- United States

- /

- Software

- /

- NYSE:BOX

Does Box (BOX) Present An Opportunity After Its Steep Multi‑Year Share Price Decline?

- If you are wondering whether Box's share price reflects its true value, you are not alone, especially given how mixed the recent return numbers look.

- The stock last closed at US$24.67, with returns of a 2.7% decline over 7 days, 17.8% decline over 30 days, 14.4% decline year to date, 28.1% decline over 1 year and 26.9% decline over 3 years, while the 5-year return sits at 29.2%.

- Recent attention around Box has focused on its position in cloud content management and collaboration, particularly as investors reassess how software spending fits into their portfolios. This backdrop has shaped how the market is pricing the stock and helps explain why returns have recently moved the way they have.

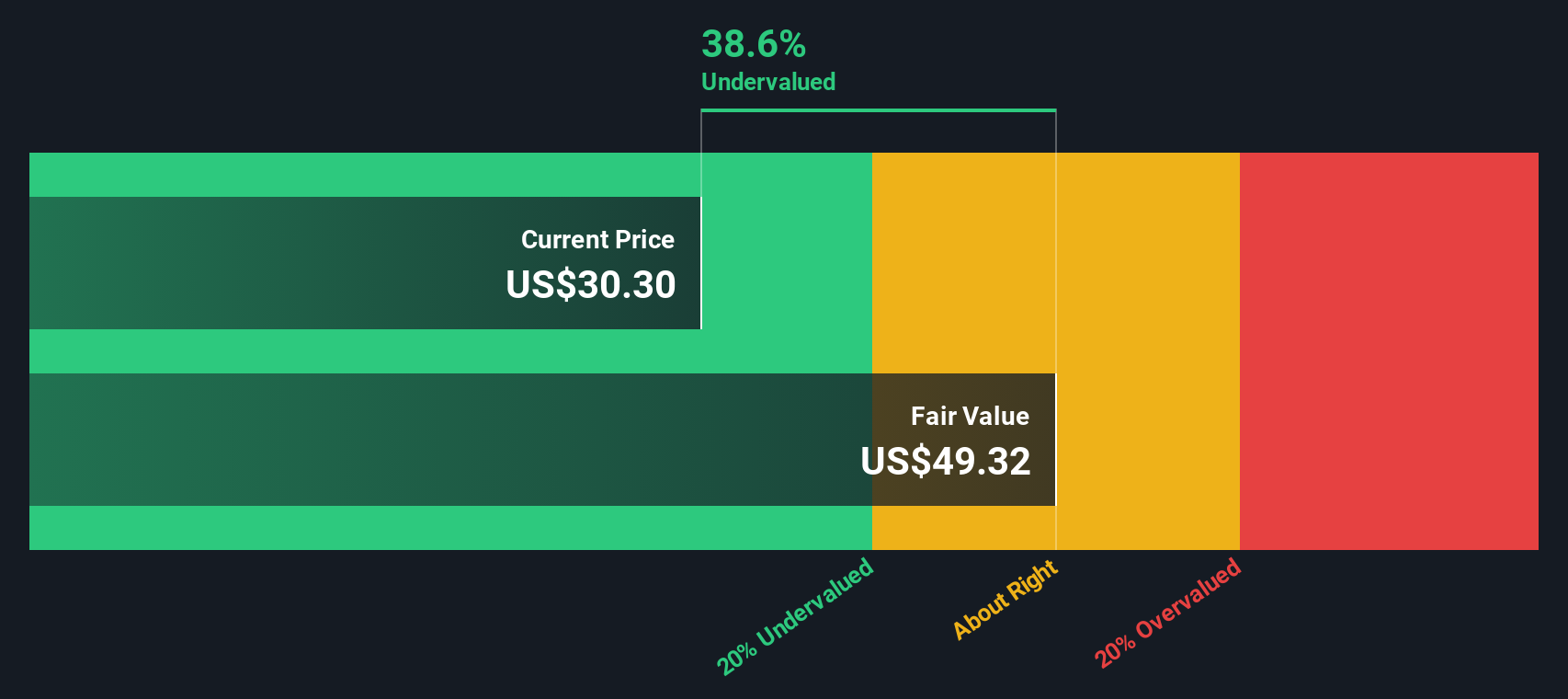

- Box currently has a valuation score of 5/6, meaning it screens as undervalued on five of six checks. Next, we will look at what different valuation approaches are indicating about the shares and why there may be an even more complete way to think about value by the end of this article.

Find out why Box's -28.1% return over the last year is lagging behind its peers.

Approach 1: Box Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a business could be worth today by projecting future cash flows and discounting them back to the present using a required rate of return. It focuses on cash that could, in theory, be returned to shareholders over time.

For Box, the model uses a 2 Stage Free Cash Flow to Equity approach. The company’s latest twelve month free cash flow is about $316.8 million. Analyst inputs are provided out to 2028, with free cash flow for that year projected at $388.4 million, and Simply Wall St extrapolates further out to 2035, with a 2035 free cash flow estimate of $533.2 million. All projections are in $ and remain below $1b per year, so they are discussed in millions.

When those projected cash flows are discounted back and summed, the model arrives at an estimated intrinsic value of about $48.47 per share. Compared with the recent share price of $24.67, the DCF output implies Box trades at a 49.1% discount, which screens as materially undervalued on this measure alone.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Box is undervalued by 49.1%. Track this in your watchlist or portfolio, or discover 53 more high quality undervalued stocks.

Approach 2: Box Price vs Earnings

For a profitable company, the P/E ratio is a common way to think about what you are paying for each dollar of current earnings, which helps you compare companies that may have very different share prices. A higher P/E usually goes with higher growth expectations or lower perceived risk, while a lower P/E can reflect more modest growth expectations or higher perceived risk.

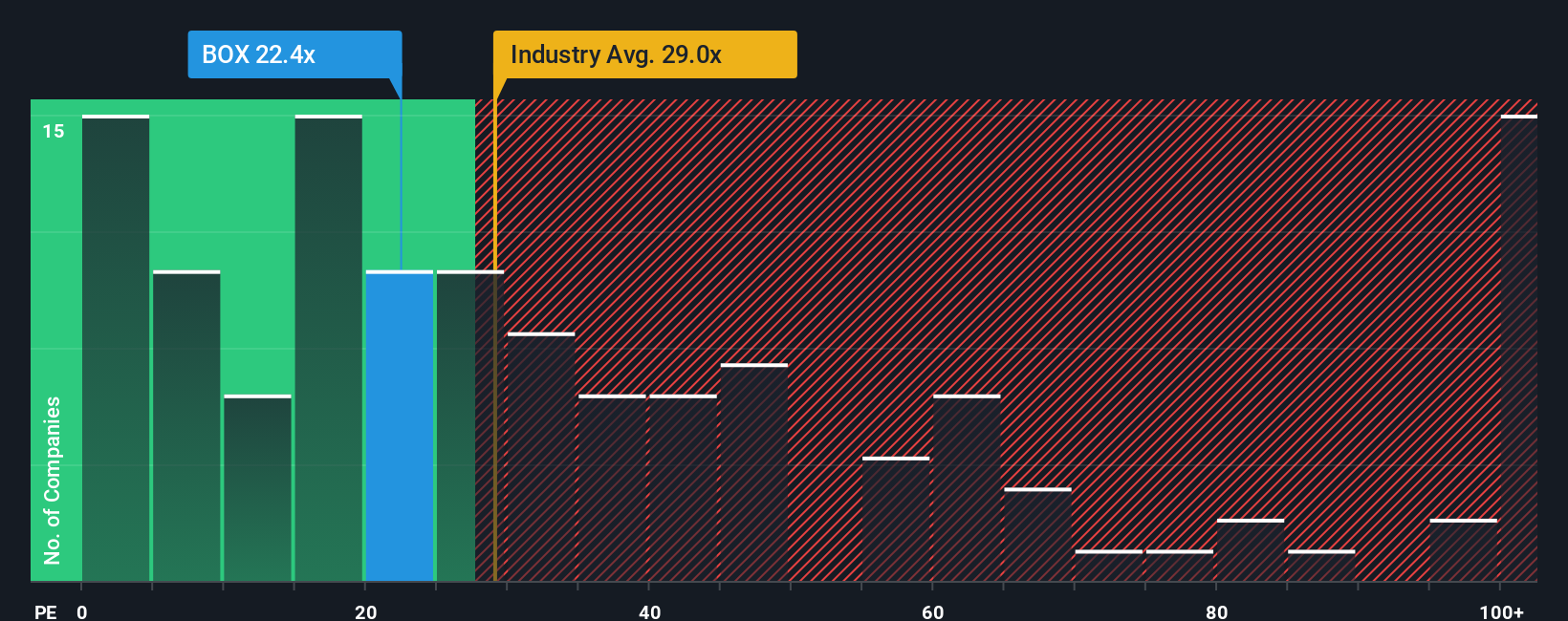

Box currently trades on a P/E of 18.94x. That sits below the Software industry average P/E of 26.94x and well below the peer group average of 52.19x. On the surface, that points to a cheaper earnings multiple than many Software names.

Simply Wall St also calculates a “Fair Ratio” of 22.38x for Box. This is a proprietary P/E level that reflects factors such as the company’s earnings growth profile, its industry, profit margins, market cap and key risks. Because it is tailored to Box’s specific characteristics, it can be more informative than a simple comparison with the broad industry or a selected peer set. Comparing the Fair Ratio of 22.38x with the actual P/E of 18.94x suggests Box trades below this customised reference point, which screens as undervalued on this metric.

Result: UNDERVALUED

P/E ratios tell one story, but what if the real opportunity lies elsewhere? Start investing in legacies, not executives. Discover our 22 top founder-led companies.

Upgrade Your Decision Making: Choose your Box Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, which Simply Wall St hosts on the Community page for millions of investors.

A Narrative is your story about a company, where you spell out what you think happens to its revenue, earnings and margins, then connect that story to a forecast and an implied fair value per share.

Instead of only looking at Box's DCF or P/E, you build a Narrative that links what you believe about its place in cloud content management and collaboration to specific numbers, which then gives you a clear fair value you can compare with the current share price.

Narratives on Simply Wall St update automatically as new information like news or earnings arrives, so your fair value view stays linked to the latest data and can help you decide whether the gap between Fair Value and Price looks wide enough to consider buying, holding or selling.

For example, one Box Narrative on the platform may assume relatively cautious revenue growth and a lower fair value, while another assumes stronger long term adoption and a higher fair value, which shows how two investors can look at the same company and reach very different conclusions.

Do you think there's more to the story for Box? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Box might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BOX

Box

Provides a cloud content management platform that enables organizations of various sizes to manage and share their content from anywhere on any device in the United States and Japan.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Future PE of 12.8x Shines Bright for FactSet Growth

BIPC: A strategic player in the energy crisis, a hybrid of Utility and Digital REIT.

Quintessential serial acquirer

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The "Sleeping Giant" Stumbles, Then Wakes Up

Trending Discussion

As a gamer, I would not touch this company now. They are hated by the community and have been releasing major flops on their AAA games during the last 5 years (for good reasons). It is true that the valuation is ridiculously low compared to what the licenses are worth, but if the trend continues the value of those will also decline. Management needs to almost make a 180° turnaround to get things right. I agree that a take-private deal before it is too late might be the best option for an investor entering today. We might also see a split sales of the different studios. It is a very risky play, but potentially with high reward.