- United States

- /

- Software

- /

- NYSE:BILL

Is Rising Odds of a Fed Rate Cut Altering the Investment Case for BILL Holdings (BILL)?

Reviewed by Sasha Jovanovic

- Shares of BILL Holdings recently advanced after New York Federal Reserve President John Williams suggested that the probability of a December interest rate cut has increased, indicating potential for further policy easing.

- Lower interest rates can be especially supportive for growth-focused software companies like BILL, making future expected earnings more valuable by reducing the discount rate applied to those cash flows.

- We’ll explore how the prospect of lower interest rates could influence BILL Holdings’ longer-term growth and profitability expectations.

Find companies with promising cash flow potential yet trading below their fair value.

BILL Holdings Investment Narrative Recap

At its core, owning shares of BILL Holdings means believing in the ongoing shift of small and midsize businesses to digital financial operations, supported by AI-powered automation. While the recent hints at a December rate cut may lend some support to near-term valuations, the largest catalyst remains product innovation, with ongoing risks around transaction-driven revenue exposure and competitive pressures unchanged for now.

Among recent developments, the launch of BILL AI stands out due to its relevance in an environment where lower rates can boost growth-focused software firms. This innovation strengthens BILL’s long-term growth proposition by targeting higher customer retention and deeper product adoption, but near-term revenue and profit drivers will also depend on overall SMB transaction volumes.

By contrast, investors should keep in mind potential headwinds if SMB spending trends were to reverse sharply...

Read the full narrative on BILL Holdings (it's free!)

BILL Holdings' narrative projects $2.1 billion revenue and $94.8 million earnings by 2028. This requires 13.2% yearly revenue growth and a $71 million increase in earnings from $23.8 million today.

Uncover how BILL Holdings' forecasts yield a $60.91 fair value, a 23% upside to its current price.

Exploring Other Perspectives

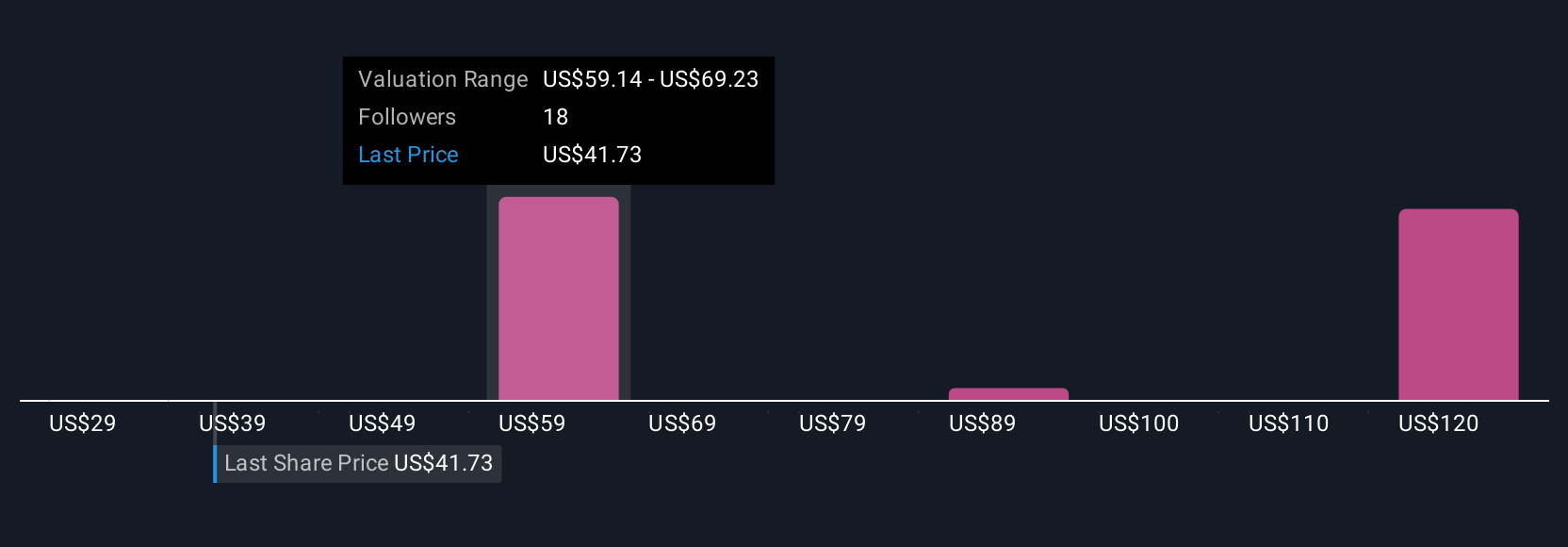

Simply Wall St Community members produced five fair value estimates for BILL ranging from US$42 to US$91, showing a difference of more than 100 percent. With rate cycles still top-of-mind, the ongoing reliance on transaction-based revenues could play a critical role in shaping the company’s future risk and reward profile.

Explore 5 other fair value estimates on BILL Holdings - why the stock might be worth 15% less than the current price!

Build Your Own BILL Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BILL Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BILL Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BILL Holdings' overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BILL Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BILL

BILL Holdings

Provides financial operations platform for small and midsize businesses worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success