- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler (ZS) Projects US$3.3 Billion Revenue for FY2026 Despite Net Losses

Reviewed by Simply Wall St

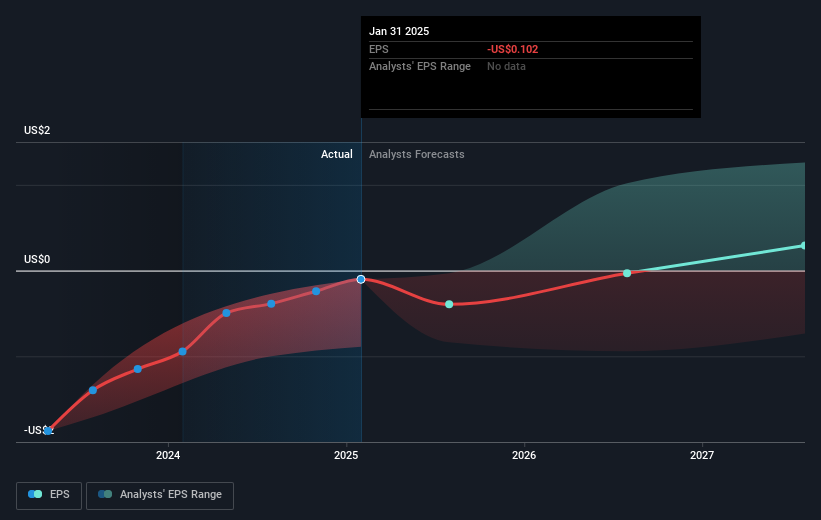

Zscaler (ZS) recently announced its Q4 and full-year earnings, highlighting a significant increase in revenue and an improved net loss compared to the previous year. As tech stocks generally rose thanks to positive moves by companies like Alphabet, Zscaler's favorable earnings and optimistic future revenue guidance likely lent additional support to its 2.57% stock price increase last week. Meanwhile, broader market trends such as declining Treasury yields and a rise in major stock indexes also contributed to a more positive environment for tech companies. This combination helped ZS align with the general market's upward trend, reinforcing investor confidence.

We've identified 1 warning sign for Zscaler that you should be aware of.

The recent announcement of Zscaler's improved financial performance has added momentum to the company's narrative of growth driven by the adoption of cloud and zero trust security solutions. This aligns with their efforts to expand recurring revenue and customer retention, potentially bolstering future revenue and earnings forecasts. The Q4 and full-year earnings update, combined with favorable market conditions like declining Treasury yields, supports the company's optimistic future revenue guidance. As a result, analysts may find reason to adjust their forecasts upward, which could impact the consensus price target of US$317.68.

Over the past five years, Zscaler's total shareholder return, including dividends, has been 106.18%. This signifies the growth trajectory the company has been on, particularly as demand for their cloud-native security platform continues to expand. In comparison, Zscaler's performance over the past year has surpassed both the US market and the US Software industry benchmarks, highlighting its resilience and potential competitiveness.

Currently trading at US$274.57, the stock is positioned at a 15.7% discount to the consensus price target. This discrepancy might entice investors who believe in the company's long-term revenue growth potential. Furthermore, the robust performance and alignment with broader positive market trends reinforce confidence in meeting or exceeding future revenue and earnings projections. However, the stock remains costly compared to its industry peers, based on the Price-To-Sales Ratio, which could temper expectations.

Assess Zscaler's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion