- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN) Q1 2026 Margin Slippage Reinforces Concerns Over Slowing Profit Growth

Reviewed by Simply Wall St

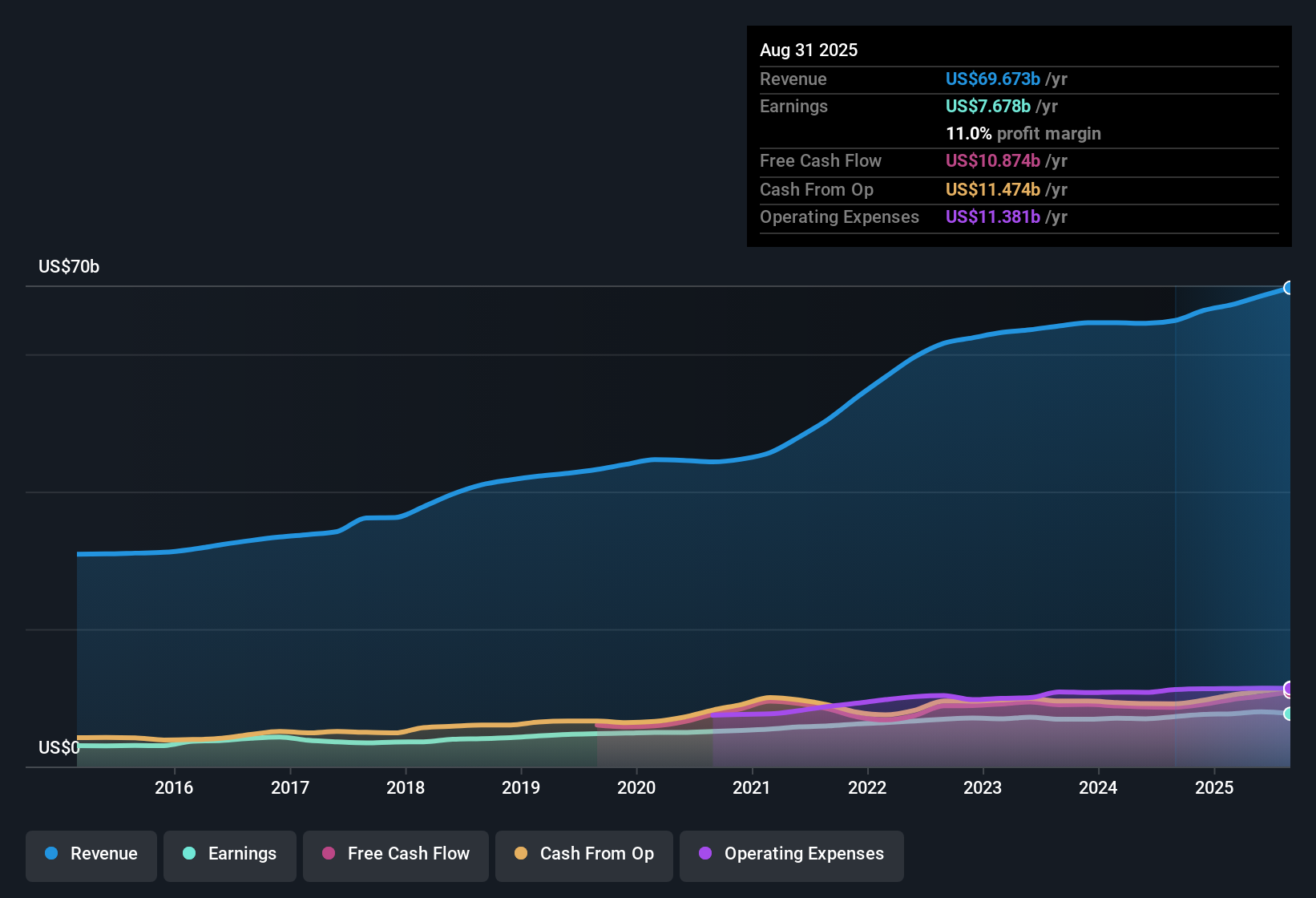

Accenture (ACN) opened fiscal 2026 with Q1 revenue of about $18.7 billion and basic EPS of $3.57, setting the tone for another year where profit growth is firmly in focus. The company has seen quarterly revenue move from roughly $16.4 billion in Q4 2024 to $18.7 billion in Q1 2026, while basic EPS has ranged between about $2.27 and $3.64 over that stretch. This gives investors a clear view of how top line and per share earnings have been tracking. With trailing net margins easing a touch and multi year earnings growth still intact, this latest print is a nuanced update on how Accenture is managing profitability.

See our full analysis for Accenture.With the headline numbers on the table, the next step is to compare these results with the most widely followed narratives around Accenture to see which stories the data supports and which ones start to look a bit stretched.

See what the community is saying about Accenture

Margins Softening Despite Solid Profit Base

- Over the last twelve months, Accenture generated about $7.6 billion of net income on $70.7 billion of revenue, which works out to a 10.8 percent net margin that is down from 11.4 percent a year earlier.

- Critics highlight margin pressure and slowing profit growth, and the latest numbers partly back that up while also showing resilience:

- One year earnings growth of about 0.5 percent is well below the 6.7 percent per year pace seen over the last five years, even though net income is still running in the multi billion dollar range.

- The dip in trailing margin from 11.4 percent to 10.8 percent aligns with worries about higher costs, yet profitability remains comfortably in double digits, which bears need to factor into their case.

Revenue Growth Steady But Trails Market

- On a trailing basis, revenue has risen from roughly $64.9 billion to $70.7 billion over the past year, yet is only forecast to grow about 5.3 percent per year compared with a 10.5 percent annual revenue growth rate cited for the broader US market.

- The bullish view that strategic bets like Gen AI and Industry X can drive durable top line expansion meets mixed evidence in the data:

- Analysts expect earnings to grow around 8.9 percent per year and to reach about $10.0 billion by 2028, which implies improving profitability on top of mid single digit revenue growth.

- At the same time, the recent 0.5 percent one year earnings growth and slower forecast revenue growth versus the market show that translating those growth initiatives into clearly faster company wide expansion is still a work in progress.

Valuation Leaves Room If Growth Improves

- With the share price around $269.96 and a trailing price to earnings ratio of 21.8 times that sits below both the US IT industry average of 29.9 times and the peer average of 25.7 times, Accenture also offers a 2.42 percent dividend yield and trades under a DCF fair value estimate of about $293.19.

- Bears question whether moderating margins and sub market revenue growth deserve any valuation premium, and the current setup gives both sides something to point to:

- The gap between the current price and the $293.19 DCF fair value, together with five year earnings growth of 6.7 percent per year and the dividend, supports the idea that investors are not overpaying for the existing track record.

- However, the combination of a 10.8 percent net margin that is lower than last year and only 0.5 percent one year earnings growth means the stock will likely need the forecast step up in earnings growth to fully justify even this discounted multiple.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Accenture on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at these figures from a different angle? In just a few minutes, you can shape and publish your own take: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

See What Else Is Out There

Accenture’s easing margins, muted recent earnings growth and slower revenue expansion than the broader market suggest its growth story is not firing on all cylinders.

If you want businesses already proving they can grow consistently rather than hoping forecasts play out, use our stable growth stocks screener (2101 results) today to focus on steadier compounders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion