- United States

- /

- IT

- /

- NasdaqGS:VRSN

A Fresh Look at VeriSign (VRSN) Valuation After Recent Share Price Dip

Reviewed by Kshitija Bhandaru

VeriSign (VRSN) shares have drifted lower over the past month, declining around 10% without any specific news releasing from the company. This move has led some investors to reassess the current valuation and recent stock performance.

See our latest analysis for VeriSign.

Despite some recent weakness, VeriSign's 1-year total shareholder return of over 40% shows investors have been rewarded for the long haul. Short-term share price momentum has faded from its earlier pace, and recent price dips may reflect investors debating future growth against a backdrop of robust multi-year performance and ongoing profitability.

If you’re looking beyond today’s headlines for what else might be gaining traction, now’s a great time to discover fast growing stocks with high insider ownership

With shares recently slipping, but long-term returns remaining impressive, investors are left to wonder whether VeriSign is undervalued after the drop or if the market has already accounted for its future growth potential.

Most Popular Narrative: 15.9% Undervalued

With VeriSign recently closing at $259.79, the narrative consensus values the shares notably higher, hinting at unrecognized upside even after recent declines. Here is what is fueling that outlook right now.

VeriSign's financial stability and strategic initiatives, including dividends, buybacks, and effective refinancing, position it for positive revenue growth and investor confidence.

Curious how this value target is built? One foundational assumption underpins the entire narrative, and it is all about climbing profits and a steeper margin. What is the exact blend driving this bullish scenario, and where does the math get aggressive? Spoiler: the answer lies deep in future earnings projections and what they imply for the company’s market stature.

Result: Fair Value of $309 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in industry trends or regulatory hurdles, such as delays to .web operations, could quickly challenge the current bullish outlook.

Find out about the key risks to this VeriSign narrative.

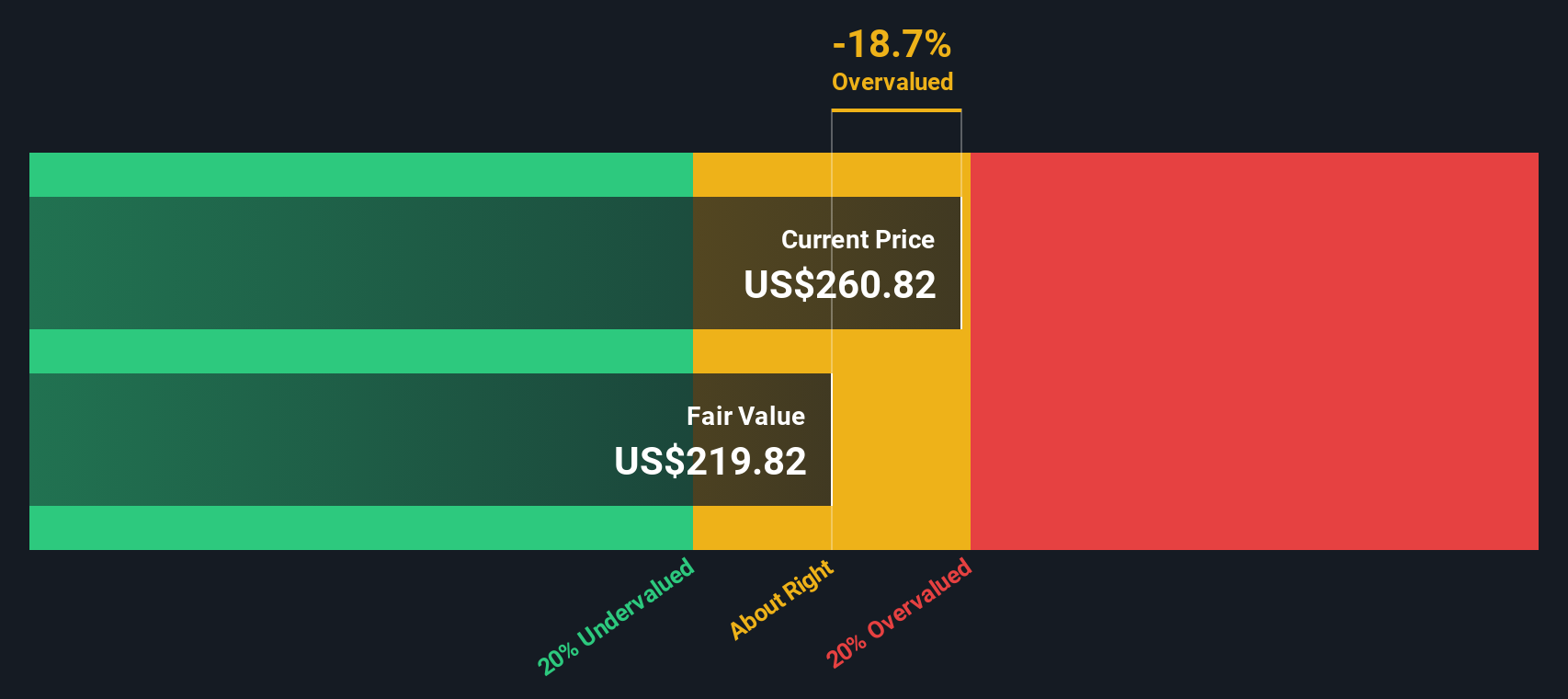

Another View: SWS DCF Model Signals Overvaluation

While the analyst consensus leans optimistic, our DCF model values VeriSign at $218.89. This is below the current share price and suggests the market may have priced in more future growth and stability than the cash flow outlook justifies. This raises questions about downside risk in today’s valuation.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out VeriSign for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own VeriSign Narrative

If you see the story differently, or want to dig into the numbers on your own terms, you can shape your own view in just a few minutes. Do it your way

A great starting point for your VeriSign research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Thousands of investors are already getting ahead using these powerful stock screeners curated by Simply Wall Street. Don’t let the next opportunity slip by you.

- Tap into high-yield opportunities when you zero in on these 20 dividend stocks with yields > 3% with stable payouts and impressive returns.

- Uncover future market movers among these 24 AI penny stocks that are fueling breakthroughs in artificial intelligence and automation.

- Boost your search for value by checking out these 867 undervalued stocks based on cash flows with significant upside based on their cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRSN

VeriSign

Provides internet infrastructure and domain name registry services that enables internet navigation for various recognized domain names worldwide.

Good value with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion