- United States

- /

- Biotech

- /

- NasdaqGM:ALVO

Exploring 3 High Growth Tech Stocks in the US Market

Reviewed by Simply Wall St

The United States market has shown positive momentum, climbing 2.7% in the last week and up 13% over the past year, with earnings anticipated to grow by 15% annually in the coming years. In this favorable environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and adaptability to capitalize on these upward trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.99% | 39.09% | ★★★★★★ |

| Mereo BioPharma Group | 53.64% | 66.60% | ★★★★★★ |

| Ardelyx | 21.03% | 60.42% | ★★★★★★ |

| TG Therapeutics | 26.46% | 38.75% | ★★★★★★ |

| Legend Biotech | 26.68% | 57.96% | ★★★★★★ |

| AVITA Medical | 27.42% | 61.05% | ★★★★★★ |

| Alnylam Pharmaceuticals | 23.69% | 60.42% | ★★★★★★ |

| Alkami Technology | 20.53% | 76.67% | ★★★★★★ |

| Ascendis Pharma | 35.07% | 59.92% | ★★★★★★ |

| Lumentum Holdings | 22.99% | 103.97% | ★★★★★★ |

Click here to see the full list of 226 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Alvotech (ALVO)

Simply Wall St Growth Rating: ★★★★★★

Overview: Alvotech, with a market cap of $2.77 billion, operates globally through its subsidiaries to develop and manufacture biosimilar medicines for patients.

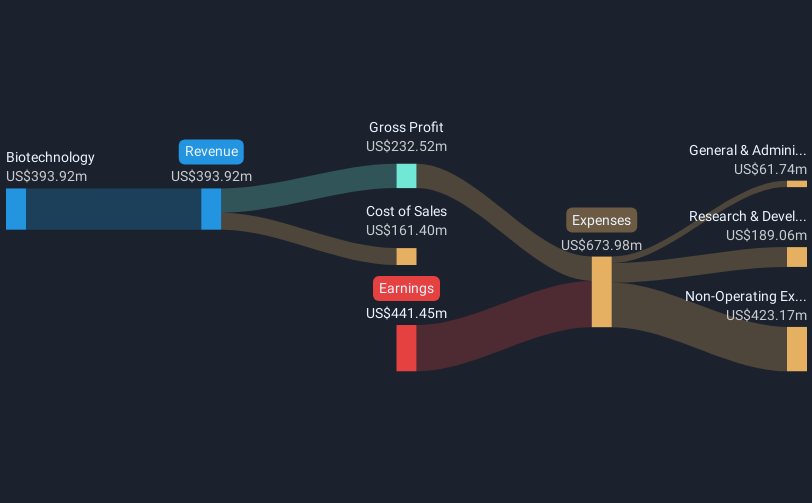

Operations: With a focus on biotechnology, Alvotech generates revenue of $587.89 million by developing and manufacturing biosimilar medicines globally.

Alvotech's recent strategic maneuvers, including a beneficial debt refinancing that will save the company $8.2 million in interest payments over the next year, underscore its robust financial management and operational efficiency. This move, coupled with the positive outcomes from their latest clinical trials for AVT23, a biosimilar to Xolair, highlights Alvotech's commitment to expanding its biosimilar portfolio. The firm has also secured multiple commercial partnerships across global markets, enhancing its distribution capabilities and market reach. These developments not only reflect Alvotech’s agility in navigating complex biotech landscapes but also bolster its position in competitive biosimilar markets.

- Unlock comprehensive insights into our analysis of Alvotech stock in this health report.

Examine Alvotech's past performance report to understand how it has performed in the past.

AvePoint (AVPT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: AvePoint, Inc. offers a cloud-native data management software platform across multiple regions including North America, Europe, the Middle East, Africa, and the Asia Pacific with a market capitalization of $3.82 billion.

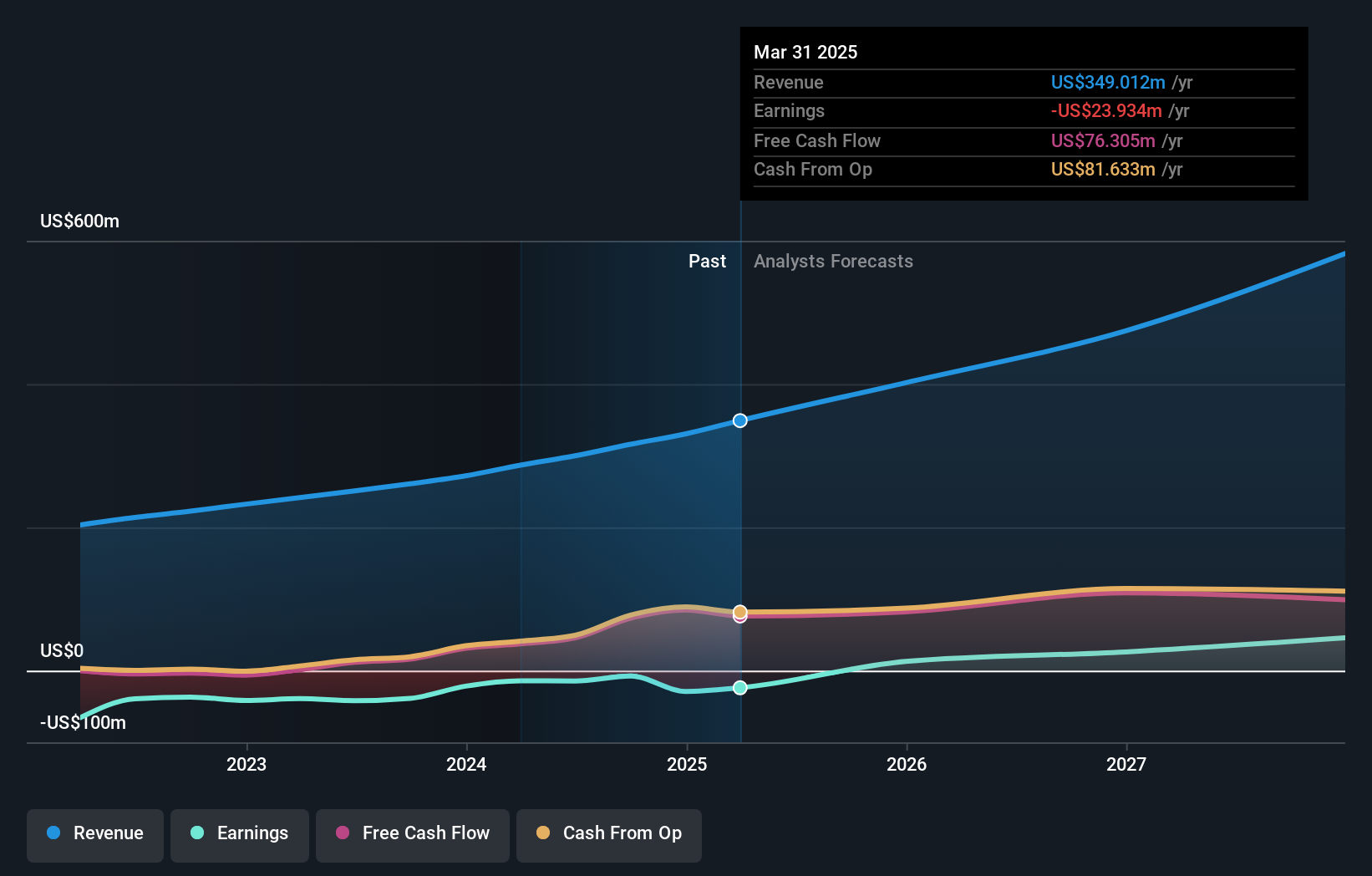

Operations: The company generates revenue primarily through its software and programming segment, which recorded $349.01 million. It operates across various global regions, focusing on cloud-native data management solutions.

AvePoint's recent advancements underscore its strategic positioning within the tech sector, particularly in enhancing data governance and security for managed service providers (MSPs). With a robust annual revenue growth of 18.3% and earnings projected to surge by 93.7% annually, AvePoint is capitalizing on significant market opportunities. Recent product launches like the Optimization and ROI Command Center reflect a deep understanding of enterprise needs for cost efficiency and robust data management—critical as businesses increasingly rely on multi-cloud strategies. These innovations not only cater to immediate client needs but also position AvePoint favorably in a competitive landscape, suggesting promising prospects for sustained growth and market penetration.

- Take a closer look at AvePoint's potential here in our health report.

Understand AvePoint's track record by examining our Past report.

Verint Systems (VRNT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verint Systems Inc. offers customer engagement solutions on a global scale and has a market capitalization of approximately $1.09 billion.

