- United States

- /

- Software

- /

- NasdaqCM:XTKG

X3 Holdings Co Ltd. (NASDAQ:XTKG) May Have Run Too Fast Too Soon With Recent 26% Price Plummet

X3 Holdings Co Ltd. (NASDAQ:XTKG) shares have had a horrible month, losing 26% after a relatively good period beforehand. For any long-term shareholders, the last month ends a year to forget by locking in a 95% share price decline.

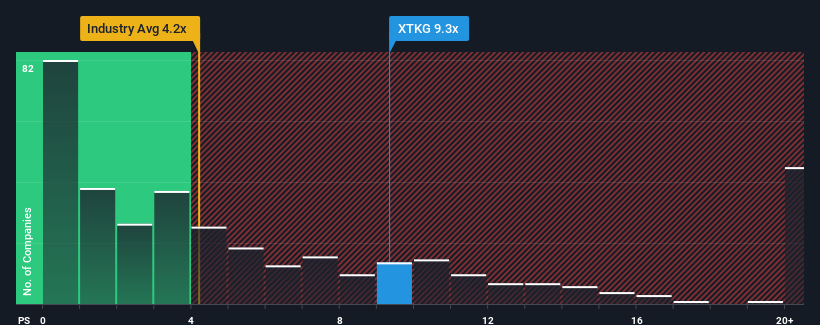

Even after such a large drop in price, X3 Holdings Co's price-to-sales (or "P/S") ratio of 9.3x might still make it look like a strong sell right now compared to other companies in the Software industry in the United States, where around half of the companies have P/S ratios below 4.2x and even P/S below 1.6x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for X3 Holdings Co

What Does X3 Holdings Co's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, X3 Holdings Co has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on X3 Holdings Co will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For X3 Holdings Co?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like X3 Holdings Co's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 60%. However, this wasn't enough as the latest three year period has seen the company endure a nasty 37% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 14% shows it's an unpleasant look.

With this information, we find it concerning that X3 Holdings Co is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does X3 Holdings Co's P/S Mean For Investors?

A significant share price dive has done very little to deflate X3 Holdings Co's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that X3 Holdings Co currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Having said that, be aware X3 Holdings Co is showing 3 warning signs in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on X3 Holdings Co, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:XTKG

X3 Holdings

Through its subsidiaries, provides software application and technology services to corporate and government customers in the People’s Republic of China.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success