- United States

- /

- Software

- /

- NasdaqGS:WDAY

Workday (WDAY) Valuation: New Gartner Recognition and AI Tools Put Growth Narrative in Focus

Reviewed by Simply Wall St

Workday (WDAY) is drawing extra attention after it was named a Leader in the 2025 Gartner Magic Quadrant for Cloud ERP Finance. In addition to this recognition, the company has introduced new AI-driven tools and major platform partnerships.

See our latest analysis for Workday.

Workday's recognition as a Gartner Magic Quadrant Leader has brought a fresh wave of interest, though investor enthusiasm hasn't fully translated into recent gains. The share price is off 8.1% year-to-date and logged a 1-year total shareholder return of -2.9%. However, the three-year total return remains an impressive 61%, suggesting the longer-term momentum is still on Workday’s side despite some near-term cooling. Ongoing partnerships and the rollout of innovative AI tools further support the company’s push to drive new growth and give investors reasons to watch future performance closely.

If these developments have you watching tech trends, it’s a good moment to discover See the full list for free.

The question now is whether Workday's recent advances and analyst optimism signal an undervalued opportunity for investors, or if the current price already reflects expectations for continued growth and innovation.

Most Popular Narrative: 18% Undervalued

Workday’s fair value, based on the most popular narrative, stands about 18% above the latest closing price of $231.36. This sets up a debate: are current market doubts missing key catalysts driving the company’s value higher?

Workday is positioned to benefit from the accelerating demand for cloud-native and AI-powered enterprise solutions, as organizations continue replacing legacy on-premise systems and prioritize digital transformation, driving sustained subscription revenue growth and expanding backlog.

What underpins such a bullish assessment? The narrative hinges on bold projections, including upgraded profitability and ambitious margin expansion, with future earnings expected to reach heights that surprise even seasoned analysts. Find out which assumptions set the stage for this premium price target and why analysts believe Workday's evolution is just getting started.

Result: Fair Value of $282 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from major incumbents and fast-moving AI startups, along with regulatory hurdles, could quickly challenge these optimistic growth assumptions.

Find out about the key risks to this Workday narrative.

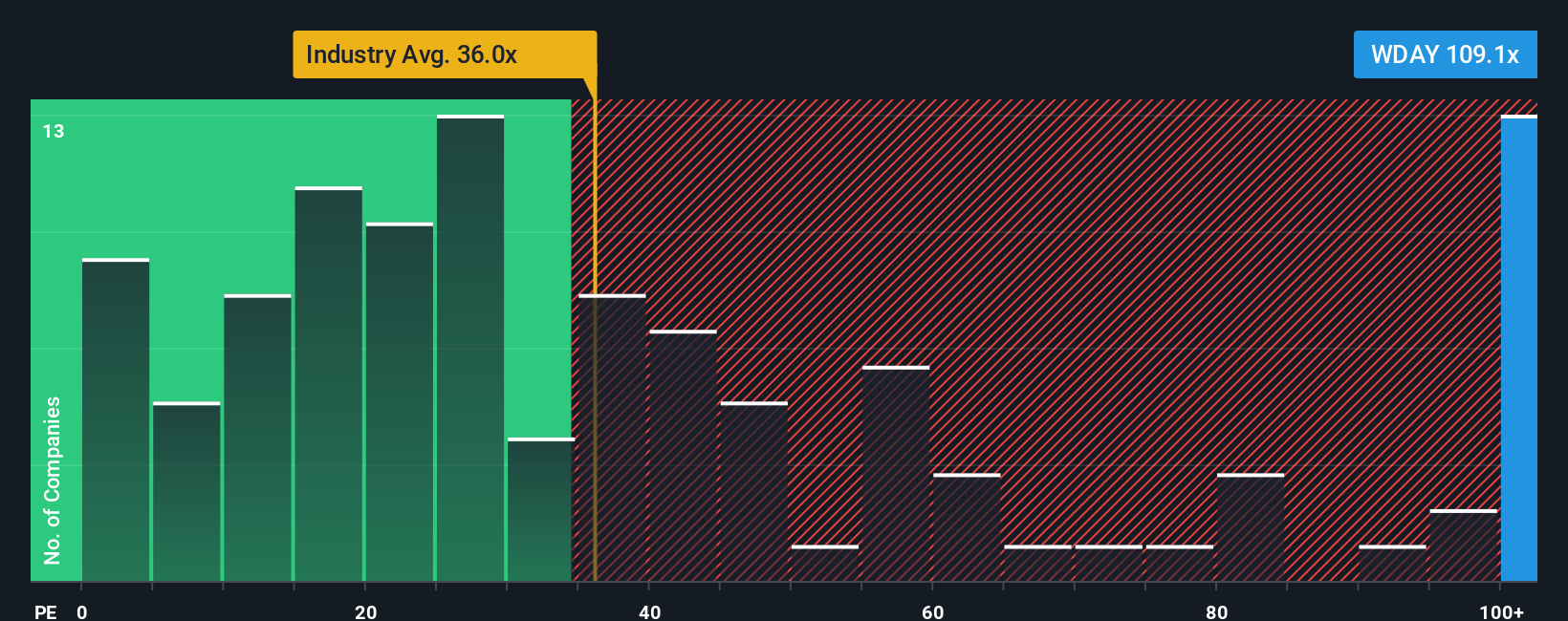

Another View: Price Ratio Sends a Different Signal

Looking through a price-to-earnings lens, Workday appears much more expensive than its peers. Trading at 106x earnings, it is valued far above both the peer average of 62.8x and the US Software industry average of 34.8x. The market's current optimism could bring greater valuation risk, especially if expectations shift. Where does opportunity end and risk begin?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Workday Narrative

If you have a different perspective or want to dive deeper into the numbers, you can easily build your own company story in just a few minutes. Do it your way

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Actionable Opportunities?

Smart investing means staying ahead, and Simply Wall Street’s powerful screeners can lead you straight to ideas you might be missing. Don’t let tomorrow’s winners slip past you. Check these out right now:

- Unlock steady income and compounding returns when you browse these 21 dividend stocks with yields > 3% that yield above 3% and reward shareholders over time.

- Zero in on the tech disruptors by jumping on these 26 AI penny stocks poised for rapid growth as artificial intelligence revolutionizes entire industries.

- Snap up hidden value by tapping into these 849 undervalued stocks based on cash flows overlooked by most and trading below their true potential based on cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives