- United States

- /

- Software

- /

- NasdaqGS:WDAY

A Fresh Look at Workday (WDAY) Valuation Following Major AI Product and Partnership Launches

Reviewed by Kshitija Bhandaru

Workday (WDAY) Unveils a New Wave of AI-Driven Innovation: What Does It Mean for Investors?

If you’ve been weighing your next move on Workday, you’ll want to know what just happened. Over the past week, Workday has rolled out new AI-infused products across HR and finance, debuted its Workday Data Cloud, and expanded partnerships with some of the industry’s biggest names, including Databricks, Salesforce, Snowflake, and Microsoft. With these releases, Workday is making a strong bid to cement its role as the backbone for enterprise AI, giving customers new ways to connect data and automate work. For investors, such a bold product push feels like a signal that the company is betting big on future growth and enterprise adoption of AI-based business platforms.

This burst of activity has gotten the market’s attention, especially as the company’s stock shows signs of forward momentum. Workday has cycled up roughly 7% over the past month and is up modestly for the year, even after factoring in some choppier stretches earlier in 2025. While the long-term trend remains positive, recent innovations and client announcements are fueling new debate about where the stock could go next, particularly as investors reassess how much of this AI-driven upside is reflected in today’s price.

So after a year of fits and starts, is Workday offering long-term value with its latest innovations, or has the stock’s recent run already factored in the promise of AI-led growth?

Most Popular Narrative: 12.5% Undervalued

According to the most widely followed narrative, Workday shares are considered undervalued compared to their estimated fair value. Upbeat assumptions about future earnings and margins are driving a higher price target.

Broad adoption of Workday's AI-enabled HR and finance products (with over 70% of customers using Workday Illuminate and over 75% of net new deals including at least one AI product), along with acquisitions such as Paradox and Flowise, is fueling cross-sell and upsell activity. This is increasing average contract values and bolstering future topline growth.

Wondering what is powering this big valuation call? The narrative spotlights a fast-expanding AI customer base and a jump in profit margins. One of the most surprising aspects may be the premium placed on future profits, which suggests even bolder financial projections. Want the full picture behind the number? Look closer at the key assumptions shaping this valuation and see what could come next.

Result: Fair Value of $282.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent competition from nimble AI startups and tighter regulatory demands could quickly upend Workday’s current growth outlook and valuation assumptions.

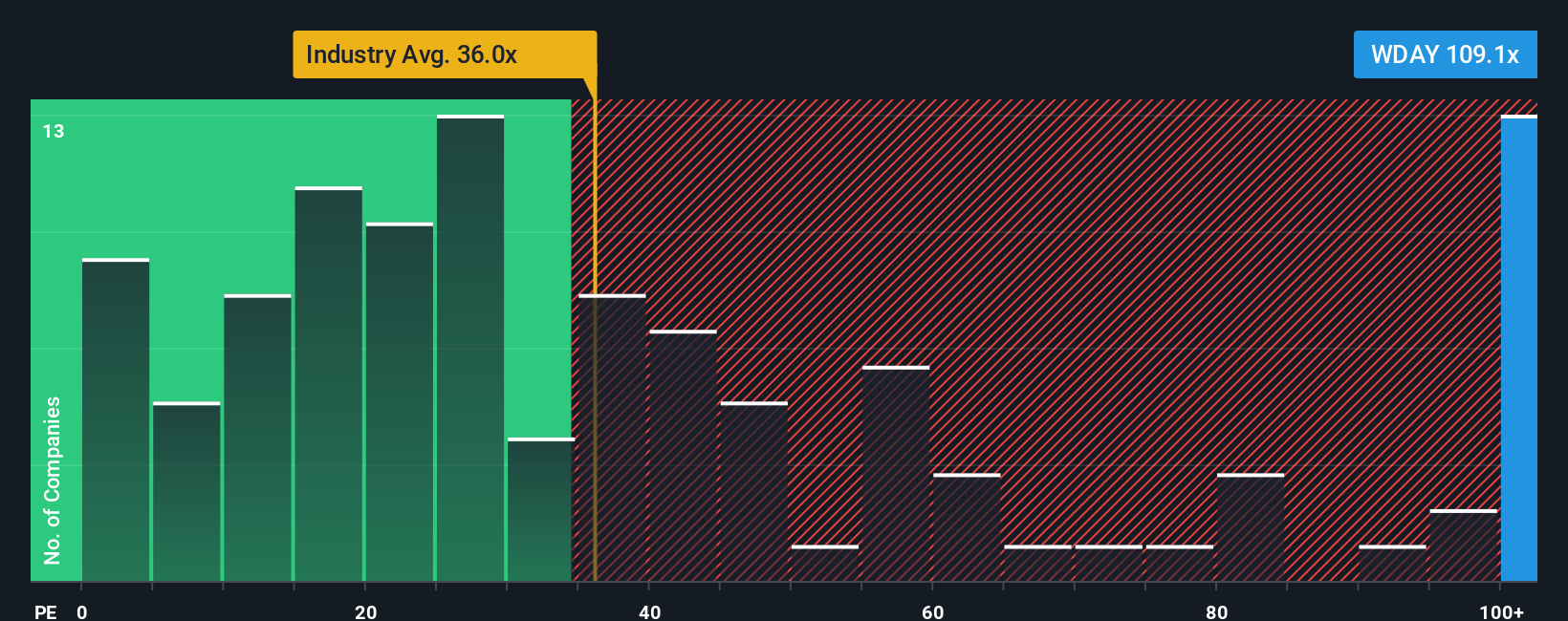

Find out about the key risks to this Workday narrative.Another View: Multiples Tell a Different Story

While the consensus points to undervaluation, a quick check against the price-to-earnings ratio for the broader industry suggests Workday is trading at a notable premium. Does market excitement about AI justify paying up for growth?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Workday Narrative

Not convinced by the prevailing views or keen to dive into the numbers yourself? You can shape your own perspective in just a few minutes. Do it your way.

A great starting point for your Workday research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Let’s make sure you never miss your next winning stock. Broaden your investment toolkit with these proven screeners and tap into the trends everyone’s talking about.

- Unleash your potential for growth by targeting businesses reshaping the artificial intelligence landscape with AI penny stocks.

- Capture tomorrow’s undervalued breakthroughs today by pinpointing companies trading below their true worth using our undervalued stocks based on cash flows.

- Pounce on income opportunities from companies offering robust yields with the guidance of our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Workday might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:WDAY

Workday

Provides enterprise cloud applications in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives