- United States

- /

- Software

- /

- NasdaqGS:ZS

Will Zscaler's (ZS) Enhanced Monitoring Tools Strengthen Its Competitive Edge in Enterprise Security?

Reviewed by Sasha Jovanovic

- Zscaler recently introduced new Zscaler Digital Experience (ZDX) enhancements designed to accelerate issue detection, strengthen service level agreements, and reduce user downtime through features like automated network rerouting and comprehensive device monitoring.

- These innovations address a key industry challenge by unifying device, network, and application data for rapid root-cause identification, helping enterprises minimize productivity losses from digital disruptions estimated at US$400 billion annually.

- We'll examine how the rollout of real-time performance insights across internet and endpoints could reshape Zscaler's investment outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Zscaler Investment Narrative Recap

To be a Zscaler shareholder, you need to believe in the continued expansion of cloud-based cybersecurity and the company’s ability to protect its competitive edge as enterprises shift to zero trust architectures. The recent Zscaler Digital Experience enhancements aim to reduce costly digital disruptions for enterprises, but do not materially change the most important short-term catalyst, large-scale upsell deals with major global clients, or the primary risk from intense competition and platform bundling by public cloud providers.

Among recent announcements, Zscaler’s expanded partnership with HCLTech stands out as directly relevant, enhancing the AI-powered automation and zero trust capabilities that underpin its platform. This alignment with enterprise digital transformation trends supports Zscaler’s efforts to secure Fortune 500 customers and drive higher annual recurring revenue while reinforcing the value proposition targeted by the latest ZDX product rollout.

However, investors should be aware that, in contrast to the product momentum, the risk from bundled public cloud security offerings remains...

Read the full narrative on Zscaler (it's free!)

Zscaler's narrative projects $4.7 billion revenue and $139.8 million earnings by 2028. This requires 20.5% yearly revenue growth and a $181.3 million earnings increase from the current earnings of $-41.5 million.

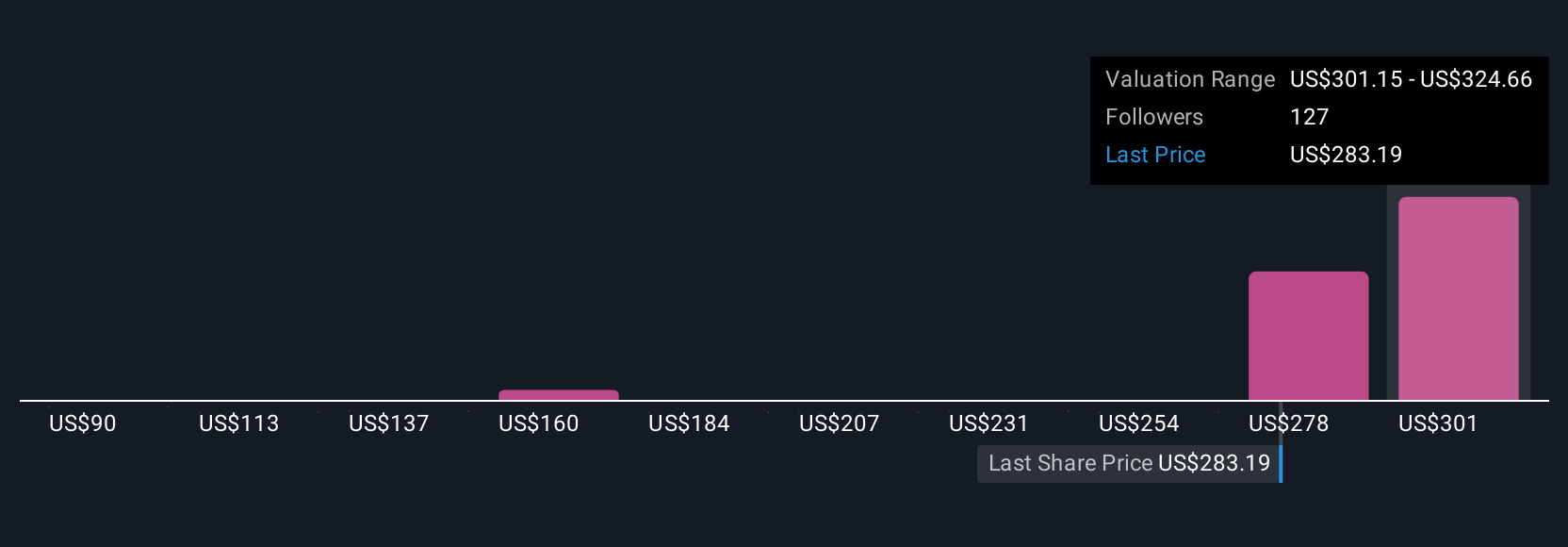

Uncover how Zscaler's forecasts yield a $324.66 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members produced nine fair value estimates for Zscaler, ranging from US$86.42 to US$324.66. These perspectives highlight how views can vary sharply, especially given the ongoing risk that public cloud providers could erode Zscaler’s competitive position, look closely at multiple viewpoints before drawing your own conclusions.

Explore 9 other fair value estimates on Zscaler - why the stock might be worth as much as $324.66!

Build Your Own Zscaler Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Zscaler research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Zscaler research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Zscaler's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zscaler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZS

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives