- United States

- /

- Software

- /

- NasdaqGS:VRNS

There's Reason For Concern Over Varonis Systems, Inc.'s (NASDAQ:VRNS) Price

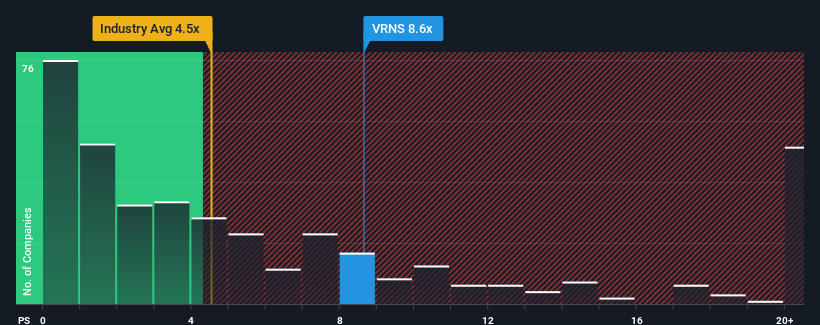

Varonis Systems, Inc.'s (NASDAQ:VRNS) price-to-sales (or "P/S") ratio of 8.6x might make it look like a strong sell right now compared to the Software industry in the United States, where around half of the companies have P/S ratios below 4.5x and even P/S below 1.7x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

We've discovered 1 warning sign about Varonis Systems. View them for free.See our latest analysis for Varonis Systems

How Has Varonis Systems Performed Recently?

With revenue growth that's inferior to most other companies of late, Varonis Systems has been relatively sluggish. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Varonis Systems.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Varonis Systems' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered a decent 10% gain to the company's revenues. Pleasingly, revenue has also lifted 41% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the analysts watching the company. That's shaping up to be similar to the 15% each year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Varonis Systems' P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Varonis Systems' P/S Mean For Investors?

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Varonis Systems currently trades on a higher than expected P/S. The fact that the revenue figures aren't setting the world alight has us doubtful that the company's elevated P/S can be sustainable for the long term. A positive change is needed in order to justify the current price-to-sales ratio.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Varonis Systems that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Micron Technology will experience a robust 16.5% revenue growth

Amazon will rebound as AI investments start paying off by late 2026

Inside Harvey Norman: Asset-Heavy Retail in an Online World

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion