- United States

- /

- Software

- /

- NasdaqCM:WULF

TeraWulf (WULF): Assessing Valuation After 87% Revenue Growth and Major Google AI Compute Deals

Reviewed by Simply Wall St

TeraWulf (WULF) got investors’ attention after reporting 87% revenue growth for the quarter, and its expansion into high-performance computing through major multi-year deals with Fluidstack and Google.

See our latest analysis for TeraWulf.

TeraWulf’s rapid move into AI computing and massive new deals grabbed headlines, but the market responded with significant volatility. After a powerful rally earlier in the year, the share price has pulled back sharply, logging a one-week share price return of -21% and a one-month drop of nearly 29%. Even as its year-to-date return holds above 100% and its one-year total shareholder return sits at 53%, momentum has cooled recently. Despite this, the multi-year gains and ambitious expansion plans keep the growth narrative very much alive.

If the shifts in TeraWulf's strategy have you wondering what other fast-evolving companies are out there, it’s worth taking a look at fast growing stocks with high insider ownership

With earnings surging, ambitious AI partnerships, and a huge pipeline of new high-performance computing contracts, is TeraWulf’s pullback a rare buying opportunity, or has the market already priced in its growth ambitions?

Most Popular Narrative: 48.4% Undervalued

TeraWulf’s most widely followed narrative suggests its fair value sits far above the last close, hinting the market may be missing just how profoundly recent mega-contracts could shift its earnings trajectory. With analyst targets rising and sentiment moving positive, attention is firmly on how this digital infrastructure upstart might outpace sector expectations.

Long-term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital. This directly supports margin expansion and accelerated infrastructure growth.

Want to know what projections could justify such a striking fair value gap? The secret sauce consists of expectations of explosive multi-year growth and highly unusual future profit multiples. Are you curious which specific financial turning points are expected to transform the business model? Find out exactly what’s fueling this bold valuation call.

Result: Fair Value of $21.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps in scaling new AI infrastructure or unforeseen issues with cornerstone partnerships could quickly challenge confidence in TeraWulf’s growth story.

Find out about the key risks to this TeraWulf narrative.

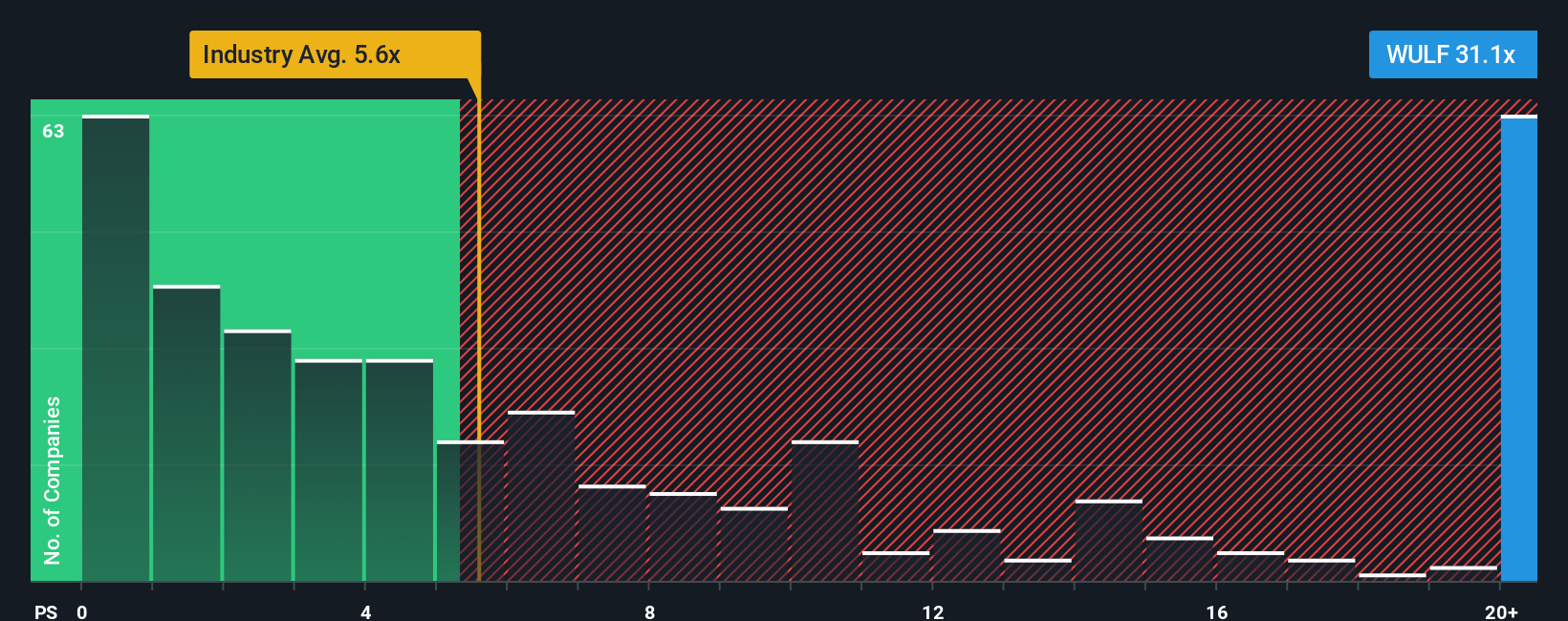

Another View: Multiples Suggest a Premium Price

Looking from another perspective, TeraWulf trades at a price-to-sales ratio of 27.5 times, which is significantly higher than the US Software industry average of 4.7 times and its peers at 17.9 times. Even in comparison to its own fair ratio of 21.5 times, shares appear expensive. Does paying a premium for growth increase the risk if the company encounters challenges?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TeraWulf Narrative

If you see the numbers differently or have your own angle, dive in and craft a TeraWulf narrative of your own in just minutes. Do it your way

A great starting point for your TeraWulf research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step confidently into your next investment move by tapping into unique stocks that others might overlook. Don’t let real opportunities slip past you. Smart portfolios start here.

- Spot untapped value early by scanning these 3588 penny stocks with strong financials with proven financial strength and growth potential before the mainstream takes notice.

- Power up your portfolio with the frontier of artificial intelligence via these 24 AI penny stocks that are shaping transformative tech and industry disruption.

- Secure reliable returns even in turbulent markets when you hunt for income standouts using these 16 dividend stocks with yields > 3% yielding above-average payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

Slight risk with limited growth.

Similar Companies

Market Insights

Community Narratives