- United States

- /

- Software

- /

- NasdaqCM:ZENA

Why ZenaTech (ZENA) Is Down 6.4% After Drone Segment Drives Sharp Revenue Surge

- ZenaTech, Inc. reported past third-quarter results showing revenue climbed to C$4.35 million, up sharply from C$327,878 a year earlier, with its Drone as a Service segment accounting for the majority of sales.

- This performance reflects a fundamental shift as ZenaTech accelerates consolidation in the land surveying industry using drone and AI-powered analytics across growing commercial and defense markets.

- We’ll examine how the rapid expansion of Drone as a Service operations continues to shape ZenaTech’s evolving investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is ZenaTech's Investment Narrative?

At the heart of the ZenaTech investment story is conviction in the company's ability to execute its ambitious expansion of Drone as a Service (DaaS), underpinned by recent record revenue growth and an aggressive acquisition strategy. The latest third-quarter results revealed a swift rise in DaaS as the primary revenue engine, with further momentum from newly expanded manufacturing operations in the UAE. This bolsters key short-term catalysts such as integration of newly acquired US surveying firms, advancement toward US defense supplier approval and international scaling of DaaS solutions. That said, these gains come amid steeply higher losses and continued shareholder dilution, highlighting the pressure on ZenaTech to translate rapid top-line growth into sustainable margins. The recent developments sharpen the focus on execution risk: while the expansion potentially accelerates revenue opportunities, it adds immediate cost and integration complexity that could weigh on near-term profitability or cash runway.

Yet with such strong expansion, one risk investors should not miss lies in ZenaTech's need for profitable scaling amid rising losses.

Exploring Other Perspectives

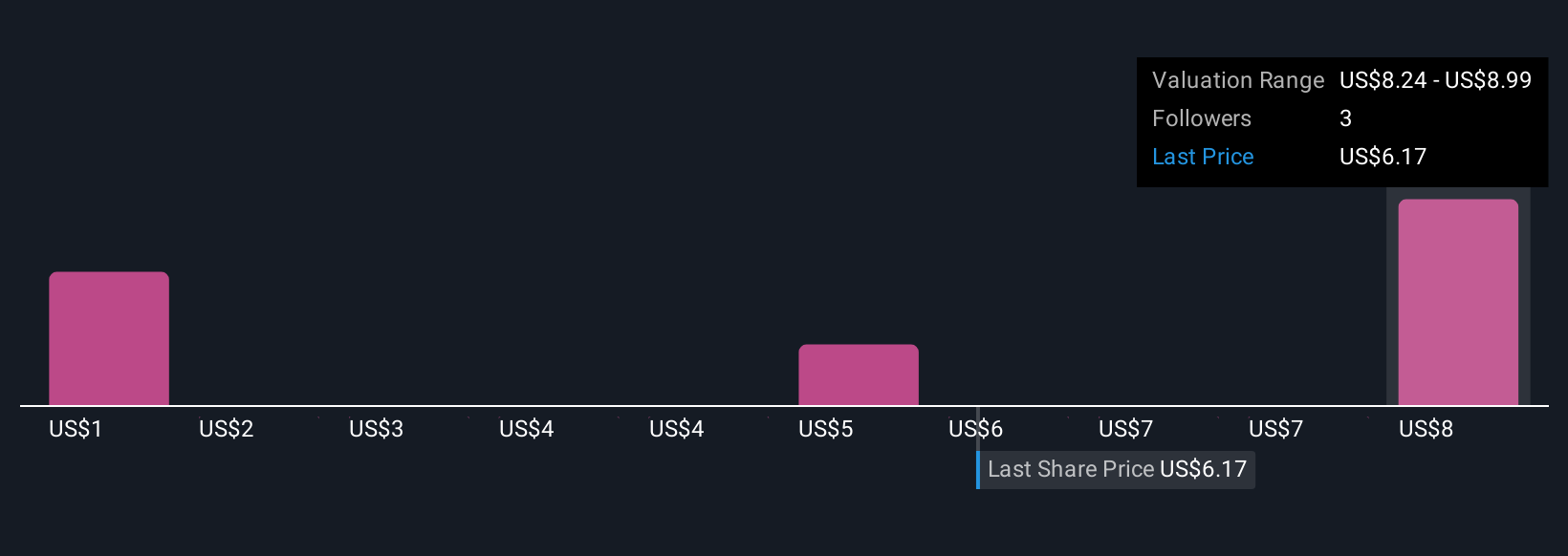

Explore 4 other fair value estimates on ZenaTech - why the stock might be worth over 2x more than the current price!

Build Your Own ZenaTech Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ZenaTech research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free ZenaTech research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ZenaTech's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if ZenaTech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ZENA

ZenaTech

An enterprise software technology company, develops cloud-based software applications in Canada.

Slight risk with limited growth.

Market Insights

Weekly Picks

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

EU#4 - Turning Heritage into the World’s Strongest Luxury Empire

The "Easy Money" Is Gone: Why Alphabet Is Now a "Show Me" Story

Recently Updated Narratives

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

EU#5 - From Industrial Giant to the Digital Operating System of the Real World

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion