- United States

- /

- Software

- /

- NasdaqGS:ZS

Zscaler (ZS): Evaluating Valuation Following Real-Time Digital Experience Upgrades and Zero Trust Enhancements

Reviewed by Simply Wall St

Zscaler (ZS) introduced new Zscaler Digital Experience innovations aimed at helping organizations detect and address IT performance issues with real-time insights. These enhancements reduce issue detection time and support seamless Zero Trust initiatives.

See our latest analysis for Zscaler.

Zscaler’s rollout of new digital experience features has landed at a time when momentum is building. Its 1-month share price return of 8.7% and 90-day return of 18.2% reflect growing investor confidence. Over the past year, shareholders have seen a robust 82% gain in share price, while the 3-year total shareholder return is over 170%. This signals that ongoing innovation continues to deliver for both the company and its investors.

If Zscaler’s rapid pace of product launches has you curious, take your research further and explore the top movers with our See the full list for free.

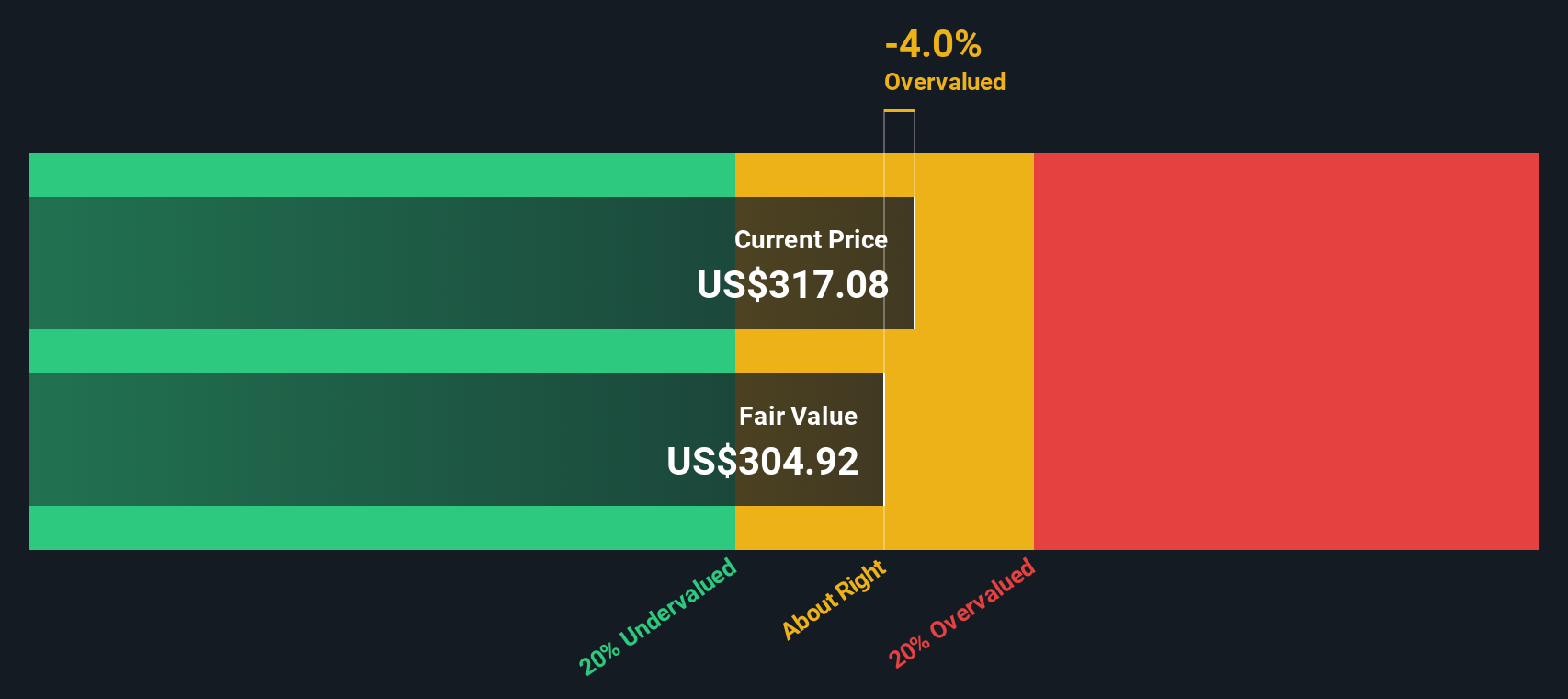

With Zscaler’s recent run-up and the pace of new innovations, investors now face a key question: is Zscaler’s stock currently undervalued, or has the market already priced in its future growth potential?

Most Popular Narrative: 2% Overvalued

The market has pushed Zscaler's share price above the most followed fair value estimate, setting the stage for a debate over whether current expectations are too high or not high enough.

Rapid response to AI-driven threats and shifting industry trends supports sustained revenue growth, higher margins, and increasing operating efficiency through automation and scale. Growing competition, talent shortages, and aggressive expansion are pressuring Zscaler's profitability, margins, and long-term market share in an evolving cybersecurity landscape.

Curious what makes Zscaler’s valuation stand out? The secret lies with high-powered growth calculations and ambitious margin forecasts that only a handful of companies can match. Want to know which financial leap of faith analysts have built into their outlook? Don’t miss the deeper dive that unpacks just how bold these fair value assumptions really are.

Result: Fair Value of $324.66 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the integration of security by cloud giants and intensifying competition could threaten Zscaler’s future earnings potential and overall growth trajectory.

Find out about the key risks to this Zscaler narrative.

Another View: What Does the SWS DCF Model Suggest?

Looking at valuation from a different angle, the SWS DCF model estimates Zscaler’s fair value at $297.83 per share. This figure is below both its current share price and the analyst consensus, suggesting Zscaler could be overvalued if cash flow forecasts are more reliable than revenue-based multiples. Which approach will prove right as market conditions evolve?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Zscaler Narrative

If this outlook doesn’t line up with your perspective or you’re ready to analyze the numbers yourself, you can craft a narrative of your own in just a few minutes with our Do it your way

A great starting point for your Zscaler research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Give yourself an advantage in the market by acting on unique, handpicked opportunities you won’t want to miss. See where smart investors are looking next.

- Catch the wave of innovative companies leveraging artificial intelligence as you check out these 26 AI penny stocks with real growth momentum and tech-driven potential.

- Secure your income stream by scanning these 22 dividend stocks with yields > 3% that offer attractive yields and reward shareholders with consistent returns.

- Lead the pack into the future with these 28 quantum computing stocks, spotlighting breakthroughs and pioneers in quantum computing set to transform the industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives