- United States

- /

- IT

- /

- NYSE:BBAI

Why BigBear.ai Holdings (BBAI) Is Up 12.6% After Securing AI Aerospace Deal in Malaysia

Reviewed by Sasha Jovanovic

- Earlier this month, BigBear.ai announced it had signed a memorandum of understanding with Pahang Aerospace City Development Berhad (PAC) and other partners at the Dubai Air Show to accelerate advanced technology integration in Pahang Aerospace City and support regional security initiatives.

- This collaboration includes a focus on AI-powered border operations and is positioned to play a significant role in establishing Southeast Asia's first international spaceport and boosting Malaysia’s aerospace industry.

- We’ll explore how BigBear.ai’s push into the Malaysian aerospace market with cutting-edge AI technologies could reshape its investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

BigBear.ai Holdings Investment Narrative Recap

BigBear.ai Holdings is making a significant move to expand its international presence through technology partnerships in high-growth regions, such as Southeast Asia. The recent memorandum of understanding with Pahang Aerospace City signals progress on its international expansion catalyst, with the potential to open new revenue streams, but does not directly resolve the short-term variability in contract timing or the risk of inconsistent revenue, which remain key issues for the business in the near term.

Among recent announcements, the deployment of veriScan at Chicago O’Hare Airport is especially relevant, as it supports BigBear.ai's push into real-time AI-powered border solutions, a focus echoed in its new Southeast Asia partnership. These collaborations align closely with the company’s drive to scale recurring technology offerings and could contribute to its long-term growth narrative.

However, despite such milestones, investors should also consider the ongoing risk of revenue lumpiness and contract delays...

Read the full narrative on BigBear.ai Holdings (it's free!)

BigBear.ai Holdings is projected to reach $162.2 million in revenue and $10.3 million in earnings by 2028. This outlook assumes annual revenue growth of 2.1% and an earnings increase of $454.2 million from current earnings of -$443.9 million.

Uncover how BigBear.ai Holdings' forecasts yield a $6.33 fair value, in line with its current price.

Exploring Other Perspectives

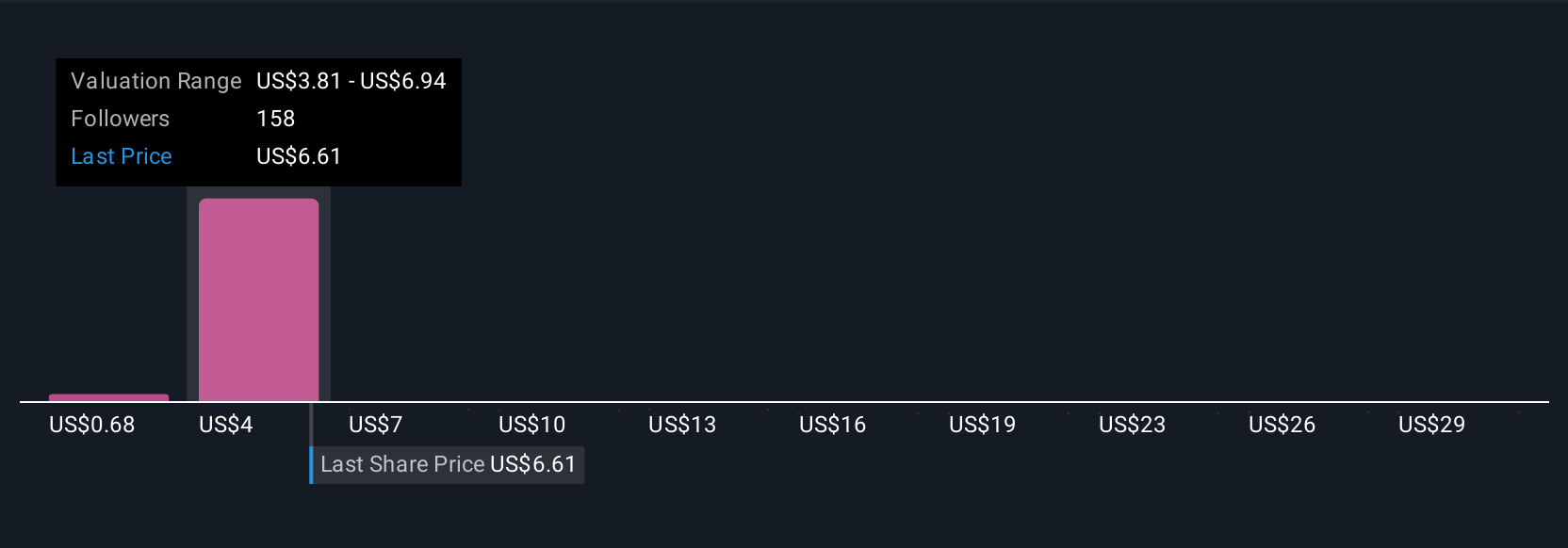

Fair value estimates from 33 Simply Wall St Community members range widely from US$0.68 to US$15.26 per share. While some see significant upside, the trend of inconsistent revenue from contract timing and milestone billing remains a core challenge for consistent financial performance; you can explore these differing viewpoints in more detail.

Explore 33 other fair value estimates on BigBear.ai Holdings - why the stock might be worth over 2x more than the current price!

Build Your Own BigBear.ai Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BigBear.ai Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free BigBear.ai Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BigBear.ai Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026