- United States

- /

- IT

- /

- NasdaqCM:WYFI

Will WhiteFiber's (WYFI) New Index Addition and Analyst Coverage Strengthen Its Market Credibility?

Reviewed by Sasha Jovanovic

- On September 22, 2025, WhiteFiber, Inc. (NasdaqCM: WYFI) was added to the S&P TMI Index and received a buy rating initiation from Craig-Hallum analyst Richard Shannon.

- Analyst coverage from a firm with a strong track record often draws significant attention from investors, highlighting WhiteFiber's growing profile in the market.

- We'll explore how this analyst endorsement shapes WhiteFiber's investment narrative and appeals to investor interest moving forward.

Rare earth metals are the new gold rush. Find out which 33 stocks are leading the charge.

What Is WhiteFiber's Investment Narrative?

For anyone considering WhiteFiber as an investment, the big-picture belief hinges on high-revenue growth and the company's position in AI infrastructure, even as profitability remains elusive. The latest news, WhiteFiber's addition to the S&P TMI Index and a buy rating from a well-followed analyst, has undeniably increased visibility for the stock. Institutional buying related to index inclusion and fresh analyst coverage often fuel near-term momentum, as we've seen with the sharp share price moves these past months. However, while these events highlight WhiteFiber's appeal and potential, they don’t change the core risks: high valuation, cash burn, and a young management team. Questions about sustainable growth and how the business will transition to profits remain central. The market will likely watch the upcoming earnings and the February 2026 lock-up expiry for deeper signals on long-term progress.

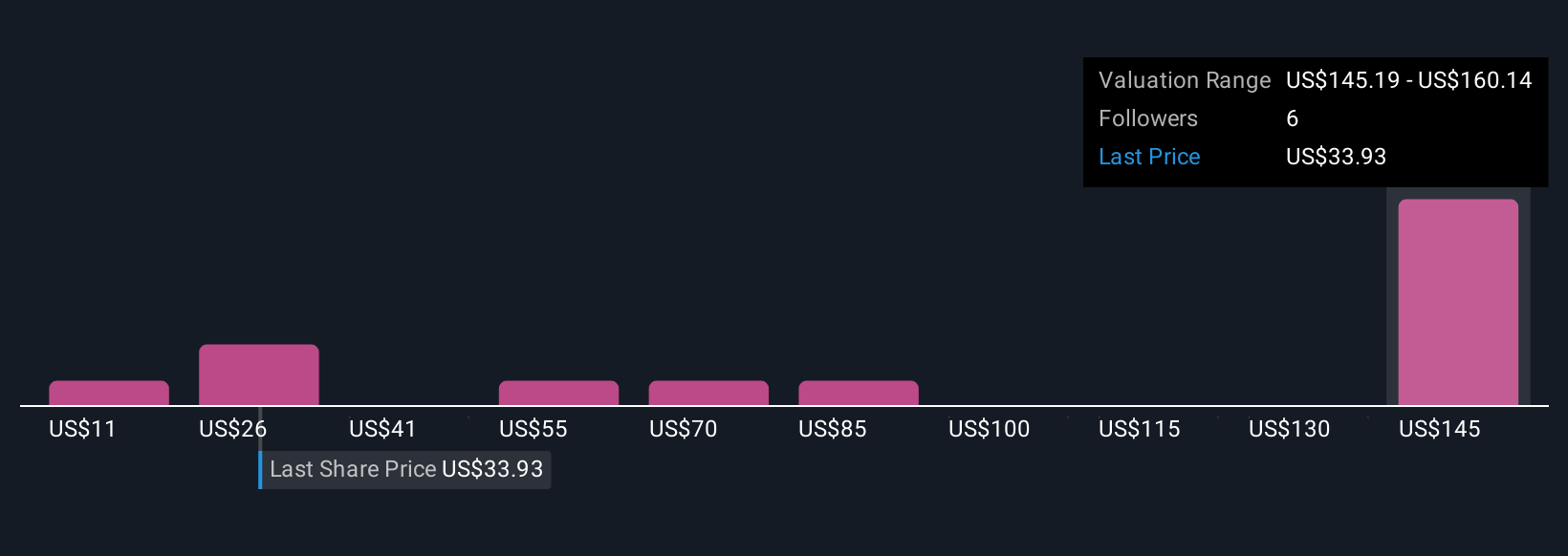

But balancing WhiteFiber’s growth excitement is its short cash runway, an essential risk to keep in mind. Our comprehensive valuation report raises the possibility that WhiteFiber is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore 6 other fair value estimates on WhiteFiber - why the stock might be worth less than half the current price!

Build Your Own WhiteFiber Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WhiteFiber research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free WhiteFiber research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WhiteFiber's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WhiteFiber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WYFI

WhiteFiber

Designs, develops, and operates data centers and provides artificial intelligence (AI) infrastructure solutions.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives