- United States

- /

- Software

- /

- NasdaqGS:VRNS

The Bull Case For Varonis Systems (VRNS) Could Change Following Next-Gen Database Security Launch and imPAC Labs Partnership

Reviewed by Simply Wall St

- In recent days, Varonis Systems announced the launch of its Next-Gen Database Activity Monitoring platform, entered a new cloud-security partnership with imPAC Labs, and released both second-quarter financial results and guidance projecting double-digit revenue growth for 2025.

- This combination of product innovation, collaborative client solutions, and strong revenue growth guidance underscores Varonis’s focus on expanding its data security platform while addressing evolving enterprise needs.

- We’ll assess how the rollout of advanced database security and the imPAC Labs partnership shape Varonis’s investment narrative going forward.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Varonis Systems Investment Narrative Recap

To invest in Varonis Systems, you need to believe that its ongoing shift to SaaS and innovation in cloud data security will sustainably drive growth and improve customer retention, despite continued net losses and the complexity of transitioning its customer base. Recent shelf registrations and buybacks do not materially change the most important short term catalyst: the pace and efficiency of SaaS conversion, nor do they impact the primary risk, which is the strain this transition places on earnings and margins.

Among the latest developments, the launch of Varonis’s Next-Gen Database Activity Monitoring platform stands out for directly supporting the push into advanced data protection, an area closely linked to both revenue growth potential and customer retention, the core catalysts for the business at this stage. Investors will want to weigh how effectively these new solutions translate into SaaS adoption and top line expansion, particularly as competition intensifies and post-transition upsell potential remains uncertain.

But while new offerings aim for expansion, the transition’s impact on profit margins remains a key pressure point investors should be aware of...

Read the full narrative on Varonis Systems (it's free!)

Varonis Systems' outlook forecasts $853.4 million in revenue and $113.0 million in earnings by 2028. This scenario assumes a 14.2% annual revenue growth rate and an earnings increase of $204.1 million from current earnings of -$91.1 million.

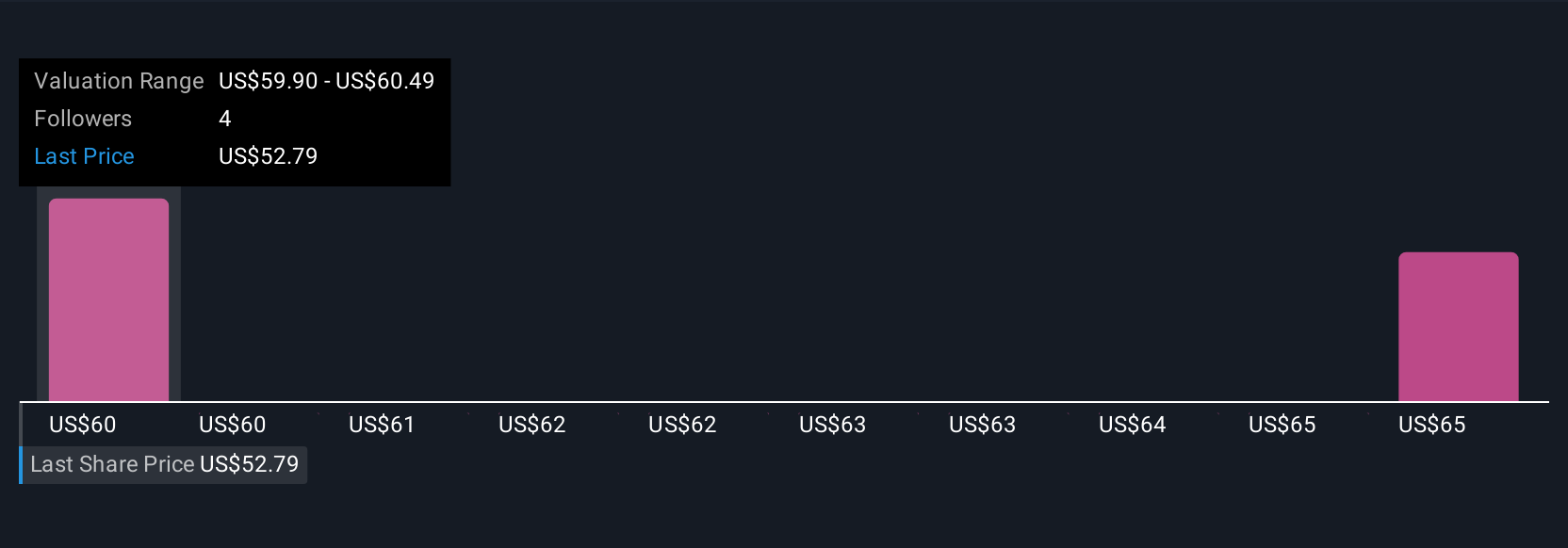

Uncover how Varonis Systems' forecasts yield a $59.90 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members peg Varonis’s fair value between US$59.90 and US$72.28, with two different estimates. While many view the accelerated SaaS transition as a strong growth catalyst, opinions differ widely and it pays to compare multiple viewpoints.

Explore 2 other fair value estimates on Varonis Systems - why the stock might be worth just $59.90!

Build Your Own Varonis Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Varonis Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Varonis Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Varonis Systems' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 25 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRNS

Varonis Systems

Provides software products and services that continuously discover and classify critical data, remediate exposures, and detect advanced threats with AI-powered technology in North America, Europe, APAC, and rest of world.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives