- United States

- /

- Software

- /

- NasdaqCM:WULF

A Look at TeraWulf (WULF) Valuation Following Recent Share Price Gains

Reviewed by Simply Wall St

TeraWulf (WULF) shares have taken investors on a ride lately, with the stock up nearly 15% over the past month and boasting a gain of close to 150% in the past 3 months. This pattern has sparked fresh curiosity among traders watching the U.S. crypto mining landscape.

See our latest analysis for TeraWulf.

TeraWulf’s momentum has been hard to ignore, with a 1-month share price return of nearly 15% and an eye-popping 149% jump over the past three months. While the latest moves have certainly turned heads, the overall trend suggests building enthusiasm for the company’s growth narrative, especially considering its 107% total return in the last twelve months and a staggering 930% total return over three years.

If this kind of rapid growth has you wondering what other stocks might be breaking out, consider expanding your search and discover fast growing stocks with high insider ownership

With such explosive gains and analysts still projecting more upside, the question becomes clear: is TeraWulf still trading at a bargain, or has the market already factored in its ambitious growth story?

Most Popular Narrative: 18.1% Undervalued

With TeraWulf’s fair value pegged at $15.73 in the most widely followed narrative, compared to its last close of $12.88, the gap has sparked debate among market watchers weighing the company’s trajectory against its current rally.

Long-term partnerships and investments from marquee players (Google's $1.8B lease backstop and equity stake) signal institutional validation, enhance creditworthiness, and are likely to lower WULF's future cost of capital, directly supporting margin expansion and accelerated infrastructure growth.

Want to know what’s fueling analyst conviction? The answer: bold expectations for revenue acceleration and a dramatic turnaround in profit margins. Curious how these projections translate to that fair value? Unlock the details inside the full narrative.

Result: Fair Value of $15.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, challenges remain, as execution missteps or slower than expected demand in AI and hosting could quickly change the current growth narrative.

Find out about the key risks to this TeraWulf narrative.

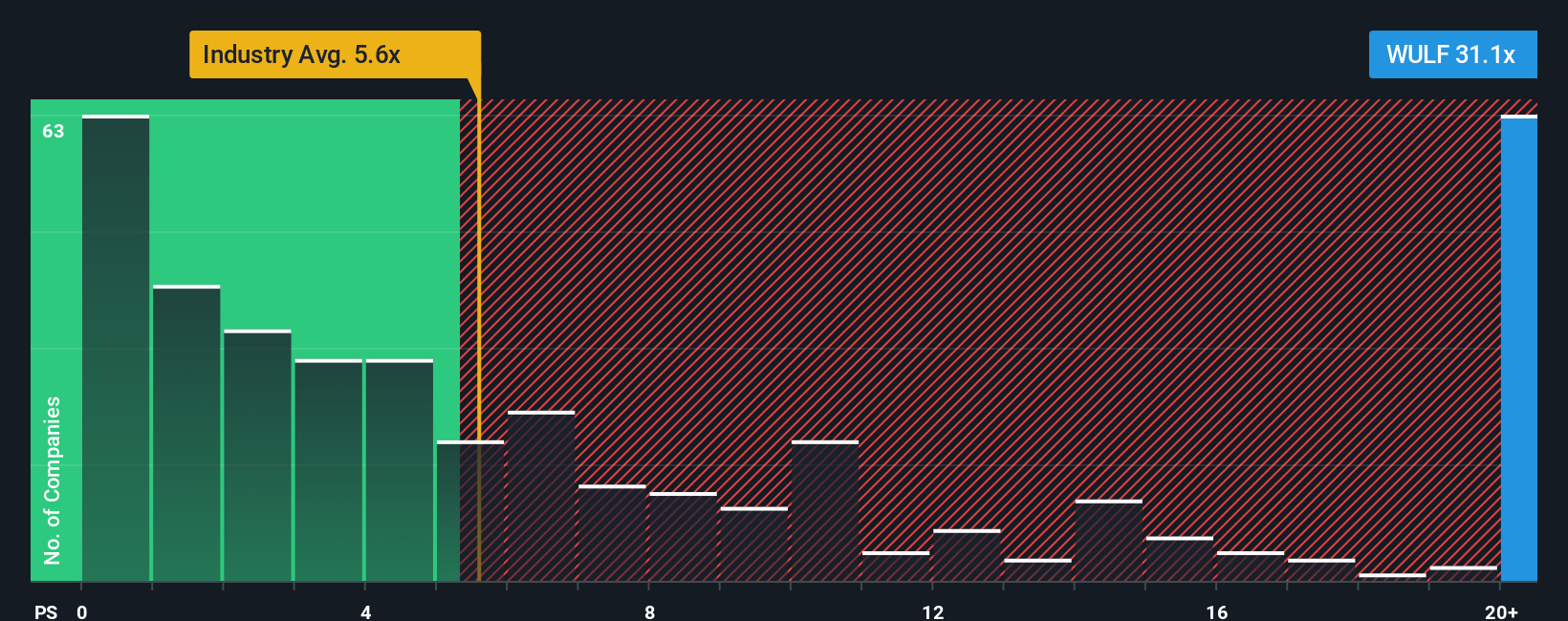

Another View: Multiples Paint a Cautious Picture

While the fair value narrative suggests upside, looking at valuation based on the price-to-sales ratio tells a more cautious story. TeraWulf trades at 36.5x sales, which is much higher than both the US software industry average of 5.2x and the peer group at 29x. This gap signals higher valuation risk if market sentiment shifts or growth expectations disappoint. Are investors paying too much for future potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TeraWulf Narrative

If you want a different perspective or prefer to dive into the numbers yourself, you can shape your own take in just a few minutes. Do it your way

A great starting point for your TeraWulf research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Ambitious investors always keep an eye on the next big opportunity. Don’t limit yourself. See what else is gaining ground and position yourself ahead of the curve with these focused stock ideas:

- Capitalize on high yields and reliable income by checking out these 17 dividend stocks with yields > 3% offering standout returns with robust cash flows and strong track records.

- Tap into breakthrough artificial intelligence trends and uncover emerging leaders by exploring these 27 AI penny stocks shaking up the future of tech-driven industries.

- Boost your search for hidden gems trading below their fair value by reviewing these 868 undervalued stocks based on cash flows primed for potential upside based on solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TeraWulf might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:WULF

TeraWulf

Operates as a digital asset technology company in the United States.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives