After a bombastic public trading debut that saw its shares skyrocket 174%,C3.ai, Inc. (NYSE: AI) came crashing down in 2021. The stock now trades at US$34, around the point where the firm planned to price its shares initially, before a private sale to Microsoft and others at US$42.

However, despite a fresh low, the company remains in a good financial position – managing its cash burn and keeping the balance sheet free of debt.

View our latest analysis for C3.ai

Second-quarter 2022 results

- EPS: - US$0.55 (down from US$0.39 loss in 2Q 2021).

- Revenue: US$58.3m (up 41% from 2Q 2021).

- Net loss: US$56.7m (loss widened 280% from 2Q 2021).

Revenue exceeded analyst estimates by 2.3%. Earnings per share (EPS) also surpassed analyst estimates by 34%. Earnings per share (EPS) surpassed analyst estimates by 34%. Over the next year, revenue is forecast to grow 37%, compared to a 203% growth forecast for the industry in the US.

Despite beating the expectations and raising guidance, the market sold off 17% on the news, while analysts and institutions scrambled to adjust the ratings and price targets.

Bank of America downgraded the company to Underperform with a price target of US$40 (from Neutral), as analyst Brad Sills quoted disappointing subscription revenues, as well as a sequential decline in Remaining Performance Obligations.

Other institutions were a bit less apocalyptic, with Wedbush lowering the target to US$45 but maintaining the Outperform rating (from US$70). At the same time, Needham kept the triple-digit price target, lowering from US$122 to US$103 and keeping the Buy rating.

Meanwhile, the company reached an agreement with the U.S. Department of Defense for a US$500m worth contract. The agreement allows the government agency to acquire company products and services for modeling and simulation, but the details remain rather vague. However, improving the ties with the government is a win for a rather young company like C3.ai.

Getting Worse Before It Gets Better

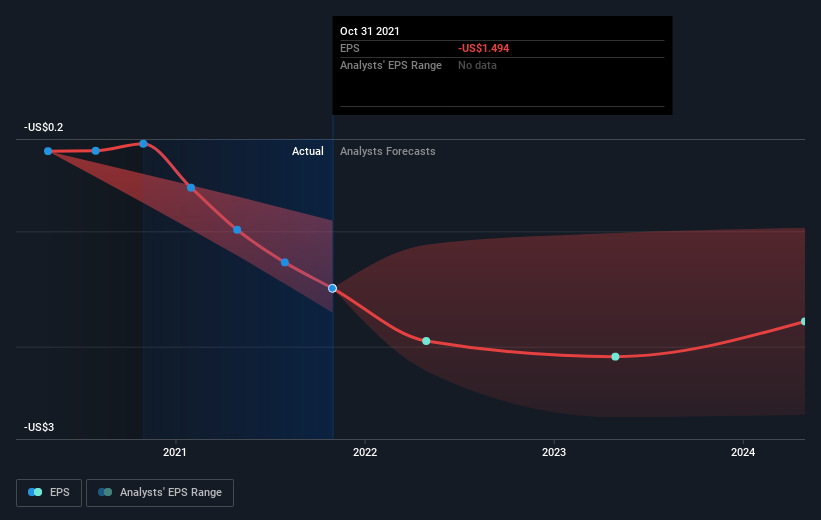

According to the 10 American Software analysts, C3.ai is still not closing on the breakeven point. If anything, it looks like the losses might widen before things start getting better.

We're not going to go through company-specific developments for C3.ai given that this is a high-level summary, but keep in mind that generally, periods of lower growth in the upcoming years are not out of the ordinary, particularly when a company is in a period of investment.

Before we wrap up, there’s one aspect worth mentioning. C3.ai currently has no debt on its balance sheet, which is rare for a loss-making growth company, which typically has high debt relative to its equity. This means that the company has been operating purely on its equity investment and has no debt burden. This aspect reduces the risk around investing in the loss-making company.

Next Steps:

With the latest downslide, it seems that the market misplaced the expectations. From our standpoint, the company is in a good spot to deliver on its promises. It keeps a clean balance sheet and manages its cash burn rather well. However, its high volatility points out that it might best suit the long-term investors who are willing to exercise patience.

This article is not intended to be a comprehensive analysis of C3.ai. If you are interested in understanding the company at a deeper level, take a look at C3.ai's company page on Simply Wall St.

We've also compiled a list of key aspects you should look at:

- Historical Track Record: What has C3.ai's performance been like over the past? Go into more detail in the past track record analysis and take a look at the free visual representations of our analysis for more clarity.

- Management Team: An experienced management team at the helm increases our confidence in the business – take a look at who sits on C3.ai's board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NYSE:AI

C3.ai

Operates as an enterprise artificial intelligence application software company.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026