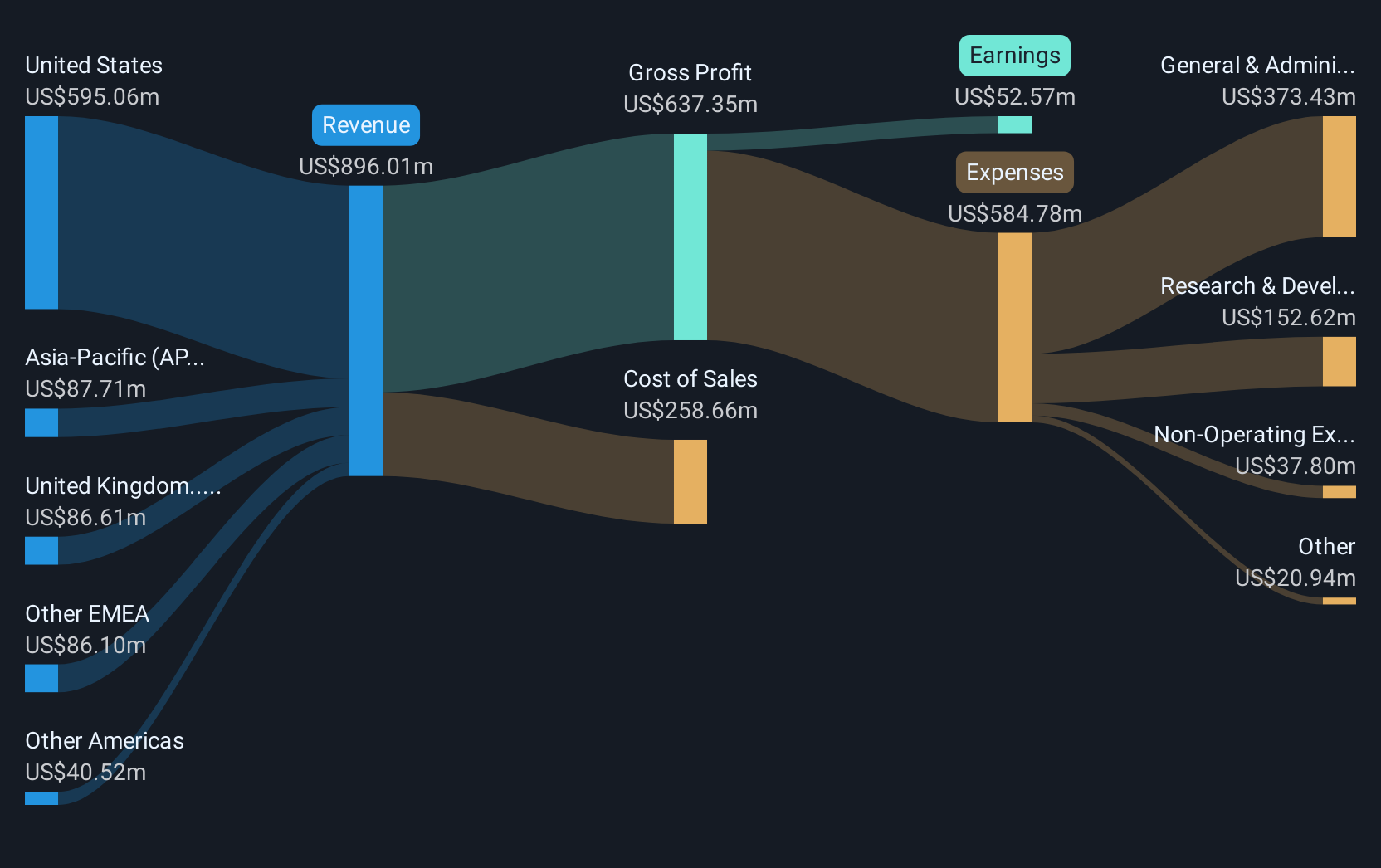

Operations: The company generates revenue primarily from its customer engagement segment, which accounts for $896.01 million.

Verint Systems is distinguishing itself in the high-tech sector, particularly through its AI-driven solutions that are reshaping customer and employee experiences. With a notable earnings growth of 76.7% over the past year, surpassing the software industry's average of 18.9%, Verint demonstrates robust performance and potential for future expansion. Recent strategic client engagements, like the expanded use with BT Group which now utilizes Verint's AI bots across 4,500 agents, underscore its capability to scale operations effectively while enhancing productivity and customer satisfaction. This approach not only solidifies its market position but also aligns with industry trends towards integrating human and AI workforce solutions, promising continued relevance and growth in a rapidly evolving tech landscape.

Key Takeaways

- Click here to access our complete index of 226 US High Growth Tech and AI Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ALVO

Alvotech

Through its subsidiaries, develops and manufactures biosimilar medicines for patients worldwide.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Community Narratives