- United States

- /

- IT

- /

- NasdaqCM:WYFI

Why WhiteFiber (WYFI) Is Up 31.8% After Strong Q2 Results Driven by Cloud and AI Focus

Reviewed by Simply Wall St

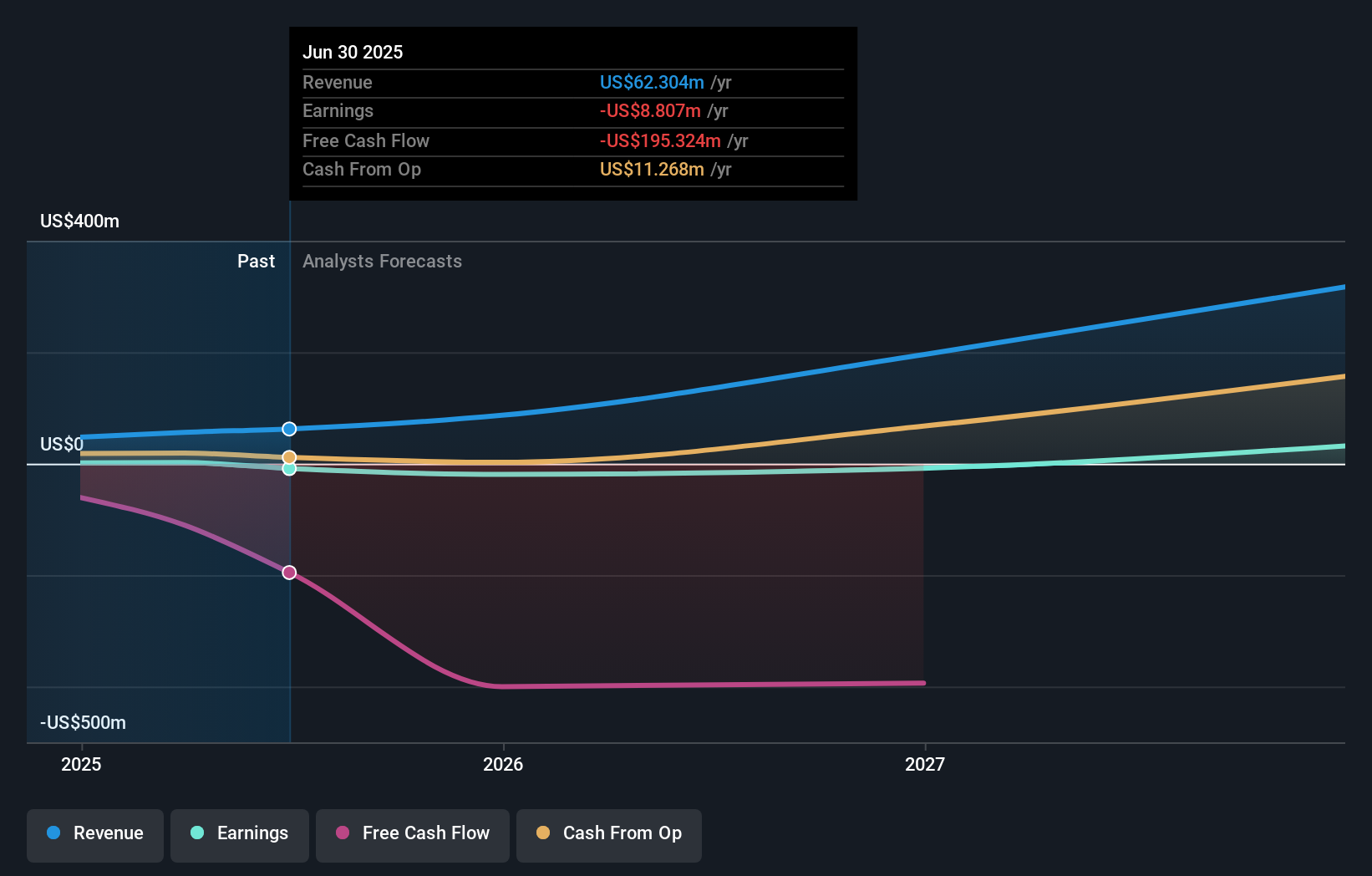

- WhiteFiber, Inc. recently reported its second-quarter 2025 results, highlighting a 48% year-over-year revenue surge largely driven by its expanding cloud services business and ongoing infrastructure investments following its August IPO.

- An interesting development is WhiteFiber's focus on a faster, cost-efficient retrofit model for AI infrastructure, a move that has attracted strong customer interest and positions the company for potential large-scale contracts.

- We’ll assess how WhiteFiber’s impressive revenue growth and investment in AI infrastructure shape its evolving investment narrative.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

What Is WhiteFiber's Investment Narrative?

To own WhiteFiber stock, you have to believe not just in the continued explosion of demand for AI and cloud infrastructure, but in the company's ability to convert high growth into lasting profitability. The recent Q2 results, with revenue jumping 48% and cloud services leading the charge, keep this growth story alive and offer fresh evidence that WhiteFiber’s retrofit model is resonating in the market. On the other side of the ledger, a swing to operating loss driven by heavy spend on compensation and consulting is an important shift, previous risk assessments were focused on growth execution, but rising costs and unprofitability are now more front-and-center. Add in an already high valuation and a new board and management team with little track record, and the news may have made the short-term path both more promising and more volatile.

However, unusually high staff costs could catch new shareholders off guard.

Exploring Other Perspectives

Explore 4 other fair value estimates on WhiteFiber - why the stock might be worth over 6x more than the current price!

Build Your Own WhiteFiber Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your WhiteFiber research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free WhiteFiber research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate WhiteFiber's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WhiteFiber might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WYFI

WhiteFiber

Designs, develops, and operates data centers and provides artificial intelligence (AI) infrastructure solutions.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives