- United States

- /

- IT

- /

- NYSE:BBAI

BigBear.ai (BBAI) Valuation: Analyzing the Impact of the Ask Sage Acquisition and Q3 Earnings Beat

Reviewed by Simply Wall St

BigBear.ai Holdings (NYSE:BBAI) caught investors’ attention this week after announcing the acquisition of Ask Sage, a generative AI platform serving secure government environments. The deal signals significant ambitions for growth in defense and national security sectors.

See our latest analysis for BigBear.ai Holdings.

The stock’s recent slide follows a volatile rally fueled by upbeat third-quarter results and the headline-grabbing Ask Sage acquisition, both considered pivotal for future growth. Despite a 22% share price pullback over the past month, BigBear.ai’s total shareholder return over the past year stands at a remarkable 152%. Its three-year total return is up an astounding 461%. Momentum may be cooling in the short term, but the long-run story is characterized by dramatic gains and high expectations tied to defense-focused AI expansion.

Interested in how other innovators are reshaping the defense and security landscape? Now’s a great time to discover See the full list for free.

With shares pulling back after a major run and analysts projecting double-digit upside, investors are left to wonder: does BigBear.ai represent a compelling bargain at today’s prices, or has the market already factored in next year’s growth?

Most Popular Narrative: 13% Undervalued

BigBear.ai Holdings’ most widely followed narrative sets a fair value of $6.33, about 13% above the latest closing price of $5.51. This suggests the crowd sees more upside ahead, assuming ambitious future milestones are achieved.

The company is focused on business alliances and strategic acquisitions, which could drive faster innovation and open new revenue streams by accessing additional markets and technologies. BigBear.ai is targeting opportunities in defense, security, and infrastructure. The company aims to capitalize on increased federal spending and shifting procurement practices toward efficiency and advanced commercial technologies, which could potentially boost revenue and long-term contracts.

Want to know the growth blueprint behind this high valuation? The key element of this narrative is rapid revenue expansion and margin transformation. What future financial levers are analysts betting on to reach that premium target? Unlock the full story to see which assumptions tip the scales and why expectations keep climbing.

Result: Fair Value of $6.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent government contract delays and fluctuating revenues could undermine BigBear.ai’s optimistic trajectory, putting continued margin improvement at risk.

Find out about the key risks to this BigBear.ai Holdings narrative.

Another View: Is the Market Overpaying?

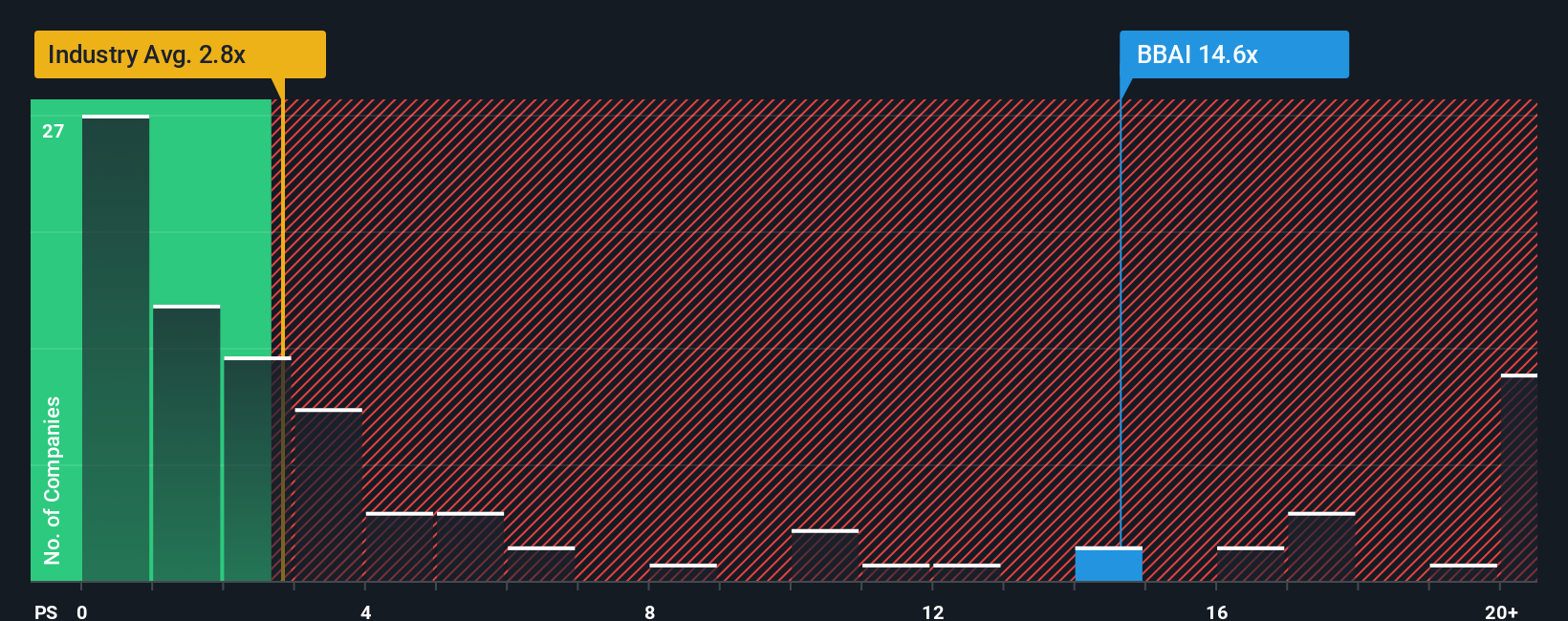

Looking at BigBear.ai’s price-to-sales ratio reveals a much less optimistic picture. The company trades at 16.7 times sales, which is significantly higher than the US IT industry average of just 2.4 and a peer average of 0.5. In comparison, the fair ratio for a business like this is estimated at 3.3. This steep premium could signal that the market has driven up the price far past fundamentals, introducing real valuation risk for new investors. Is this the sign of a visionary, high-growth play, or does it expose the stock to harsh corrections if expectations slip?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BigBear.ai Holdings Narrative

If the consensus view does not line up with your perspective, you can dive into the numbers and craft your own narrative in just minutes. Do it your way

A great starting point for your BigBear.ai Holdings research is our analysis highlighting 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Moves?

Smart investors always look beyond the obvious. Don’t just settle for one story when you can uncover stocks with untapped potential and unique advantages across multiple sectors.

- Seize opportunities with undervalued companies showing strong growth by analyzing these 915 undervalued stocks based on cash flows to identify stocks that may be poised for a price catch-up.

- Boost your portfolio with steady income and reliable returns by reviewing these 16 dividend stocks with yields > 3%, which features high-yield performers above 3%.

- Gain an edge in the rapidly evolving world of quantum computing by checking out these 26 quantum computing stocks to find early movers rewriting the rulebook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BigBear.ai Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:BBAI

BigBear.ai Holdings

Provides artificial intelligence-powered decision intelligence solutions.

Flawless balance sheet with low risk.

Market Insights

Community Narratives