- United States

- /

- Software

- /

- NYSE:ASAN

Asana (ASAN): Evaluating Valuation After Sharp Stock Drop on Earnings and Shaky Market Sentiment

Reviewed by Simply Wall St

If you have been eyeing Asana (ASAN) recently, this might be one of those moments that stop you in your tracks. The company just released its second-quarter results, reporting sales growth and narrower losses, and even gave upbeat guidance for the year ahead. Yet, almost immediately, shares tumbled more than 8% as investors zeroed in on operational weaknesses and lingering questions about profitability. Combined with a weak U.S. jobs report fueling broader selling pressure, this has created market tension that has Asana holders on edge.

This pullback comes after a year of volatility for Asana. While the company’s revenues have climbed steadily and losses are shrinking, the stock is still down over 32% for the year despite a 17% gain over the past twelve months. As a result, short-term momentum has turned sharply negative, overshadowing recent milestone announcements like raised full-year revenue targets and improved cost control. The disconnect between management's encouraging outlook and investor reaction is hard to ignore.

After this sharp selloff, the question remains whether Asana is now trading at a bargain for those willing to bet on a turnaround, or if the market is simply pricing in more risk as growth expectations level out.

Most Popular Narrative: 17.8% Undervalued

According to the most widely followed narrative, Asana is currently trading at a meaningful discount to its estimated fair value, suggesting potential upside if the company can deliver on its strategic growth drivers.

Widespread digital transformation and hybrid/remote work trends are fueling sustained, global demand for advanced productivity platforms. Asana is benefiting from strong international expansion, especially in EMEA and Japan, as well as above-average growth in large enterprise accounts. This positions the company for TAM expansion and multiyear recurring revenues.

Want to know how this company could transform its valuation story? There is a bold quantitative forecast beneath the surface here, hinting at strong growth rates, margin improvements, and ambitious profit assumptions. Intrigued by the bullish thesis behind this price target? The narrative’s projections might surprise you.

Result: Fair Value of $16.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing competition from larger platforms and potential downgrades in major enterprise renewals could dampen Asana’s growth and challenge its long-term outlook.

Find out about the key risks to this Asana narrative.Another View: The SWS DCF Model Perspective

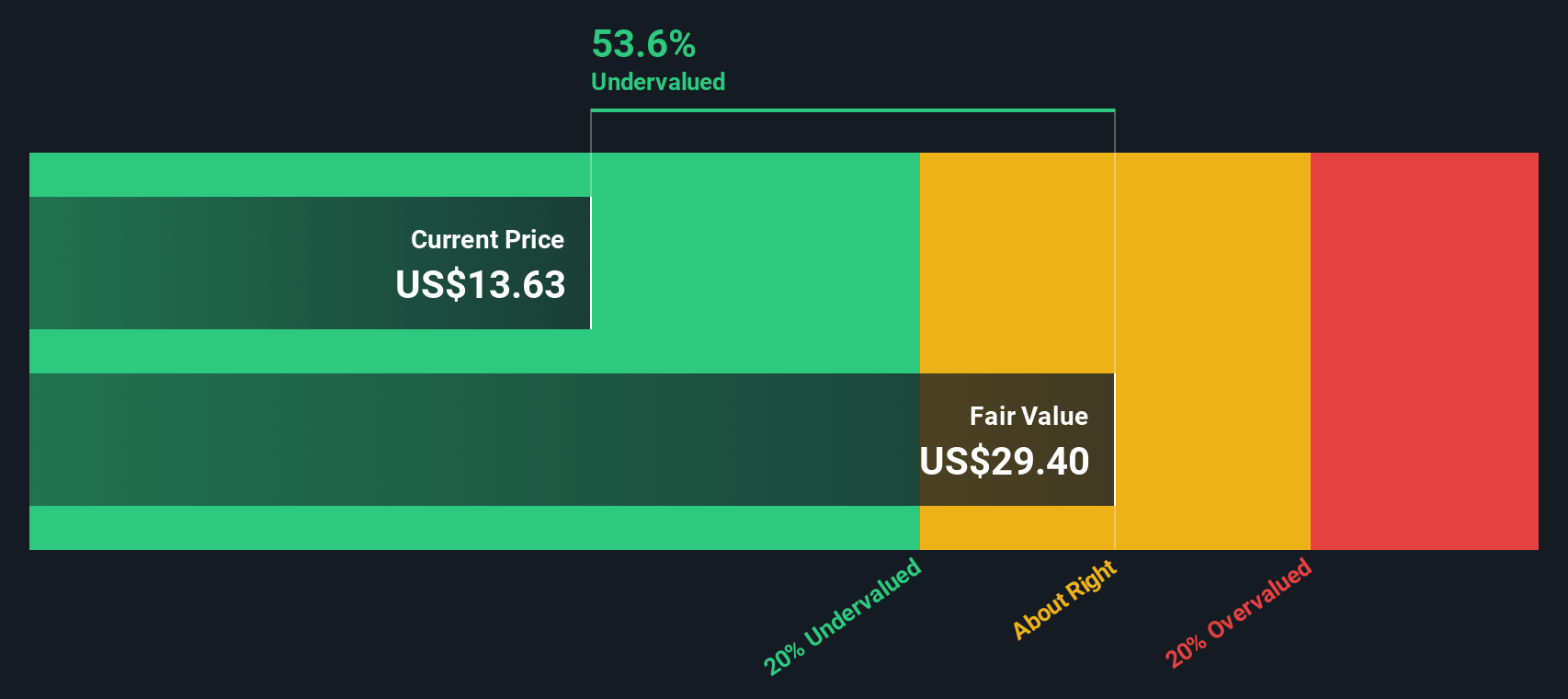

While some see value using sales ratios compared to the software industry, our DCF model also suggests Asana is undervalued. However, it goes further by closely analyzing future cash flows. Could longer-term assumptions influence the outcome differently?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Asana Narrative

If you want a different perspective or feel there's more beneath the headline numbers, you can craft your own analysis using the available data in just a few minutes. Do it your way

A great starting point for your Asana research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step up your investing game and get a head start on the market by scanning new opportunities. The right picks today could shape your financial future tomorrow.

- Tap into explosive potential with emerging technology firms harnessing artificial intelligence breakthroughs. AI penny stocks

- Boost your passive income by seeking out companies delivering attractive yields and steady payouts. dividend stocks with yields > 3%

- Uncover hidden market gems trading below their intrinsic worth and position yourself ahead of the crowd. undervalued stocks based on cash flows

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:ASAN

Asana

Operates a work management software platform for individuals, team leads, and executives in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives