and global market dominance.

Do you think there's more to the story for Circle Internet Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRCL

Circle Internet Group

Operates as a platform, network, and market infrastructure for stablecoin and blockchain applications.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives