- United States

- /

- Software

- /

- NasdaqGS:WDAY

A Fresh Look at Workday (WDAY) Valuation Following Strong Earnings and New Product Announcements

Reviewed by Simply Wall St

Workday (WDAY) just rolled out financial results that beat expectations while also raising its outlook for the next quarter and year. In addition, the company unveiled several product expansions and new partnerships aimed at driving innovation and efficiency.

See our latest analysis for Workday.

Workday shares have seen some turbulence lately, with the stock down 15.3% year-to-date and posting a 17% total shareholder return loss over the past year. Despite these short-term dips, the company's ambitious partnerships and product rollouts continue to highlight building momentum for longer-term growth.

If you're interested in uncovering other innovative names in tech, now is a great opportunity to see the full list of high-growth software and AI companies with See the full list for free.

After solid results, upgraded guidance, and a string of product and partnership announcements, investors are left to consider whether Workday's current valuation reflects all this momentum, or if there could be an overlooked buying opportunity.

Most Popular Narrative: 23.1% Undervalued

Workday's widely-followed narrative values shares 23.1% higher than the last close price, highlighting the fundamental disconnect between analyst optimism and recent share underperformance. This perspective draws on robust growth assumptions that sharply contrast with market sentiment.

"Broad adoption of Workday's AI-enabled HR and finance products (with >70% of customers using Workday Illuminate and >75% of net new deals including at least one AI product), along with acquisitions like Paradox and Flowise, is fueling cross-sell/upsell activity, increasing average contract values and bolstering future topline growth."

Wondering what’s behind this bullish case? The real story lies in bold profit forecasts, transformative technology momentum, and aggressive long-range assumptions that could upend the standard valuation playbook. Prepare to challenge the status quo and see what’s driving the numbers.

Result: Fair Value of $277.28 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, fierce competition from new AI-powered software and tightening regulations could quickly challenge Workday’s current growth outlook. This could also reshape investor expectations.

Find out about the key risks to this Workday narrative.

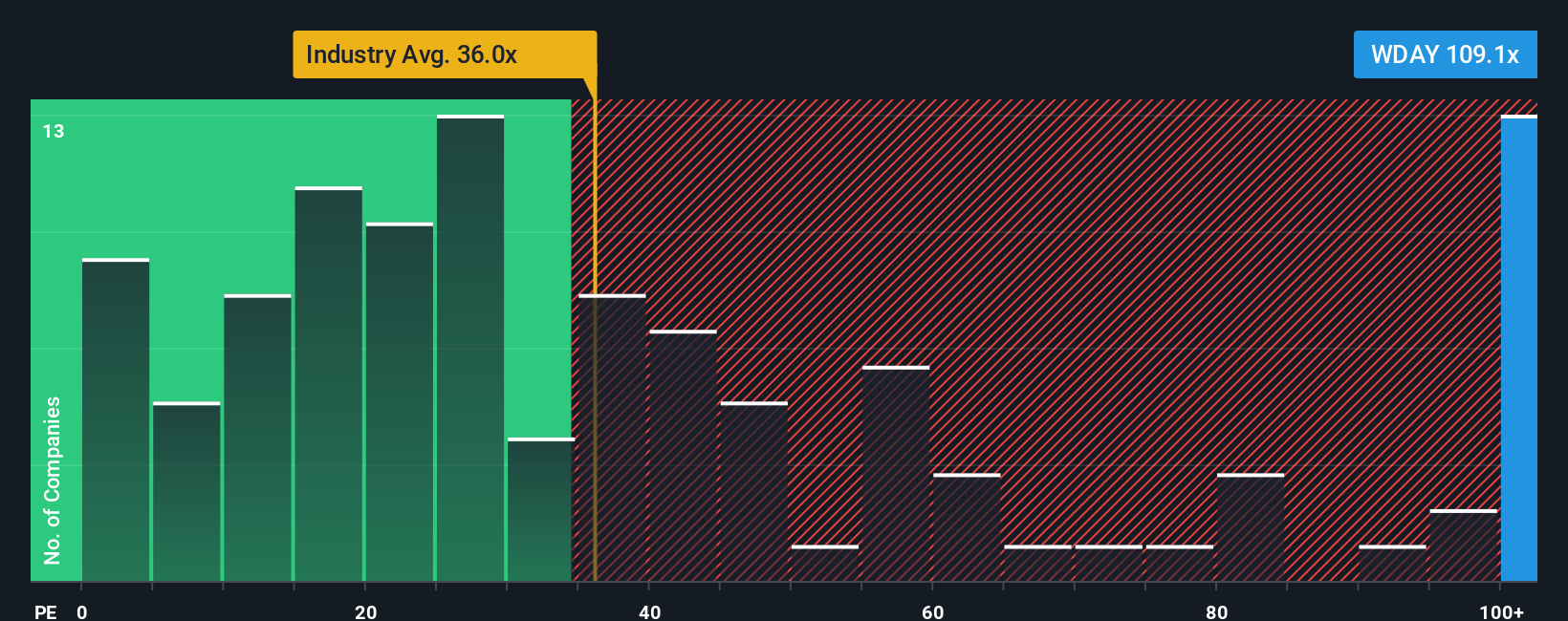

Another View: The Multiples Perspective

While fair value models paint Workday as undervalued, traditional valuation ratios tell a different story. The stock currently trades at an 87.4x earnings multiple, which is notably higher than both the US software industry average (32x) and its own fair ratio of 48.8x. This steep premium signals heightened valuation risk if growth fails to accelerate as expected. Could the market be getting ahead of itself, or does this optimism foreshadow future results?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Workday Narrative

If you want a different perspective or want to dive into the numbers yourself, building your own narrative takes just a few minutes. Do it your way.

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t limit your strategy to just one name. Uncover high-potential opportunities with these powerful screeners and turn today’s insights into tomorrow’s gains:

- Kickstart your search for market bargains by tapping into these 932 undervalued stocks based on cash flows, a tool packed with stocks priced attractively based on future cash flows.

- Turbocharge your portfolio’s income potential by browsing these 14 dividend stocks with yields > 3%, which features consistent payers with yields above 3%.

- Capture the next wave of disruption with these 25 AI penny stocks, highlighting fast-moving innovators at the heart of artificial intelligence advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026