- United States

- /

- IT

- /

- NYSE:ACN

Should Accenture's (ACN) Expanded Google Cloud Alliance Transform Its Digital Reinvention Narrative?

Reviewed by Sasha Jovanovic

- In recent news, Google Cloud and Accenture announced an expanded strategic alliance to deliver Gemini Enterprise agentic AI solutions, advancing the integration of generative AI and multi-agent systems into client workflows across sectors such as hospitality, telecommunications, and healthcare. This collaboration highlights Accenture's growing emphasis on AI-driven transformation and is further supported by internally aligning leadership through the appointment of Shaheen Sayed as Chief Commercial Officer of Reinvention Services.

- One interesting facet of this development is the scaling of Accenture's joint generative AI Center of Excellence with Google Cloud, which now enables clients to access and orchestrate more than 450 engineered AI agents directly within Gemini Enterprise, potentially unlocking significant operational efficiencies and personalized customer experiences.

- We'll assess how Accenture's deepening AI partnership with Google Cloud could influence its investment narrative and outlook on digital transformation.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Accenture Investment Narrative Recap

To be a shareholder in Accenture, you need to believe in the company's ability to harness its scale and expertise to drive digital transformation for its global client base, especially by leveraging partnerships like the expanded alliance with Google Cloud to accelerate adoption of generative AI. While this deepening collaboration may reinforce Accenture’s credibility and potential to win large enterprise AI projects, it is unlikely to materially shift the most important short term catalyst: broader client spending on digital reinvention initiatives. Meanwhile, the most pressing risk continues to be slowing federal revenue amid uncertain public sector policy and procurement trends, which is not directly mitigated by the Google partnership.

The appointment of Shaheen Sayed as Chief Commercial Officer of Reinvention Services, announced earlier this month, stands out in this context. Her new role signals management's intent to unify and strengthen Accenture’s AI-led consulting offerings just as the Google Cloud relationship is expanding, which may provide additional confidence to clients considering multi-domain digital transformation.

However, investors should also keep in mind that while technology partnerships might open new doors, pressure from declining government business remains a key factor that could...

Read the full narrative on Accenture (it's free!)

Accenture's narrative projects $81.5 billion revenue and $10.0 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $2.1 billion earnings increase from $7.9 billion today.

Uncover how Accenture's forecasts yield a $278.32 fair value, a 14% upside to its current price.

Exploring Other Perspectives

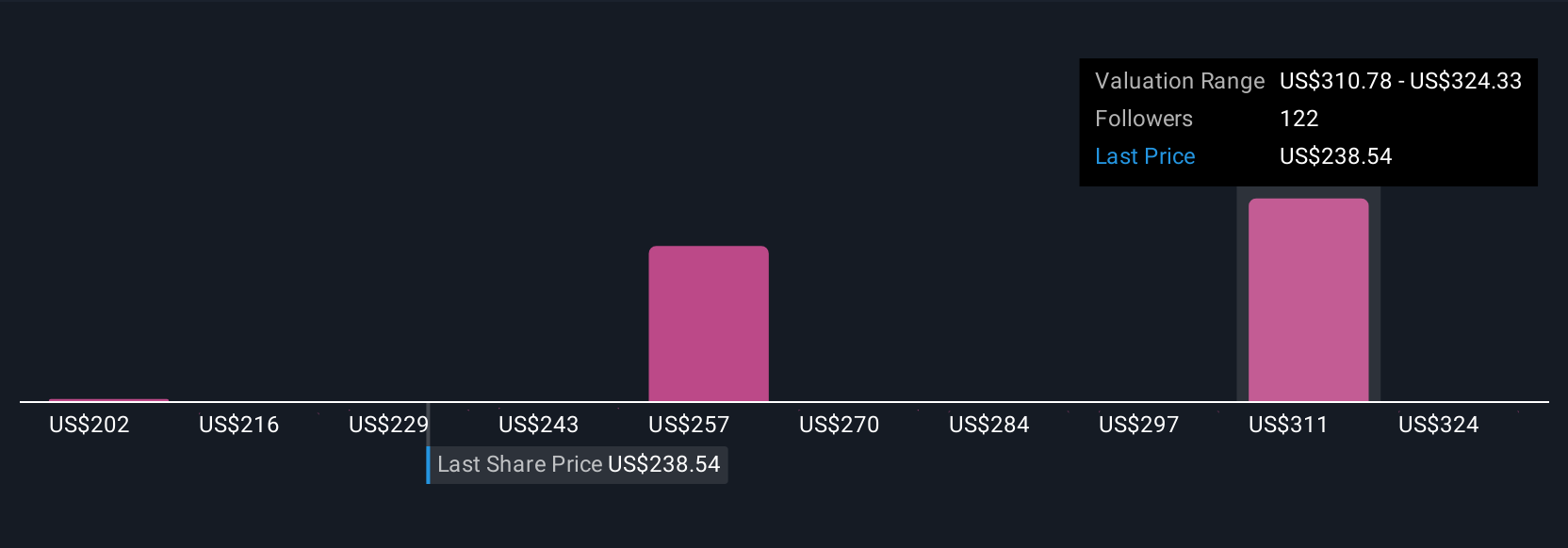

Fifteen member fair value estimates from the Simply Wall St Community range from US$202 to US$338 per share. These varied outlooks reflect broad uncertainty at a time when Accenture's exposure to fluctuating client demand has far-reaching consequences for its operational momentum.

Explore 15 other fair value estimates on Accenture - why the stock might be worth 17% less than the current price!

Build Your Own Accenture Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Accenture research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Accenture research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Accenture's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion