- United States

- /

- IT

- /

- NYSE:ACN

Accenture (ACN): Evaluating Shareholder Value and Future Potential After Recent Price Fluctuations

Reviewed by Simply Wall St

See our latest analysis for Accenture.

Looking back, Accenture’s share price has dipped about 29% so far this year, though the stock has still delivered a healthy 23% total shareholder return over the past five years. Volatility in recent months may reflect shifting investor confidence around the company’s growth prospects as the tech landscape evolves.

If you’re curious what other big movers are out there, now is an ideal moment to broaden your outlook with our fast growth and insider-backed stock discoveries. Check out fast growing stocks with high insider ownership.

With Accenture shares trading below recent highs and analysts forecasting some upside, the key question remains: is the current price an attractive entry point, or is the market already factoring in the company’s future growth?

Most Popular Narrative: 22% Overvalued

Accenture’s narrative fair value stands at $202.38, which trails its recent closing price of $247.65. Investors are likely grappling with whether the current share price fully justifies Accenture’s earning potential and outlook.

After a sector de-rating, ACN trades around its long-run average multiple with superior profitability and returns on capital for a services name.

Craving the real story behind Accenture’s premium? The secret lies in how robust margins, sector momentum, and a surprising blend of financial resilience shape the narrative’s numbers. Want to find out what powers this valuation call? The next chapter reveals exactly which bold assumptions drive this sharp pricing outlook.

Result: Fair Value of $202.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sluggish bookings trends and elongated client decision cycles could challenge Accenture's bullish long-term outlook if they persist in coming quarters.

Find out about the key risks to this Accenture narrative.

Another View: DCF Undervalued?

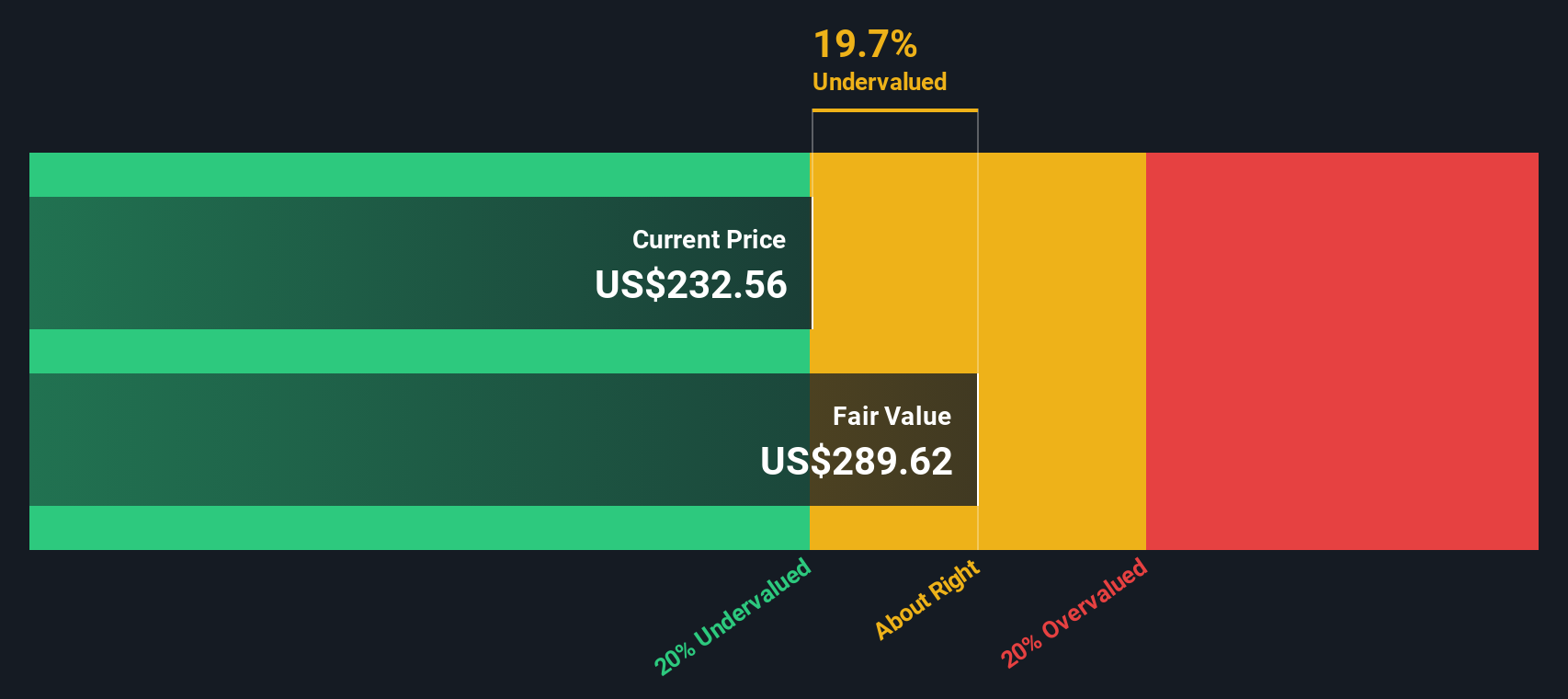

Looking at the SWS DCF model, Accenture’s current price of $247.65 sits around 9.5% below its DCF fair value estimate of $273.68. This suggests the market may be underestimating the company’s long-term cash flow potential. How much weight should investors give to this more optimistic outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Accenture Narrative

If you want to dive into the numbers yourself or put your own views to the test, you can craft a personal narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Accenture.

Looking for more investment ideas?

Smart investors never limit their options. Act now to uncover fresh opportunities and ensure you stay ahead in today’s dynamic market. Missing out could mean leaving gains on the table.

- Capture reliable income streams by reviewing these 17 dividend stocks with yields > 3% with impressive yields above 3% for your portfolio.

- Ride the wave of healthcare innovation by checking out these 33 healthcare AI stocks transforming patient care and diagnostics through artificial intelligence.

- Seize a head start on tomorrow’s financial trends by tapping into these 80 cryptocurrency and blockchain stocks at the forefront of digital and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ACN

Accenture

Provides strategy and consulting, industry X, song, and technology and operation services in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives